Concept explainers

Determining

Wolverine World Wide, Inc., manufactures military, work, sport, and casual footwear and leather accessories under a variety of brand names, such as Caterpillar, Hush Puppies, Wolverine, and Steve Madden. The following transactions occurred during a recent month.

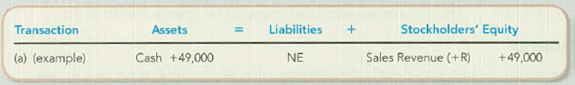

- a. Made cash sales of $49,000 (example).

- b. Purchased $3,000 of additional supplies on account.

- c. Borrowed $58,000 on long-term notes.

- d. Purchased $18,600 in additional equipment, paying in cash.

- e. Incurred $27,000 in selling expenses, paying two-thirds in cash and owing the rest on account.

- f. Paid $4,700 in rent for this month, and $4,700 for next month.

Required:

For each of the transactions, complete the table below, indicating the account, amount, and direction of the effect (+ for increase and − for decrease) of each transaction under the accrual basis. Write NE if there is no effect. Include revenues and expenses as subcategories of stockholders’ equity, as shown for the first transaction, which is provided as an example. Also, determine the company’s preliminary net income.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Fundamentals of Financial Accounting

- Compute the depreciation chargearrow_forwardFor its inspecting cost pool, Brilliant Professor Mullen Company expected an overhead cost of $360,000 and an estimated 14,200 inspections. The actual overhead cost for that cost pool was $395,000 for 16,000 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is __.arrow_forwardCan you help me with accounting questionsarrow_forward

- Compute the depreciation charge for 2016arrow_forwardFor this year, Jackson Enterprises has $25,000 net earnings on the income statement and $10,000 net cash inflow from operating activities, $18,000 net cash outflow from investing activities, and $22,000 cash inflow from financing activities on the statement of cash flows. What is the accruals total reported for this period?arrow_forwardHii expert please give me correct answer general accounting questionarrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning