PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 29, Problem 12PS

Short-term financial plans

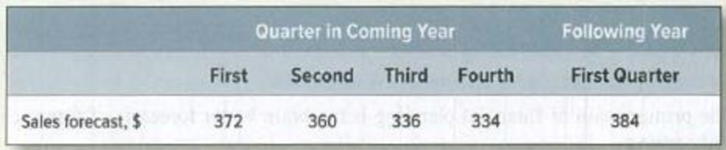

- a. Paymore places orders for goods equal to 75% of its sales forecast for the next quarter. What will orders be in each quarter of the coming year if the sales in the current quarter are expected to be $320 and the sales forecasts for the next five quarters are as follows?

- b. Paymore pays for two-thirds of the purchases immediately and pays for the remaining purchases in the next quarter. Calculate Paymore’s cash payments in the coming year.

- c. Paymore’s customers pay their bills with a two-month delay. What are the expected cash receipts from sales in the coming year?

- d. Now suppose that Paymore’s other expenses are $105 a quarter. Calculate the expected net cash flow for each quarter in the coming year.

- e. Suppose that Paymore’s starting cash balance is $40 and its minimum acceptable balance is $30. Work out the short-term financing requirements for the coming year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your company forecasts that next year's sales will be $59.00 million, Cost of Goods Sold (COGS) will be 85% of sales, and the Days Payables Outstanding (DPO) ratio will be 22.19. What is the forecasted accounts payable for next year?

The Corado Company has predicted sales for the first three quarters of 2024. The predictions are: 1 ^ (st) quarter , $250,000 ; 2nd quarter , $200,000 ; 3rd quarter , $300,000 Cash collected from 80 percent of sales in the same quarter as the sale , and the remaining 20 percent is collected in the following quarter . The Corado Company's expected cash inflows in the second quarter of 2024 are :

$240,000

None of the listed choices are correct

$ 210,000

$ 270,000

$420,000

Your firm expects to receive a $20,000 payment from a supplier in 25 days. Calculate the increase in the cash inflow's present value if the cash inflow can be collected 5 days sooner. Assume an annual discount rate of 10%.

A. -$56.18

b. $27.07

c. $19,9972.64

d. $18,587.25

Chapter 29 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 29 - Sources and uses of cash State whether each of the...Ch. 29 - Sources and uses of cash Table 29. 11 shows...Ch. 29 - Prob. 3PSCh. 29 - Sources and uses of cash and working capital...Ch. 29 - Prob. 5PSCh. 29 - Prob. 6PSCh. 29 - Cash cycle A firm is considering several policy...Ch. 29 - Collections on receivables Here is a forecast of...Ch. 29 - Collections on receivables If a firm pays its...Ch. 29 - Forecasts of payables Dynamic Futon forecasts the...

Ch. 29 - Cash budget Table 29.13 lists data from the budget...Ch. 29 - Short-term financial plans a. Paymore places...Ch. 29 - Short-term financial plans Which items in Table...Ch. 29 - Short-term financial plans Work out a short-term...Ch. 29 - Prob. 16PSCh. 29 - Prob. 17PSCh. 29 - Long-term financial plans Corporate financial...Ch. 29 - Prob. 19PSCh. 29 - Prob. 20PSCh. 29 - Long-term financial plans Construct a new model...Ch. 29 - Long-term financial plans a. Use the Dynamic...Ch. 29 - Long-term financial plans Table 29.15 summarizes...Ch. 29 - Long-term financial plans Abbreviated financial...Ch. 29 - Prob. 25PSCh. 29 - Forecast growth rate What is the maximum possible...Ch. 29 - Forecast growth rate a. What is the internal...Ch. 29 - Forecast growth rate Bio-Plasma Corp. is growing...Ch. 29 - Long-term plans Table 29.18 shows the 2019...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Projected annual sales of a LED keychain are projected to be 25,00025,00025,000 USD the first year and increase by 10,00010,00010,000 USD per year until 55,00055,00055,000 USD are sold during the fourth year. Sales are then predicted to decrease by 5,0005,0005,000 USD per year in the fifth year and each year thereafter until 25,00025,00025,000 USD are sold in the tenth year. Firm is going to purchase manufacturing equipment costing 100,000100,000100,000 USD with an estimated salvage value of 20,00020,00020,000 USD at the end of 10 years. The variable manufacturing cost per unit is 0.80.80.8 USD. If the interest rate is 9%9\%9%, what is the Present Equivalent cost for a 10-year production period?arrow_forward4. Sovereign-Tea Company projected to make even monthly cash payments of P150,000 during the year. The average return on money market placements is eight percent per annum and payment for cash transfer is expected to be P250 per transaction. Determine the total relevant cost using the Baumol Model.arrow_forwardA firm is considering a new inventory system that will cost $120,000. The system is expected to generate positive cash flows over the next four years in the amounts of $35,000 in year 1, $55,000 in year 2, $65,000 in year 3, and $40,000 in year 4. The firm’s required rate of return is 9%. What is the payback period of this project? 1.95 years 2.46 years 2.99 years 3.10 years Based on the information from Question 47. What is the net present value (NPV) of the project? $28,830.29 $30,929.26 $36,931.43 $39,905.28 Based on the information from Question 47, what is the internal rate of return (IRR) of this project? 14.03% 17.56% 19.26% 21.78% Based on the information from Question 47, what is the profitability index (PI) of this project? 0.87 1.11 1.31 1.83.arrow_forward

- The demand for a product during the next ten years will be such that revenues will be $100,000 the first year and will increase by $10,000 each year thereafter. If inflation is assumed to be 6% per yuear and the company uses 10% in its economic studies, what is the present worth of the revenues expressed in present dollars?arrow_forwardYour firm expects to receive a $40,000 payment from a supplier in 40 days. What is the present value of this cash inflow? Assume an annual discount rate of 4%. Use simple interest.arrow_forwardGreen Corporation anticipates a cash requirement of P1,000 over a 1- month period. It is expected that cash will be paid uniformly. The annual interest rate is 24 percent. The transaction cost of each borrowing or withdrawal is P30. Requirement: (a) What is the optimal cash balance? (b) What is the average cash balance?arrow_forward

- Suppose the company has just the opposite news and now expects unit sales for August, September, and October to be double (200%) the original estimates. What effect will this have on the company’s net income and borrowing? Explain your findings.arrow_forwardXader Manalastas predicts a cash requirement of P25,000 over a 1-month period in which cash is expected to be paid constantly. The opportunity interest rate is 12% per annum. The transaction cost associated with each borrowing or withdrawal is P10.a. What is the optimal transaction size? b. Since it is known how much is usually available to meet operating needs, What is the average cash balance?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY