FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

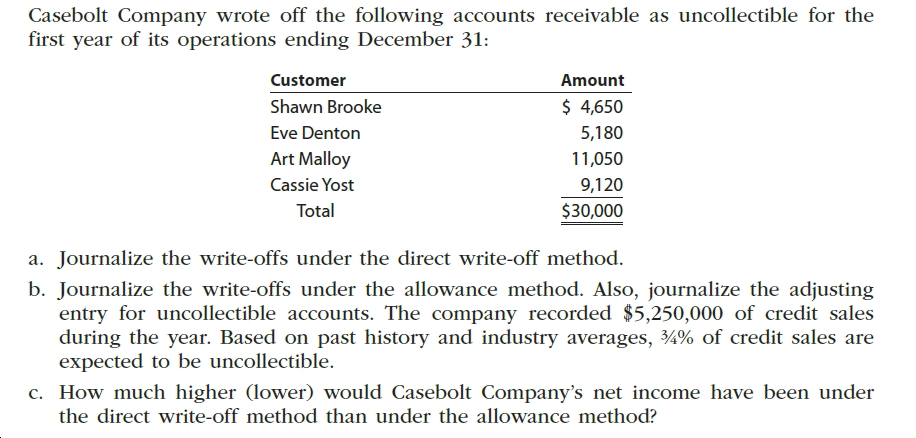

Transcribed Image Text:Casebolt Company wrote off the following accounts receivable as uncollectible for the

first year of its operations ending December 31:

Customer

Amount

$ 4,650

Shawn Brooke

Eve Denton

5,180

Art Malloy

11,050

Cassie Yost

9,120

Total

$30,000

a. Journalize the write-offs under the direct write-off method.

b. Journalize the write-offs under the allowance method. Also, journalize the adjusting

entry for uncollectible accounts. The company recorded $5,250,000 of credit sales

during the year. Based on past history and industry averages, 4% of credit sales are

expected to be uncollectible.

c. How much higher (lower) would Casebolt Company's net income have been under

the direct write-off method than under the allowance method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- The ledger of Teal Mountain Inc. at the end of the current year shows Accounts Receivable $74,000; Credit Sales $810,000; and Sales Returns and Allowances $36,000. If Teal Mountain uses the direct write-off method to account for uncollectible accounts, journalize the entry if on December 31 Teal Mountain determines that Matisse Company's $750 balance is uncollectible. (a) If Allowance for Doubtful Accounts has a credit balance of $1,400 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (b) If Allowance for Doubtful Accounts has a debit balance of $600 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. (c) Prepare journal entries to record the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) Dec.…arrow_forwardSubject: accountingarrow_forwardSteve Company estimates uncollectible accounts receivable using percentage of receivable method. During the month of August, the company wrote off a $7 ,000 receivable. Following the adjusting entry for August, the credit balance in the Allowance for Doubtful Accounts was $6,000 larger than it was on I August. What amount of bad debt expense was recorded for August? A: $5,000 B: $2,000 C: $3,000 D: $13,000arrow_forward

- On January 1, Wei company begins the accounting period with a $34,000 credit balance in Allowance for Doubtful Accounts. 1. On February 1, the company determined that $7,600 in customer accounts was uncollectible; specifically, $1,300 for Oakley Co. and $6,300 for Brookes Co. Prepare the journal entry to write off those two accounts. 2. On June 5, the company unexpectedly received a $1,300 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received.arrow_forwardThe following account balances were taken from the adjusted trial balance for Shaw Messenger Service, a delivery service firm, for the fiscal year ended April 30, 2011: Depreciation Expense $14,500 875,000 Fees Earned 6,000 Insurance Expense Miscellaneous Expense Rent Expense Salaries Expense Supplies Expense Utilities Expense Prepare an income statement. Shaw Messenger Service 10,200 75,000 481,300 7,150 40,850 Income Statement For the Year Ended April 30, 20Y1 Line Item Description Amount Amount Expenses: Total expensesarrow_forwardSolstice Company determines on October 1 that it cannot collect $61,000 of its accounts receivable from its customer, P. Moore. Apply the direct write-off method to record this loss as of October 1. View transaction list Journal entry worksheet 1 Record the write-off an account. Note: Enter debits before credits. Date October 01 General Journal Debit Creditarrow_forward

- On January 1, Wei Company begins the accounting period with a $30,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $6,800 in customer accounts was uncollectible; specifically, $900 for Oakley Co. and $5,900 for Brookes Co. Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $900 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received.arrow_forwardSeaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount $ 21,550 Kim Abel Lee Drake 33,925 Jenny Green 27,565 Mike Lamb 19,460 Total $102,500arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Kim Abel Lee Drake Jenny Green Mike Lamb Total Aging Class (Number of Days Past Due) 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables Bad Debt Expense Accounts Receivable-Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Allowance for Doubtful Accounts Accounts Receivable-Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Bad Debt Expense Amount $24,200 34,150 29,700 17,600 $105,650 Allowance for Doubtful Accounts Feedback Receivables Balance on…arrow_forward

- Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables: Jan. 30. Sold merchandise on account to Jane Doe, $80,000. The cost of the merchandise sold was $45,000. June 3. Received $48,000 and wrote off the remainder owed on the sale of January 30 as uncollectible. Nov. 27. Reinstated the account that had been written off on June 3 and received cash in full payment.arrow_forwardRequirement 1. Record the transactions in the journal and post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $4.300 (cr.) and so. respectively. Remember to update account balances but ignore posting references. Begin by recording the transactions in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Jan 17: Sold inventory to Rick Harrison, $900 on account. Ignore cost of goods sold. Journal Entry Date Accounts Debit Credit Jan 17 Jun 29: Wrote off the Rick Harrison account as uncollectible after repeated efforts to collect from him Journal Entry Date Accounts Debit Credit More Info Jun 29 Jan 17 Sold inventory to Rick Harrison, $900, on account. Ignore cost of goods sold. Jun 29 Wrote off the Rick Harrison account as uncollectible after repeated efforts to collect from him. Aug 6 Received $50 from Rick Harrison, along with a letter…arrow_forwardThe accounts receivable clerk for Evers Industries prepared the following partially completed aging of receivables schedule as of the end of business on July 31: 1 A B C D E F G 2 Days Past Due Days Past Due Days Past Due Days Past Due 3 Customer Balance Not Past Due 1-30 31-60 61-90 Over 90 4 Acme Industries Inc. 2,600.00 2,600.00 5 Alliance Company 4,200.00 4,200.00 6 ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ ~~~~~ 7 Zollinger Company 5,200.00 5,200.00 8 Subtotals 1,051,100.00 597,500.00 223,600.00 114,300.00 85,400.00 30,300.00 The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: Customer Balance Due Date Boyd Industries $44,100 April 7 Hodges Company 20,600 May 29 Kent Creek Inc. 7,800 June 8 Lockwood Company…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education