PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 29, Problem 27PS

- a. What is the internal growth rate of Eagle Sport (see Problem 25) if the dividend payout ratio is fixed at 50% and the equity-to-asset ratio is fixed at two-thirds?

- b. What is the sustainable growth rate?

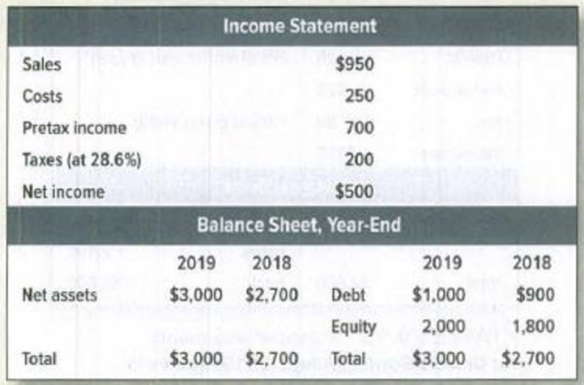

TABLE 29.17 Financial statements for Eagle Sport Supply, 2019. See Problem 25.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following security:

Brous Metalworks

Earnings Per Share, Time = 0

$2.00

Dividend Payout Rate

0.250

Return on Equity

0.150

Market Capitalization Rate

0.125

Required:

Using the information in the tables above, please calculate the sustainable growth rate, dividends per share, and intrinsic value per share. Then solve for the present value of growth opportunities.

(Use cells A5 to B8 from the given information to complete this question.)

Brous Metalworks

Sustainable Growth Rate

Dividends per share (Next Year)

Intrinsic Value

No-Growth Value Per Share

Present Value of Growth Opportunities (PVGO)

Estimate Pharma’s sustainable sales growth rate based on its 2019 financial statements. [Hint: You need to estimate the beginning of period stockholders’ equity based on the information provided.] What financial policy change might Pharma Biotech make to improve its sustainable growth rate? Show your calculations.

12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements.

Assume that Eagle's assets are proportional to its sales. (LO18-2)

INCOME STATEMENT, 2019

Sales

$950

Costs

250

Interest

50

Taxes

150

Net income

$500

BALANCE SHEET, YEAR-END

2018

2019

2018

2019

Assets

$2,700

$3,000

Debt

$ 900

$1,000

Equity

1,800

2,000

$3,000

Total

$2,700

$3,000

Total

$2,700

Chapter 29 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 29 - Sources and uses of cash State whether each of the...Ch. 29 - Sources and uses of cash Table 29. 11 shows...Ch. 29 - Prob. 3PSCh. 29 - Sources and uses of cash and working capital...Ch. 29 - Prob. 5PSCh. 29 - Prob. 6PSCh. 29 - Cash cycle A firm is considering several policy...Ch. 29 - Collections on receivables Here is a forecast of...Ch. 29 - Collections on receivables If a firm pays its...Ch. 29 - Forecasts of payables Dynamic Futon forecasts the...

Ch. 29 - Cash budget Table 29.13 lists data from the budget...Ch. 29 - Short-term financial plans a. Paymore places...Ch. 29 - Short-term financial plans Which items in Table...Ch. 29 - Short-term financial plans Work out a short-term...Ch. 29 - Prob. 16PSCh. 29 - Prob. 17PSCh. 29 - Long-term financial plans Corporate financial...Ch. 29 - Prob. 19PSCh. 29 - Prob. 20PSCh. 29 - Long-term financial plans Construct a new model...Ch. 29 - Long-term financial plans a. Use the Dynamic...Ch. 29 - Long-term financial plans Table 29.15 summarizes...Ch. 29 - Long-term financial plans Abbreviated financial...Ch. 29 - Prob. 25PSCh. 29 - Forecast growth rate What is the maximum possible...Ch. 29 - Forecast growth rate a. What is the internal...Ch. 29 - Forecast growth rate Bio-Plasma Corp. is growing...Ch. 29 - Long-term plans Table 29.18 shows the 2019...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the table given below to answer the following question. The long-run growth rate is projected at 7% and discount rate is 10%. Year Asset value Earnings Net investment Free cash flow (FF) Return on equity (ROE) Asset growth rate Earnings growth hate 2 11.00 12.43 14.05 15.87 17.46 19.20 21.13 22.60 1.43 1.43 1.62 1.62 з 1.83 1.83 5 7 8 9 10 24.19 25.88 2.06 2.27 2.40 2.54 2.60 2.18 2.33 1.59 1.75 1.92 1.48 1.58 1.69 1.81 0.48 0.52 0.48 1.06 1.02 0.48 0.52 0.13 0.13 0.13 0.13 0.13 0.13 0.13 0.13 0.13 0.13 0.125 0.12 0.115 0.09 0.09 0.10 0.10 0.13 0.10 0.07 0.07 0.07 0.07 0.10 0.06 0.06 0.03 --0.16 0.07 Assuming that competition drives down profitability (on existing assets as well as new investment) to 12.5% in year 6, 12% in year 7, 11.5% in year 8, and 9% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value millionarrow_forwardIf the SGS Corp. has an ROE of 14.5 percent and a payout ratio of 25 percent, what is its sustainable growth rate? Found in MBA 640 Finance, Economics and Decision Making in Chapter 3 questions and problems #6arrow_forwardConsider the table given below to answer the following question. The long-run growth rate is projected at 5% and discount rate is 10%. Year Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth rate Earnings growth rate 1 2 3 4 5 6 7 8 15.00 16.65 18.48 20.51 22.16 23.93 25.84 27.13 1.65 1.83 1.65 1.83 Present value 0.11 0.11 9 10 28.49 29.92 2.03 2.26 2.44 2.51 2.58 2.58 1.99 2.09 2.03 1.64 1.77 1.91 1.29 1.36 1.42 1.50 0.62 0.66 0.60 1.29 1.22 0.57 0.60 0.11 0.11 0.11 0.11 0.105 0.10 0.095 0.07 0.11 0.11 0.08 0.08 0.08 0.05 0.05 0.05 0.05 0.11 0.11 0.11 0.08 0.03 0.03 0.00 -0.23 0.05 0.07 Assuming that competition drives down profitability (on existing assets as well as new investment) to 10.5% in year 6, 10% in year 7, 9.5% in year 8, and 7% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) millionarrow_forward

- Consider the table given below to answer the following question. The long-run growth rate is projected at 5% and discount rate is 10%. Year Asset value Earnings Net investment Free cash flow (FCF) Return on equity (ROE) Asset growth ratei Earnings growth rate 1 2 4 5 6 7 8 10 28.49 29.92 15.00 16.65 18.48 20.51 22.16 23.93 25.84 27.13 1.65 1.83 2.03 1.65 1.83 2.03 1.99 2.09 1,42 1.50 2.26 2.44 2.51 2.58 2.58 1.64 1.77 1.91 1.29 1.36 0.62 9.66 0.60 1.29 1.22 0.11 0.11 0.11 0.11 0.11 0.105 0.10 0.095 0.11 0.11 0.11 0.08 0.08 0.00 0.05 0.05 0.05 0.11 0.11 0.11 0.08 0.57 0.60 0.07 9.07 0.05 0.03 0.03 0.00 -0.23 0.05 Assuming that competition drives down profitability (on existing assets as well as new investment) to 10.5% in year 6, 10% in year 7. 9.5% in year 8, and 7% in year 9 and all later years. What is the value of the concatenator business? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value millionarrow_forwardProblem . Valuation of equity X Company paid dividends of 2.12 in 2022. The dividends are expected to grow at 5%per year in the long term and the company has a cost of equity of 9.40%. What is the value per equity share?arrow_forward2. Assume that today is December 31, 2021 and you need to determine the firm value of CoolTech, Inc. You have decided to apply the free cash flow valuation model to the firm's financial data that you've developed from a variety of data sources. The key values you have compiled are summarized in the following table: Free Cash Flow Year FCF Other Data Growth rate of FCF, beyond 2025 to infinity = 3% Weighted average cost of capital = 8% 700,000 800,000 950,000 980,000 2022 %3D 2023 %3D 2024 2025 What is the value of the entire CoolTech's entire company? + Factac F%arrow_forward

- 1. What is the Internal Growth rate for Cafes Richard ? What is the sustainable growth rate for Cafes Richard ? If sales grow at SGR, how much External Financing will be needed for the year 2021 using Percentage of sales approach, assuming that the firm is operating at full capacity? Interest expense and tax rate will not change. Calculate the tax rate (hint: tax rate = tax/taxable income). Please create pro forma statements as well. What's the impact in the new Debt to equity ratio, if any?arrow_forwardSuppose the firm has historically earned 15%on equity (ROE) and has paid out 62% of earnings, and suppose investors expect similarvalues to obtain in the future. How could youuse this information to estimate the futuredividend growth rate, and what growth ratewould you get? Is this consistent with the5.8% growth rate given earlier?arrow_forwardDetermining PB Ratio for Companies with Different Returns and Growth Assume that the present value of expected ROPI follows a perpetuity with growth g (Value = Amount/ [r - g]). Determine the theoretically correct PB ratio for each of the following companies A and B. Note: NOPAT = NOA » RNOA. Company Net Operating Assets Equity RNOA ROE Weighted Avg. Cost of Capital Growth Rate in ROPI $100 $100 19% 19% 10% 2% $100 $100 12% 12% 10% 4% A B Round answers to two decimal places. PB Ratio Company A Company Barrow_forward

- Consider the following security, which you expect will grow rapidly for three years followed by a steady growth indefinitely. Emerson Tool and Die Company Earnings Per Share, 2020 $2.50 Dividend Payout Rate $0.60 Extradordinary Growth Rate 0.35 Sustainable Growth Rate 0.05 Market Capitalization Rate 0.15 Required: Using the information in the tables above, please calculate the cash flows per period and the price of this stock. (Use cells A5 to B9 from the given information to complete this question.) Time Cash Flow 1 2 3 Horizon Value Present Value (Price)arrow_forwardKimbi Limited had the following items on its balance sheet at the beginning of the year: Assets Cash Property Plant & Equipment Liabilities and equity $50,000 Debt $ 350,000 Equity $ 100, 000 $ 300,000 The net profit this year is $20, 000 with a dividend of $5, 750.arrow_forwarda. Determine average annual dividend growth rate over the past 5 years. Using that growth rate, what dividend would you expect the company to pay next year? b. Determine the net proceeds, N, that the firm will actually receive. c. Using the constant-growth valuation model, determine the required return on the company's stock, rg, which should equal the cost of retained earnings, r,. d. Using the constant-growth valuation model, determine the cost of new common stock, r,.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY