Concept explainers

Blue Ribbon Flour Company manufactures flour by a series of three processes, beginning in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour.

The balance in the account Work in Process—Sifting Department was as follows on May 1:

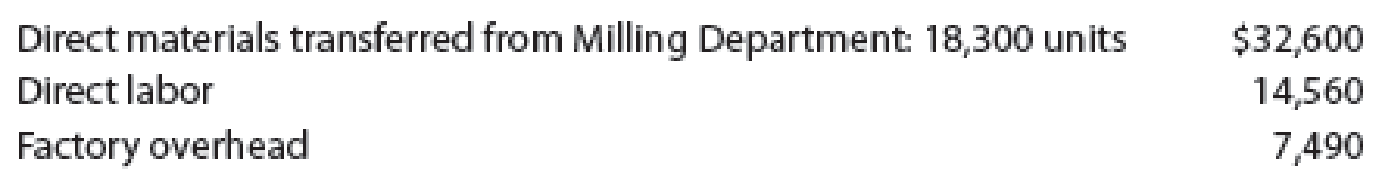

The following costs were charged to Work in Process—Sifting Department during May:

During May, 18,000 units of flour were completed and transferred to finished goods. Work in Process—Sifting Department on May 31 was 1,800 units, 75% completed.

Instructions

Prepare a cost of production report for the Sifting Department for May, using the weighted average method. Assume that direct materials are placed in process during production.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Managerial Accounting

- The following information is provided by Raynette's Pharmacy for the last quarter of its fiscal year ending on March 31, 20--: Cost Retail Inventory, start of the period, January 1, 20-- $ 33,700 $52,600 1,71,635 2,63,300 2,60,700 Net purchases during the period Net sales for the period 1. Estimate the ending inventory as of March 31 using the retail inventory method. 2. Estimate the cost of goods sold for the time period January 1 through March 31 using the retail inventory method.arrow_forwardI need answer of this accounting questionsarrow_forwardAlpha industries is evaluating a project sokve this general accounting questionarrow_forward

- In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend$ 100.0Payment for the early extinguishment of long-term bonds (book value: $89.0 million)94.0Proceeds from the sale of treasury stock (cost: $25.0 million)30.0Gain on sale of land3.4Proceeds from sale of land10.2Purchase of Microsoft common stock158.0Declaration of cash dividends59.0Distribution of cash dividends declared in 202355.0 Required: 1. In Rapid Pac's statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2024? Note: Cash outflows should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).arrow_forwardDon't use ai please give me answer general accounting questionarrow_forwardFinancial data for Hunger Games Company for last year appear below: Hunger Games Company Statements of Financial Position Beginning Balance Ending Balance Assets: Cash $120,700 $220,000 Accounts receivable 225,000 475,000 Inventory 317,000 390,000 Plant and equipment (net) 940,000 860,000 Investment in Katniss Company 100,000 98,000 Land (undeveloped) 198,000 65,000 Total assets $1,900,700 $2,108,000 Liabilities and owners' equity: Accounts payable $178,700 $8,000 Long-term debt 512,000 600,000 Owners' equity 1,210,000 1,500,000 Total liabilities and owners' $1,900,700 $2,108,000 equityarrow_forward

- Financial data for Hunger Games Company for last year appear below: Hunger Games Company Statements of Financial Position Beginning Balance Ending Balance Assets: Cash $120,700 $220,000 Accounts receivable 225,000 475,000 Inventory 317,000 390,000 Plant and equipment (net) 940,000 860,000 Investment in Katniss Company 100,000 98,000 Land (undeveloped) 198,000 65,000 Total assets $1,900,700 $2,108,000 Liabilities and owners' equity: Accounts payable $178,700 $8,000 Long-term debt 512,000 600,000 Owners' equity 1,210,000 1,500,000 Total liabilities and owners' $1,900,700 $2,108,000 equityarrow_forwardLiability?arrow_forwardSolve this question financial accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,