Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 71PB

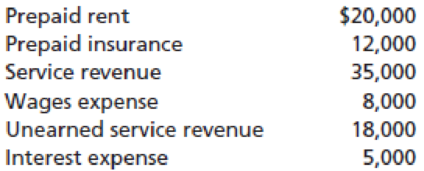

Following is a partial list of financial statement items from the records of Starnes Company at December 31, 2012, before adjustments:

Additional information includes the following:

- The insurance policy indicates that on December 31, 2012, only five months remain on the 12-month policy that originally cost $12,000.

- Starnes has a note payable with $2,500 of interest that must be paid on January 1, 2013. No interest expense has been recorded for this note.

- The accounting records show that two-thirds of the service revenue paid in advance by a customer on March 1 has now been earned.

- On August 1, the company paid $20,000 for rent for 10 months beginning on August 1.

- At year end, Starnes Company owed $500 worth of salaries to employees for work done in December. This has not been recorded or paid. The next payday is January 3, 2013.

Requirements

- 1. Use an

accounting equation worksheet to record the adjustments that must be made prior to the preparation of the financial statements for the year ended December 31, 2012. - 2. For the accounts shown, calculate the account balances that would be shown on Starnes’ financial statements for the year ended December 31, 2012; balance sheet at December 31, 2012.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.

Required:

Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to:a. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure).b. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31.

Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.

Required:

Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable.

Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during

2024:

March 17 Accounts receivable of $2,600 were written off as uncollectible. The company uses the allowance method.

March 30 Loaned an officer of the company $33,000 and received a note requiring principal and interest at 7% to be

paid on March 30, 2025.

May 30 Discounted the $33,000 note at a local bank. The bank's discount rate is 8 %. The note was discounted without

recourse and the sale criteria are met.

June 30 Sold merchandise to the Blankenship Company for $21,000. Terms of the sale are

4/10/30 Weldon uses the

gross method to account for cash discounts.

July 8 The Blankenship Company paid its account in full.

August 31 Sold stock in a nonpublic company with a book value of $5,900 and accepted a $6,900 noninterest-bearing note

with a discount rate of 8%. The $6,900 payment is due on February 28, 2025. The stock has no ready market

value.…

Chapter 3 Solutions

Financial Accounting

Ch. 3 - Prob. 1YTCh. 3 - Prob. 2YTCh. 3 - Prob. 3YTCh. 3 - Prob. 4YTCh. 3 - Prob. 5YTCh. 3 - Prob. 6YTCh. 3 - Prob. 7YTCh. 3 - How does accrual basis accounting differ from cash...Ch. 3 - Prob. 2QCh. 3 - Prob. 3Q

Ch. 3 - Prob. 4QCh. 3 - What are accrued expenses?Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Name two common deferred expenses.Ch. 3 - What does it mean to recognize revenue?Ch. 3 - How does matching relate to accruals and...Ch. 3 - What is depreciation?Ch. 3 - Why is depreciation necessary?Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 1MCQCh. 3 - Prob. 2MCQCh. 3 - Prob. 3MCQCh. 3 - Prob. 4MCQCh. 3 - Prob. 5MCQCh. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - Prob. 8MCQCh. 3 - When prepaid insurance has been used, the...Ch. 3 - Prob. 10MCQCh. 3 - Prob. 1SEACh. 3 - Prob. 2SEACh. 3 - Account for interest expense. (LO 1, 2). UMC...Ch. 3 - Prob. 4SEACh. 3 - Account for insurance expense. (LO 1, 3). Catrina...Ch. 3 - Prob. 6SEACh. 3 - Account for unearned revenue. (LO 1, 3). Able...Ch. 3 - Prob. 8SEACh. 3 - Prob. 9SEACh. 3 - Prob. 10SEACh. 3 - Calculate profit margin on sales ratio. (LO 5)....Ch. 3 - Prob. 12SEBCh. 3 - Prob. 13SEBCh. 3 - Prob. 14SEBCh. 3 - Prob. 15SEBCh. 3 - Prob. 16SEBCh. 3 - Prob. 17SEBCh. 3 - Prob. 18SEBCh. 3 - Prob. 19SEBCh. 3 - Calculate net income. (LO I, 4). Suppose a company...Ch. 3 - Prob. 21SEBCh. 3 - Prob. 22SEBCh. 3 - Prob. 23EACh. 3 - Prob. 24EACh. 3 - Prob. 25EACh. 3 - Prob. 26EACh. 3 - Prob. 27EACh. 3 - Prob. 28EACh. 3 - Account for insurance expense. (LO 1, 3). Yodel ...Ch. 3 - Prob. 30EACh. 3 - Prob. 31EACh. 3 - Prob. 32EACh. 3 - Prob. 33EACh. 3 - Prob. 34EACh. 3 - Southeast Pest Control, Inc., was started when its...Ch. 3 - Prob. 36EACh. 3 - Prob. 37EACh. 3 - Prob. 38EACh. 3 - Prob. 39EACh. 3 - Prob. 40EBCh. 3 - Prob. 41EBCh. 3 - Prob. 42EBCh. 3 - TJs Tavern paid 10,800 on February 1, 2010, for a...Ch. 3 - Prob. 44EBCh. 3 - Prob. 45EBCh. 3 - Account for insurance expense. (LO 1, 3). All...Ch. 3 - Prob. 47EBCh. 3 - Prob. 48EBCh. 3 - Prob. 49EBCh. 3 - Prob. 50EBCh. 3 - Prob. 51EBCh. 3 - Prob. 52EBCh. 3 - From the following list of accounts (1) identify...Ch. 3 - Prob. 54EBCh. 3 - Prob. 55EBCh. 3 - Prob. 56EBCh. 3 - Prob. 57PACh. 3 - Prob. 58PACh. 3 - Prob. 59PACh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 61PACh. 3 - Record adjustments. (LO 1, 2, 3). The Gladiator...Ch. 3 - Prob. 63PACh. 3 - Transactions for Pops Company for 2011 were as...Ch. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 66PACh. 3 - Prob. 67PACh. 3 - Record adjustments and prepare income statement....Ch. 3 - Prob. 69PBCh. 3 - Prob. 70PBCh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 72PBCh. 3 - Record adjustments. (LO 1, 2, 3). Summit Climbing...Ch. 3 - Prob. 74PBCh. 3 - Prob. 75PBCh. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 77PBCh. 3 - Prob. 78PBCh. 3 - Identify and explain accruals and deferrals. (LO...Ch. 3 - Prob. 2FSACh. 3 - Prob. 3FSACh. 3 - Prob. 1CTPCh. 3 - Prob. 1IECh. 3 - Prob. 3IECh. 3 - Prob. 4IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2024: March 17 Accounts receivable of $2,300 were written off as uncollectible. The company uses the allowance method. March 30 Loaned an officer of the company $30,000 and received a note requiring principal and interest at 5% to be paid on March 30, 2025. May 30 Discounted the $30,000 note at a local bank. The bank’s discount rate is 6%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $18,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. August 31 Sold stock in a nonpublic company with a book value of $5,600 and accepted a $6,600 noninterest-bearing note with a discount rate of 6%. The $6,600 payment is due on February 28, 2025. The stock has no ready market value.…arrow_forwardGreeson Corp. signed a three-month, zero-interest-bearing note on November 1, 2017 for the purchase of $500,000 of inventory. The face value of the note was $507,800. Greeson used a “Discount of Note Payable” account to initially record the note. Assuming that the discount will be amortized equally over the 3-month period and that there was no adjusting entry made for November. In the December 31, 2017 adjusting entry, what is the amount (if any) of the credit to Discount on Notes Payable?arrow_forwardWeldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2021: Mar. 17 Accounts receivable of $3,600 were written off as uncollectible. The company uses the allowance method. 38 Loaned an officer of the company $42,009 and received a note requiring principal and interest at 5% to be paid on March 30, 2022. Hay 30 Discounted the $42,eee note at a local bank. The bank's discount rate is 6%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $31,8ea. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. Aug. 31 Sold stock in a nonpublic company with a book value of $6,900 and accepted a $7,900 noninterest-bearing note with a discount rate of 6%. The $7,980 payment is due on February 28, 2022. The stock has no ready market value. Dec. 31…arrow_forward

- Shown below are selected transactions of Gulf Corp. during the month of December 2011. Dec. 1 Accepted a one-year, 8 percent note receivable from a customer, Glenn Holler. The note is in settlement of an existing $1,500 account receivable. The note, plus interest, is due in full on November 30, 2012. Dec. 8 An account receivable from S. Willis in the amount of $700 is determined to be uncollectible and is written off against the Allowance for Doubtful Accounts. Dec. 15 Unexpectedly received $200 from F. Hill in full payment of her account. The $200 account receivable from Hill previously had been written off as uncollectible. Dec. 31 The month-end bank reconciliation includes the following items: outstanding checks, $12,320; deposit in transit, $3,150; check from customer T. Jones returned “NSF,” $358; bank service charges, $10; bank collected $20,000 in maturing U.S. Treasury bills (a cash equivalent) on the company’s behalf. (These Treasury bills had cost $19,670, so the amount…arrow_forwardAt December 31, 2018, the Accounts Receivable balance of Solar Energy Manufacturing is $205,000. The Allowance for Bad Debts account has a $8,050 debit balance. Solar Energy Manufacturing prepares the following aging schedule for its accounts receivable: Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2018. Begin by determining the target balance of Allowance for Bad Debts by using the age of each account. Age of Accounts 1-30 31-60 61-90 Over 90 Total Days Days Days Days Balance Accounts Receivable $70,000 $85,000 $45,000 $5,000 Estimated percent uncollectible 0.5 % 5.0 % 7.0 % 46.0 % Estimated total uncollectible Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and…arrow_forwardRaintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following Current asseter Receivables, set of allowance for uncollectible accounts of $32,000 During 2024, credit sales were $1760,000, cash collections from customers $1,840,000, and $37,000 in accounts receivable were written off. In addition, $3,200 was collected from a customer whose account was written off in 2023. An aging of accounts receivable at December 31, 2024, reveals the following: Age Group 0-60 days 61-30 days 91-120 days Over 120 days Percentage of Year- End Receivables in Group 458 10 20 Percent collectible 10 35 50 5442,000 Required: 1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off 2. Prepare the year-end adjusting entry for bad debts according to each of the following…arrow_forward

- At the end of the current year, using the aging of receivable method, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $375. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardAt the end of the current year, using the aging of receivable method, management estimated that $24,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $465. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardMagrath Company has an operating cycle of less than one year and provides credit terms for all of its customers.On April 1, 2018, the company factored, without recourse, some of its accounts receivable. Magrath transferredthe receivables to a financial institution, and will have no further association with the receivables.Magrath uses the allowance method to account for uncollectible accounts. During 2018, some accounts werewritten off as uncollectible and other accounts previously written off as uncollectible were collected.Required:1. How should Magrath account for and report the accounts receivable factored on April 1, 2018? Why is thisaccounting treatment appropriate?2. How should Magrath account for the collection of the accounts previously written off as uncollectible?3. What are the two basic approaches to estimating uncollectible accounts under the allowance method? What isthe rationale for each approach?arrow_forward

- At the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of Accounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 30 F3 888 F7 F9 F10 # 2$ % & 3 4 6 7 8 9. E R Y P { F K L < ? C V alt command option + || .. .. | Harrow_forwardAt the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of ACcounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 吕0 F3 888 4 F5 F6 F7 FB # 2$ & * 4 5 7 9 E R Y U P S F G J K C V alt mand command option *3arrow_forwardWeldon Corporation’s fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2021: Mar. 17 Accounts receivable of $3,000 were written off as uncollectible. The company uses the allowance method. 30 Loaned an officer of the company $33,000 and received a note requiring principal and interest at 8% to be paid on March 30, 2022. May 30 Discounted the $33,000 note at a local bank. The bank’s discount rate is 9%. The note was discounted without recourse and the sale criteria are met. June 30 Sold merchandise to the Blankenship Company for $25,000. Terms of the sale are 2/10, n/30. Weldon uses the gross method to account for cash discounts. July 8 The Blankenship Company paid its account in full. Aug. 31 Sold stock in a nonpublic company with a book value of $6,300 and accepted a $8,000 noninterest-bearing note with a discount rate of 9%. The $8,000 payment is due on February 28, 2022. The stock…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY