Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

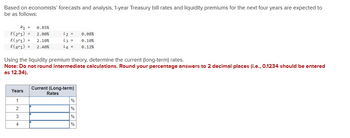

Transcribed Image Text:Based on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to

be as follows:

R1 0.85%

R₁ =

E(2r1) = 2.00%

E(3r1) = 2.10%

E(41) = 2.40%

42 =

43 =

0.08%

0.10%

L4

44 = 0.12%

Using the liquidity premium theory, determine the current (long-term) rates.

Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e., 0.1234 should be entered

as 12.34).

Years

1

2

3

4

Current (Long-term)

Rates

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Liquidity Premium Hypothesis Based on economists' forecasts and analysis, one-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 7.60% E(r2) = 8.70% L2 = 1.05% E(r3) = 8.80% L3 = 1.15% E(r4) = 9.10% L4 = 1.20% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasury security?arrow_forwardSuppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1 = 6%, E(2r1) = 7%, E(3r1) = 7.60%, E(4r1) = 7.95% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Round your answers to 2 decimal places.)arrow_forwardUsing the Treasury yield information in part c, calculate the following rates using geometric averages (round your answers to three decimal places): The 1-year rate, 1 year from now The 5-year rate, 5 years from now The 10-year rate, 10 years from now The 10-year rate, 20 years from nowarrow_forward

- The real risk-free rate is 2.70%, inflation is expected to be 3.45% this year, and the maturity risk premium is zero. Ignoring any cross-product terms, i.e., if averaging is required, use the arithmetic average, what is the equilibrium rate of return on a 1-year Treasury bond? Please explain process and show calculationsarrow_forwardSuppose that =7% (na1), and that future short term (1 year) interest rates are expected to be 5% and 3% (for the subsequent two years). The liquidity premium for n2 and 3 is 0.25% and 0.35% respectively. a. Use the liquidity premium theory to calculate for ne2 and 3, and then plot the yield curve using your results. CALCULATE showing all work and ALL formulas that you use, b. Discuss what would be the impact on the yield curve in part a. if future short term rates were suddenly expected to rise.arrow_forwardPlease show working. Please answer 1 and 2 1. The real risk-free rate is 2.75%, and inflation is expected to be 4.00% for the next 2 years. A 2-year Treasury security yields 8.25%. What is the maturity risk premium for the 2-year security? Round your answer to two decimal places. 2. The real risk-free rate is 2.9%. Inflation is expected to be 2.2% this year, 4.8% next year, and 2.65% thereafter. The maturity risk premium is estimated to be 0.05 × (t - 1)%, where t = number of years to maturity. What is the yield on a 7-year Treasury note? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Suppose that the current one-year rate (one- year spot rate) and expected one-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows: 1R1=6%, E(2r1) =7%, E(3r1) =7.5% E(4r1)=7.85% 1 Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. Show your answers in percentage form to 3 decimal places.arrow_forwardLiquidity Premium Hypothesis Based on economists' forecasts and analysis, one-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 7.20% E(r2) 8.30% L2 .65% %3D E(r3) = 8.40% L3 = .75% E(r4) = 8.70% L4 = .80% Using the liquidity premium hypothesis, what is the current rate on a four-year Treasury security?arrow_forwardSuppose the interest rate on a 3-year Treasury Note is 2.25%, and 5-year Notes are yielding 4.00%. Based on the expectations theory, what does the market believe that 2-year Treasuries will be yielding 3 years from now?arrow_forward

- 4 - Based on economistsAc€?c forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = .90% E(2r1) = 2.05% L2 = 0.09% E(3r1) = 2.15% L3 = 0.12% E(4r1) = 2.45% L4 = 0.14% Using the liquidity premium theory, plot the current yield curve. Make sure you label the axes on the graph and identify the four annual rates on the curve both on the axes and on the yield curve itself. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Year Current (Long-term) Rates 1 % 2 % 3 % 4 % 6 - On March 11, 20XX, the existing or current (spot) 1-, 2-, 3-, and 4-year zero coupon Treasury security rates were as follows: 1R1 = 0.90%, 1R2 = 1.50%, 1R3 = 1.90%, 1R4 = 2.05% Using the unbiased…arrow_forwardSuppose 1-year T-bills currently yield 7.00% and the future inflation rate is expected to be constant at 2.00% per year. What is the real risk-free rate of return, r*? The cross-product term should be considered , i.e., if averaging is required, use the geometric average. (Round your final answer to 2 decimal places.)arrow_forwardsomeone please help me with this!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education