Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 4PA

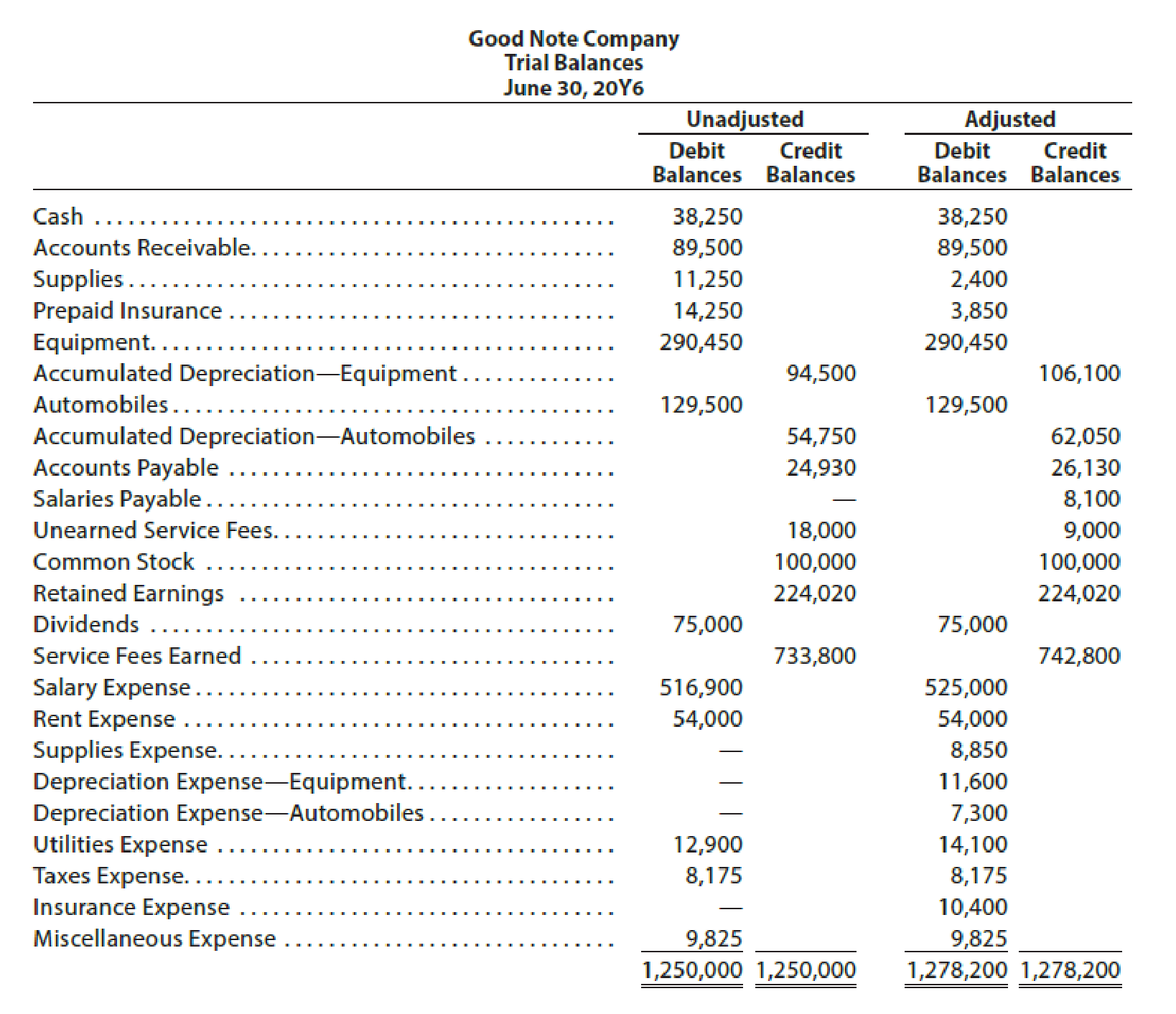

Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On June 30, 20Y6, the end of the current year, the accountant for Good Note prepared the following

Instructions

Journalize the seven entries that adjusted the accounts at June 30. None of the accounts were affected by more than one adjusting entry.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

As of Sene 30 1994, the end of the current fiscal year, the accountant for Abay General

Trading completed the worksheet before journalizing and posting the adjustments.

Required: (a) Compare the adjusted and unadjusted trial balances and prepare the eight journal entries that were required to adjust the accounts.

(b) Prepare the journal entries that were required to close temporary accounts.

Abay General Trading

Trial Balance

Sene 30, 1994

Un adjusted

Adjusted

Cash

12,825.00

12,825.00

Supplies

8,950.00

3,635.00

Prepaid rent

19,500.00

1,500.00

Prepaid insurance

3,750.00

1,250.00

Equipment

92,150.00

92,150.00

Accumulated depreciation equipment

53,480.00

66,270.00

Automobile

56,500.00

56,500.00

Accumulated depreciation automobile

28,250.00

36,900.00

Accounts payable

8,310.00

8,730.00

Salary payable

3,400.00…

At the beginning of the year, the balance in the Allowance for Doubtful Accounts is a credit of $559. During the year, $349 of previously written off accounts were reinstated and accounts totaling $837 are written off as uncollectible. The end-of-year balance (before adjustment) in the Allowance for Doubtful Accounts should be the one listed below.

a.$349

b.$71

c.$559

d.$837

Journalize the following adjusting entries on December 31:

A. The Supplies Account balance as of December 31 is $1,200. Actual supplies on hand equals $800.

B. The company uses the allowance method for accounts receivable. A review of the accounts receivable

aging report indicates that $50,000 of the accounts receivable will not be collectible. The allowance

account has a current balance of $30,000.

C. The trial balance indicates unearned revenue of $9,000. The company has determined that $3,000 of

service has still not yet been provided.

D. The company paid an annual insurance premium of $12,000 during the year. Six months of the

insurance has expired.

E. On January 1, the company purchased a delivery truck for 36,000. The company expects to use the

truck for 3 years.

Chapter 3 Solutions

Financial And Managerial Accounting

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (A) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - If the effect of the credit portion of an...Ch. 3 - Prob. 8DQCh. 3 - Prob. 9DQCh. 3 - (A) Explain the purpose of the two accounts:...

Ch. 3 - Accounts requiring adjustment Indicate with a Yes...Ch. 3 - Prob. 2BECh. 3 - Adjustment for accrued revenues At the end of the...Ch. 3 - Prob. 4BECh. 3 - Adjustment for unearned revenue On June 1, 20Y2,...Ch. 3 - Adjustment for prepaid expense The prepaid...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Prob. 10BECh. 3 - Prob. 1ECh. 3 - Classifying adjusting entries The following...Ch. 3 - Adjusting entry for accrued fees At the end of the...Ch. 3 - Effect of omitting adjusting entry Paradise Realty...Ch. 3 - Adjusting entries for accrued salaries Paradise...Ch. 3 - Determining wages paid The wages payable and wages...Ch. 3 - Effect of omitting adjusting entry Accrued...Ch. 3 - Effect of omitting adjusting entry When preparing...Ch. 3 - Adjusting entries for unearned fees The balance in...Ch. 3 - Effect of omitting adjusting entry At the end of...Ch. 3 - Adjusting entry for supplies The balance in the...Ch. 3 - Determining supplies purchased The supplies and...Ch. 3 - Effect of omitting adjusting entry At March 31,...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for unearned and accrued fees...Ch. 3 - Adjusting entries for prepaid and accrued taxes...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Determining fixed assets book value The balance in...Ch. 3 - Prob. 20ECh. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Prob. 24ECh. 3 - Prob. 25ECh. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries from trial balances The...Ch. 3 - Adjusting entries On March 31, the following data...Ch. 3 - Adjusting entries Selected account balances before...Ch. 3 - Adjusting entries Trident Repairs Service, an...Ch. 3 - Adjusting entries Good Note Company specializes in...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Prob. 6PACh. 3 - Adjusting entries On May 31, the following data...Ch. 3 - Adjusting entries Selected account balances before...Ch. 3 - Prob. 3PBCh. 3 - Adjusting entries The Signage Company specializes...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of August,...Ch. 3 - The unadjusted trial balance that you prepared for...Ch. 3 - Analyze Amazon.com Amazon.com, Inc. (AMZN) is the...Ch. 3 - Prob. 2MADCh. 3 - Prob. 3MADCh. 3 - Analyze Chipotle Mexican Grill Chipotle Mexican...Ch. 3 - Analyze Nike The following data are taken from...Ch. 3 - Prob. 6MADCh. 3 - Ethics in Action Chris P. Bacon is the chief...Ch. 3 - Prob. 2TIFCh. 3 - Prob. 4TIFCh. 3 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardThe accounts receivable clerk for Kirchhoff Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardAging of receivables schedule The accounts receivable clerk for Evers Industries prepared the following partially completed aging of receivables schedule as of the end of business on July 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of July 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

- company’s accounting records provide the following information concerning certain account balances and changes in the account balances during the current year. Transaction information is missing from each of the below. Prepare the journal entry to record the information for each account. b. Allowance for Doubtful Accounts: Jan. 1 balance, $1,500; Dec. 31 balance, $2,200; adjusting entry increasing allowance on Dec. 31, $4,800. Record write-off uncollectible accounts receivable. c. Inventory of office supplies: Jan. 1 balance, $1,500; Dec. 31 balance, $1,350; office supplies expense for the year, $9,500. Record purchase of office supplies. d. Equipment: Jan. 1 balance, $20,500; Dec. 31 balance, $18,000; equipment costing $8,000 was sold during the year. Record purchase of equipment. e. Accounts Payable: Jan. 1 balance $9,000; Dec. 31 balance, $11,500; purchases on - account for the year, $48,000. Record cash payments. Please dont provide solution in image thnxarrow_forwardUsing data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardReviewing insurance policies revealed that a single policy was purchased on March 1, for one year's coverage, in the amount of $9,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided, Make the December 31 adjusting journal entry to bring the balances to correct. Show the impact that these transactions had.arrow_forward

- As Perry Materials Supply was preparing for the year-end close, their balances were as follows: Accounts Receivable - $146000 (dr) Allowance for uncollectible accounts - $6200 (dr) Uncollected Account Expense - $0 Perry Materials uses the aging method and has completed the following analysis of the accounts receivable: Customer 1-30 Days 31-60 Days 61-90 Days Over 90 Days Total Balance Johnson $4,600 $3,200 $7,800 Hot Pots, Inc. 800 1,000 1,800 Potter 40,000 550 40,550 Harrison 3,600 900 4,500 Marx 2,000 50 2,050 Younger 65,000 65,000 Merry Maids 5,900 5,900 Acher 12,000 6,400 18,400 Totals $127,500 $13,750 $3,700 $1,050 $146,000 Uncollectible percentage 2% 10% 20% 40% Estimated uncollectible amount $2,550 $1,375 $740 $420 $5,085 Required: How much will the…arrow_forwardPrior to recording the following, Elite Electronics, Incorporated, had a credit balance of $2,200 in its Allowance for Doubtful Accounts. Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. On December 15, the customer balance for $320 written off on August 31 was collected in full.arrow_forwardAt the beginning of the year, the balance in the Allowance for Doubtful Accounts is a credit of $774. During the year, $346 of previously written off accounts were reinstated and accounts totaling $845 are written off as uncollectible. The end of the year balance in the Allowance for Doubtful Accounts should be the one listed below. Select the correct answer. $275 $346 $774 $845arrow_forward

- Prontera Co. is a merchandiser of outdoors gear. An aging of the company’s accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate what the total balance of the allowance for doubtful accounts should be as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31.arrow_forwardCasebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: Customer Amount $ 4,650 Shawn Brooke Eve Denton 5,180 Art Malloy 11,050 Cassie Yost 9,120 Total $30,000 a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded $5,250,000 of credit sales during the year. Based on past history and industry averages, 4% of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Company's net income have been under the direct write-off method than under the allowance method?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY