Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1SQ

(PRICE) In February 2009, Treasury 8.5s of 2020 yielded 3.2976%. What was their price? If the yield rose to 4%, what would happen to the price?

Expert Solution

Summary Introduction

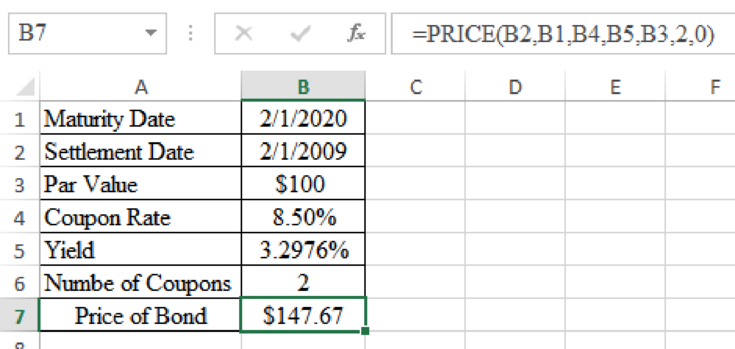

To determine: The price of bond at a yield of 3.2976%.

Answer to Problem 1SQ

The price of bond at a yield of 3.2976% is $147.67.

Explanation of Solution

Determine the price of bond at a yield of 3.2976%

Excel Spreadsheet:

Therefore the price of bond at a yield of 3.2976% is $147.67.

Expert Solution

Summary Introduction

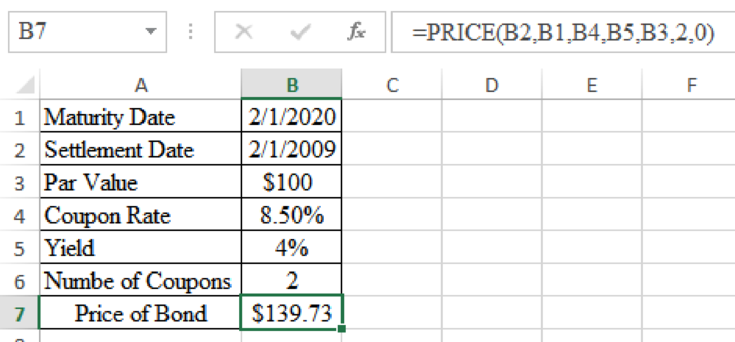

To determine: The price of bond at a yield of 4%.

Answer to Problem 1SQ

The price of bond at a yield of 4% is $139.73.

Explanation of Solution

Determine the price of bond at a yield of 4%

Excel Spreadsheet:

Therefore the price of bond at a yield of 4% is $139.73.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Given a yield to maturity of 0.00045629%.

Assume the yield to maturity immediately increases 1%. Calculate the new price of the Treasury Bill.

Show Work Please.

2. What does the following yield curve predict?

Treasury yield curve for July 31, 2000.

Maturity Yield (%)

1 month

3 months 6.20

6 months 6.35

1 year

2 years

6.30

З years

6.30

5 years

6.15

7 years

10 years 6.03

30 years 5.78

What is the nominal yield on a 10-year government T-note if the real rate is 4%, the expected inflation is 5%, the liquidity

premium is 1%, and the maturity risk premium is 1%?

1.5%

• not enough information

• 1.0%

• 2.0%

.

Chapter 3 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Prob. 1PSCh. 3 - Bond prices and yields The following statements...Ch. 3 - Prob. 3PSCh. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Spot interest rates and yields Which comes first...

Ch. 3 - Prob. 7PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Prob. 9PSCh. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Prob. 16PSCh. 3 - Prob. 17PSCh. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 20PSCh. 3 - Prob. 21PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 23PSCh. 3 - Prob. 25PSCh. 3 - Prob. 26PSCh. 3 - Prob. 27PSCh. 3 - Prob. 28PSCh. 3 - Prob. 29PSCh. 3 - Prices and yields If a bonds yield to maturity...Ch. 3 - Prob. 31PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 33PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An investment offers a total return of 13.8 percent over the coming year. You believe the total real return will be only 9.4 percent. What do you believe the exact inflation rate will be for the next year? Please show how to solve this by using Excel, thank you.arrow_forwardThe graph (attached) depicts yield curves for 5 November 2021, 5 November, 2022, and 5 November, 2019. The yield rates are given for each of those in the graph (attached). a) As of 5 November 2021, what is the one-month interest rate expected by market participants in 5 January, 2022? Are they expecting a change in monetary policy within that time frame?arrow_forwardBased on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 0.85% R₁ = E(2r1) = 2.00% E(3r1) = 2.10% E(41) = 2.40% 42 = 43 = 0.08% 0.10% L4 44 = 0.12% Using the liquidity premium theory, determine the current (long-term) rates. Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Years 1 2 3 4 Current (Long-term) Rates % % % %arrow_forward

- Inflation erodes the value of money. Assuming an annual inflation rate of 9%, what would a 2011 dollar be worth in 2006? That is, find an amount P in 2006 that would be worth $1.00 in 2011. In 2011, $1.00 will have the same purchasing power as $____ in 2006.arrow_forward65. At the beginning of the slide, you were asked to derive the annualize rate of return for the U.S. stock market. In 2016 the value was 23.6 trillion and in 2018 it was 30.1 trillion. So what is the annualized RR? Select one: O a. 6.50% O b. 27.54% O c. 30.10% O d. 13.77%arrow_forwardAssuming you have an inflation linker that pays an annual coupon of 2.5% every half a year and the real yield is 3%. What will be the price of the if it matures after 3.5 if you assume that the total inflation during this period was 5.5% ? Assume the principal is 100. Hint: Find the price without the inflation and then apply the adjustment as we did in class 103.76 98.35 102.76 104.2arrow_forward

- Assuming you have an inflation linker that pays an annual coupon of 2.5% every half a year and the real yield is 3%. What will be the price of the if it matures after 3.5 without the inflation adjustment? Assume the principal is 100. 98.35 97.2 99.1 NONE OF THE ABOVEarrow_forwardBased on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 E(2r1) E(3r1) E(4r1) 1.20% 2.35% L2 = 0.09% 2.45% L3 = 0.12% 2.75% L4= 0.14% Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forwardIn 1982 the inflation rate hit 16%. Suppose that the average cost of a textbook in 1982 was $25. What was the expected cost in the year 2017 if we project this rate of inflation on the cost? (Assume continuous compounding. Round your answer to the nearest cent.) If the average cost of a textbook in 2012 was $175, what is the actual inflation rate (rounded to the nearest tenth percent)?arrow_forward

- ok Based on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 1.00% = 2.15% 2.25% = 2.55% E(21) E(31) = E(471) 42 = L3 = L4 = Using the liquidity premium theory, determine the current (long-term) rates. 0.05% 0.10% 0.12% nel plecor (in 01234 should be enteredarrow_forwardLiquidity Premium Hypothesis Based on economists' forecasts and analysis, one-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 7.00% E(r2) 8.10% L2 = .45% E(r3) = 8.20% L3 .55% E(r4) = 8.50% L4 = .60% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasury security? = Multiple Choice 9.1000% 8.3470% 7.9500% 7.9490% 1arrow_forwarda) You invest 155 000 TL for a year. At the end the year, you have 174 375 TL net in your account. If the inflation realizes at %10 fot this year, calculate real rate of return? Can real interest rates be negative? Give a simple example?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License