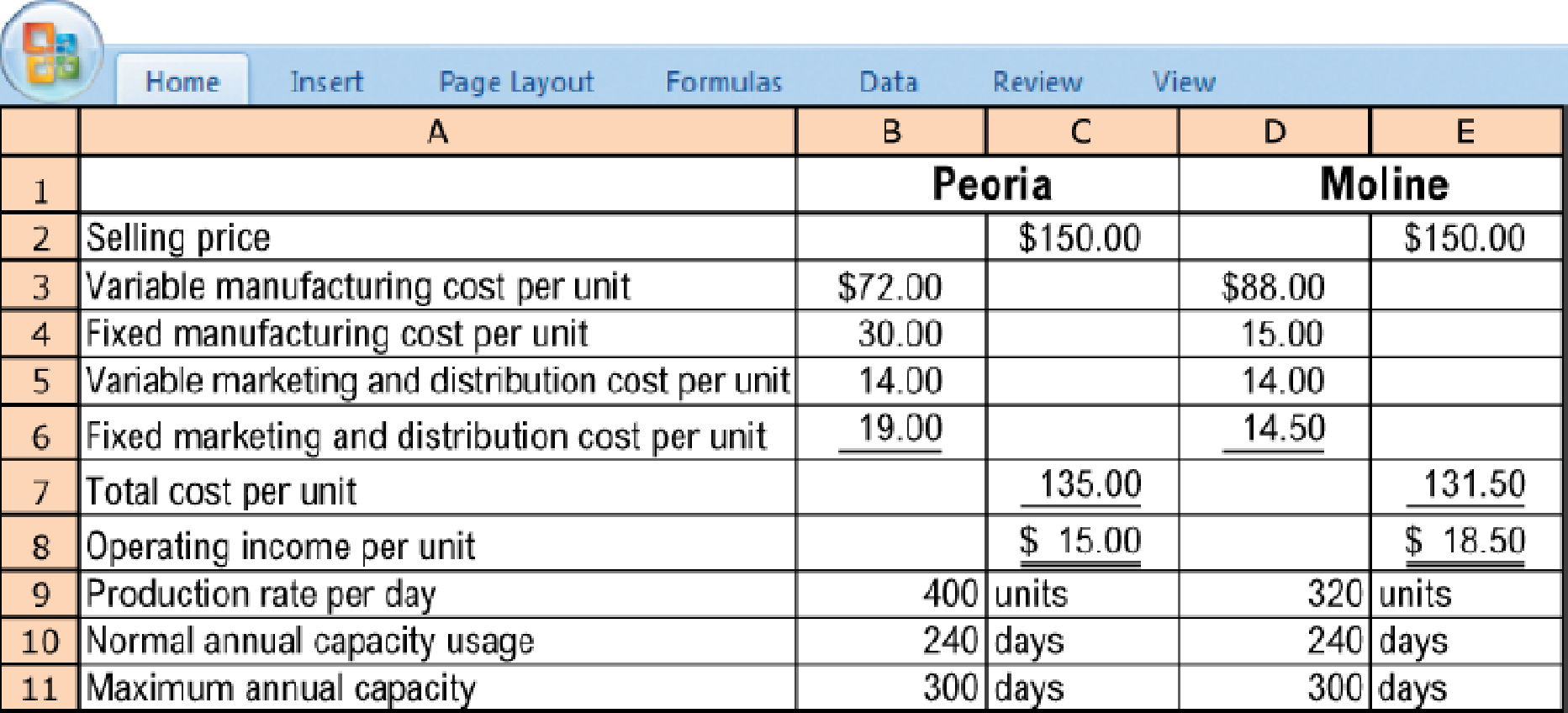

Deciding where to produce. (CMA, adapted) Portal Corporation produces the same power generator in two Illinois plants, a new plant in Peoria and an older plant in Moline. The following data are available for the two plants:

All fixed costs per unit are calculated based on a normal capacity usage consisting of 240 working days. When the number of working days exceeds 240, overtime charges raise the variable

Portal Corporation is expected to produce and sell 192,000 power generators during the coming year.

Wanting to take advantage of the higher operating income per unit at Moline, the company’s production manager has decided to manufacture 96,000 units at each plant, resulting in a plan in which Moline operates at maximum capacity (320 units per day × 300 days) and Peoria operates at its normal volume (400 units per day × 240 days).

- 1. Calculate the breakeven point in units for the Peoria plant and for the Moline plant. Required

- 2. Calculate the operating income that would result from the production manager’s plan to produce 96.000 units at each plant.

- 3. Determine how the production of 192,000 units should be allocated between the Peoria and Moline plants to maximize operating income for Portal Corporation. Show your calculations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Cost Accounting (15th Edition)

- Rundle Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials. Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rundle for $2.60 each. Required a. Calculate the total relevant cost. Should Rundle continue to make the containers? b. Rundle could lease the space it currently uses in the manufacturing process. If leasing would produce $11,600 per month, calculate the total avoidable costs. Should Rundle continue to make the containers? Answer is complete but not entirely correct. $ a. Total relevant cost a. Should Rundle continue to make the containers? b. Total avoidable cost b. Should Rundle continue to make the containers? 190.650,000 Yes $24,180,000 $ 5,200 6,100 4,000 7,800…arrow_forwardThe Pennsylvania Engine Company manufactures the identical small engine at two Pennsylvania plants, an older plant in Pottsville and a new plant in Harrisburg. Information for each of the plants for the current year is summarized below: Pottsville Harrisburg Selling price per engine $155.00 $155.00 Variable manufacturing cost per engine 91.00 75.00 Fixed manufacturing cost per engine 15.00 30.00 Variable marketing & distribution cost per engine 16.00 15.00 Fixed marketing & distribution cost per engine 13.00 16.00 Normal annual capacity (in engines) 76,800 96,000 Annual capacity with Overtime (in engines) 99,200 124,000 The above fixed and variable costs per engine are calculated based upon each plant operating at the normal annual capacity. Annual fixed costs at each plant remain constant as activity levels change and can only be eliminated through the complete shutdown of the plant. When the Pottsville plant operates above normal annual capacity, overtime costs increases the…arrow_forwardOffice Expert Inc. produces a component which is required for manufacturing many of its appliances. The monthly production data for the component are as follows: Monthly Production Data for Component Production Data Amounts Number of units produced 2,500 units Variable costs per unit $10 per unit Total monthly fixed costs (allocated) $18,000 The company received an offer from a foreign supplier to purchase the component for $15 per unit. The monthly fixed costs are unavoidable. However, if Office Expert decides to purchase the component, they can use the freed manufacturing space to earn an additional revenue of $20,000 per month. If Office Expert decides to purchase from the foreign supplier, monthly operating income would – Group of answer choices Decrease by $24,000 Increase by $7,500 Increase by $25,500 Decrease by $12,500arrow_forward

- Lakeside Incorporated produces a product that currently sells for $42 per unit. Current production costs per unit include direct materials, $11.50; direct labor, $13.50; variable overhead, $6.50; and fixed overhead, $6.50. Lakeside has received an offer from a nonprofit organization to buy 8,300 units at $32.50 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. b. Should Lakeside accept this special sales order? Complete this question by entering your answers in the tabs below. Required A Required B Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. in operating income Increasearrow_forwardThe Pennsylvania Engine Company manufactures the identical small engine at two Pennsylvania plants, an older plant in Pottsville and a new plant in Harrisburg. Information for each of the plants for the current year is summarized below: Pottsville Harrisburg Selling price per engine $155.00 $155.00 Variable manufacturing cost per engine 91.00 75.00 Fixed manufacturing cost per engine 15.00 30.00 Variable marketing & distribution cost per engine 16.00 15.00 Fixed marketing & distribution cost per engine 13.00 16.00 Normal annual capacity (in engines) 76,800 96,000 Annual capacity with Overtime (in engines) 99,200 124,000 The above fixed and variable costs per engine are calculated based upon each plant operating at the normal annual capacity. Annual fixed costs at each plant remain constant as activity levels change and can only be eliminated through the complete shutdown of the plant. When the Pottsville plant operates above normal annual capacity, overtime costs increases the…arrow_forwardSan Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor 11,250 Variable overhead 12,600 Fixed overhead 16,200 An outside supplier has offered to sell San Clemente the subcomponent for $2.85 a unit. If San Clemente accepts the offer, by how much will net income increase (decrease)?arrow_forward

- Required information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,600 units, and monthly production costs for the production of 1,300 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($270 fixed) Depreciation Total Cost $ 2,500 8,100 650 3,000 510 750 Suppose it sells each birdbath for $24. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,500 units.arrow_forwardJordan Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs Allocated facility-level costs $ 5,700 6,800 3,900 8,100 27,200 One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Jordan for $2.90 each. Required a. Calculate the total relevant cost. Should Jordan continue to make the containers? b. Jordan could lease the space it currently uses in the manufacturing process. If leasing would produce $12.300 per rhonth, calculate the total avoidable costs. Should Jordan continue to make the containers? a. Total relevant cost Should Jordan continue to make the containers? b. Total avoidable cost Should Jordan continue to make the containers?arrow_forwardRequired information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,500 units, and monthly production costs for the production of 1,200 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($340 fixed) Depreciation Required: 1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or perunit (or combination thereof). 2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove. 3. State Morning Dove's linear cost equation for a production level of 0 to1,500 units. Enter answer as an equation in the form of y=a + bx. 4. Calculate Morning Dove's expected total cost if…arrow_forward

- Campbell Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,900 6,400 4,100 9,600 26,600 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Campbell for $2.80 each. Required a. Calculate the total relevant cost. Should Campbell continue to make the containers? b. Campbell could lease the space it currently uses in the manufacturing process. If leasing would produce $12,800 per month, calculate the total avoidable costs. Should Campbell continue to make the containers? a. Total relevant cost Should Campbell continue to make the containers? b. Total avoidable cost Should Campbell continue to make the containers?arrow_forwardRequired information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,900 units, and monthly production costs for the production of 1,500 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($130 fixed) Supervisor's salary Maintenance ($340 fixed) Depreciation Total Cost $ 2,300 7,700 570 3,300 550 750 Suppose it sells each birdbath for $22. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,700 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the unit contribution margin and…arrow_forwardRequired information [The following information applies to the questions displayed below.] Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,500 units, and monthly production costs for the production of 500 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($100 fixed) Supervisor's salary Maintenance ($280 fixed) Depreciation Total Cost $ 1,500 7,500 650 3,000 480 800 Required: 1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination thereof). 2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove. 3. State Morning Dove's linear cost equation for a production level of 0 to 1,500 units. Enter answer as an equation in the form of y= a + bx. 4. Calculate…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education