Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 14E

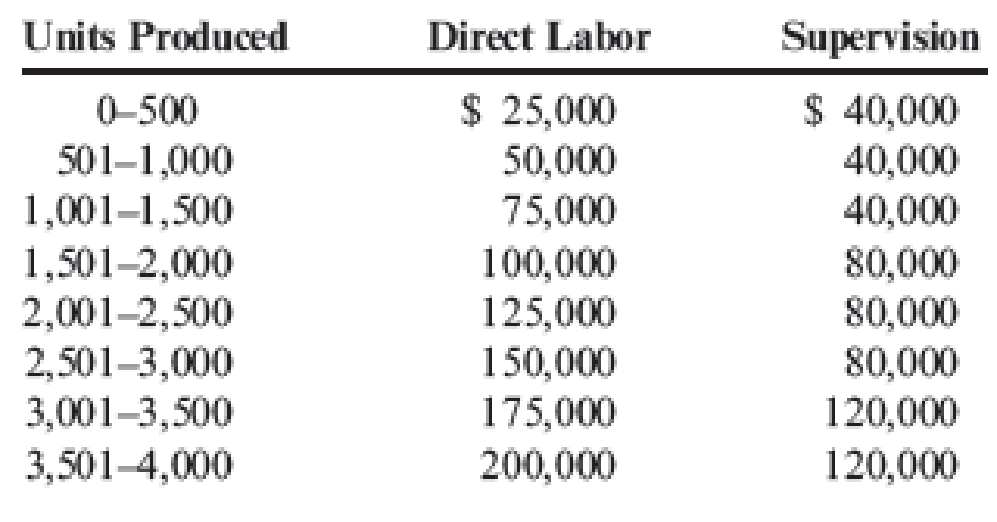

Vargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid $25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargas’s accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis):

Required:

- 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis.

- 2. How would you classify each cost? Why?

- 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following cost behavior pattern solve this question general Accounting

Provide correct answer financial accounting

Hi expert please provide correct answer general Accounting

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 3 - Why is knowledge of cost behavior important for...Ch. 3 - How does the length of the time horizon affect the...Ch. 3 - Prob. 3DQCh. 3 - What is the relationship between flexible...Ch. 3 - What is the relationship between committed...Ch. 3 - Describe the difference between a variable cost...Ch. 3 - Why do mixed costs pose a problem when it comes to...Ch. 3 - Why is a scattergraph a good first step in...Ch. 3 - What are the advantages of the scatterplot method...Ch. 3 - Prob. 10DQ

Ch. 3 - What is meant by the best-fitting line? Is the...Ch. 3 - When is multiple regression required to explain...Ch. 3 - Explain the meaning of the learning curve. How do...Ch. 3 - Assume you are the manager responsible for...Ch. 3 - Some firms assign mixed costs to either the fixed...Ch. 3 - Callies Gym is a complete fitness center. Owner...Ch. 3 - Corazon Manufacturing Company has a purchasing...Ch. 3 - Darnell Poston, owner of Poston Manufacturing,...Ch. 3 - Dohini Manufacturing Company had the following 12...Ch. 3 - Refer to Cornerstone Exercise 3.4 for data on...Ch. 3 - The controller for Dohini Manufacturing Company...Ch. 3 - Prob. 7CECh. 3 - State Universitys football team just received a...Ch. 3 - Classify the following costs of activity inputs as...Ch. 3 - SmokeCity, Inc., manufactures barbeque smokers....Ch. 3 - Cashion Company produces chemical mixtures for...Ch. 3 - For the following activities and their associated...Ch. 3 - Prob. 13ECh. 3 - Vargas, Inc., produces industrial machinery....Ch. 3 - Penny Davis runs the Shear Beauty Salon near a...Ch. 3 - Shirrell Blackthorn is the accountant for several...Ch. 3 - Deepa Dalal opened a free-standing radiology...Ch. 3 - Prob. 18ECh. 3 - The controller of the South Charleston plant of...Ch. 3 - Lassiter Company used the method of least squares...Ch. 3 - Sweet Dreams Bakery was started five years ago by...Ch. 3 - Ginnian and Fitch, a regional accounting firm,...Ch. 3 - Bordner Company manufactures HVAC (heating,...Ch. 3 - Sharon Glessing, controller for Janson Company,...Ch. 3 - The graphs below represent cost behavior patterns...Ch. 3 - Starling Co. manufactures one product with a...Ch. 3 - Alard Manufacturing Company has a billing...Ch. 3 - Prob. 28ECh. 3 - Prob. 29ECh. 3 - Natur-Gro, Inc., manufactures composters. Based on...Ch. 3 - Rolertyme Company manufactures roller skates. With...Ch. 3 - St. Teresas Medical Center (STMC) offers a number...Ch. 3 - Big Mikes, a large hardware store, has gathered...Ch. 3 - Kimball Company has developed the following cost...Ch. 3 - The management of Wheeler Company has decided to...Ch. 3 - DeMarco Company is developing a cost formula for...Ch. 3 - Weber Valley Regional Hospital has collected data...Ch. 3 - Friendly Bank is attempting to determine the cost...Ch. 3 - Randy Harris, controller, has been given the...Ch. 3 - The Lockit Company manufactures door knobs for...Ch. 3 - Harriman Industries manufactures engines for the...Ch. 3 - Thames Assurance Company sells a variety of life...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wanted This General Account solution ASAParrow_forwardWhich of the following most accurately describes the federal tax consequences of a partnership/LLC? O O A. Partnerships are disregarded as entities for tax purposes. B. LLCs are subject to the same tax consequences as partnerships. O C. The characteristics of income and deduction items flow through to the partners of a partnership. D. Partnerships are subject to double taxation. Earrow_forwardNabais Corporation uses the weighted-average method in its process costing system. Operating data for the Lubricating Department for the month of October appear below: (Units Percent Complete with Respect to Conversion) Beginning work in process inventory 3,300 80%; Transferred in from the prior department during October 30,700; Completed and transferred to the next department during October 32,200; Ending work in process inventory 1,800 60% .What were the Lubricating Department's equivalent units of production for October?arrow_forward

- General Accountarrow_forwardFinancial accountingarrow_forwardThe following information is available for Remmers Corporation for 2010. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by" $120,000. This difference will reverse in equal amounts of $30,000 over the years 2011-2014. 2. Interest received on municipal bonds was $10,000. 3. Rent collected in advance on January 1, 2010, totaled $60,000 for a 3-year period. Of this amount, $40,000 was reported as unearned at December 31, for book purposes. 4. The tax rates are 40% for 2010 and 35% for 2011 and subsequent years. 5. Income taxes of $320,000 are due per the tax return for 2010. 6. No deferred taxes existed at the beginning of 2010. Compute taxable income for 2010.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY