Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 26, Problem 4PB

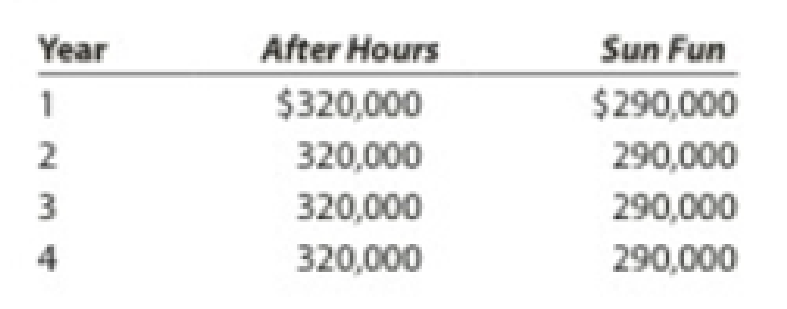

The management of Style Networks Inc. is considering two TV show projects. The estimated net

After Hours requires an investment of $913,600, while Sun Fun requires an investment of $880,730. No residual value is expected from either project.

Instructions

- 1. Compute the following for each project:

- A. The net present value. Use a rate of 10% and the present value of an annuity table appearing in Exhibit 5 of this chapter.

- B. A present value index. (Round to two decimal places.)

- 2. Determine the internal rate of return for each project by (A) computing a present value factor for an annuity of $1 and (B) using the present value of an annuity of $1 table appearing in Exhibit 5 of this chapter.

- 3. What advantage does the internal rate of return method have over the net present value method in comparing projects?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Below are four cases that you will have to solve

using Excel spreadsheets.

1st case

The company COMERCIAL SA has two investment alternatives that present the following

information:

PROJECT

A

B

It is requested

Initial

investment.

$25,000

$22,000

Cash flows

year 1

1. Determine the internal rate of return.

2. Determine the present value.

$7,000

$12,000

The discount rate for the project will be 10% and the MARR will be 20%.

3. Determine the recovery period.

4. Define which is the most viable project.

Year 2 cash

flows

$15,000

$8,000

Year 3 cash

flows

$18,000

$12,000

Use the following data to answer questions (a) to (d). Show your working method.A company is considering the purchase of a copier that costs RM 50,000. Assume the required rate of return is 10% and the following is cash flow schedule: Year 1: RM 20,000 Year 2: RM 30,000 Year 3: RM 20,000 (a) What is the project’s payback period?(b) What is the project’s NPV?(c) What is the project’s IRR?(d) What is the project’s profitability index (PI)?

NOTE: Provide a format and show your work (example: N = 6, PV = XXX, I = X%, etc.)

1. As the project manager at Jelz, Inc., you are considering a project that will cost $4,276 and produce cash flows of $1,050 in year 1, $1,250 in year 2, $1,250 in year 3, and $1,550 in year 4. Find the rate of return for the project and determine if you should take the project if your required rate of return is 7.15%. (This is a 2 part question, make sure you answer both parts. Numerical answers should be rounded to 2 decimal places.)

2. You are looking to buy a car. You can afford $550 in monthly payments for five years. In addition to the loan, you can make a $6,000 down payment. If interest rates are 7.25 percent APR, what price of car can you afford (loan plus down payment)? (Do not round intermediate calculations and round your final answer to 2 decimal places.)

Chapter 26 Solutions

Financial And Managerial Accounting

Ch. 26 - What are the principal objections to the use of...Ch. 26 - Discuss the principal limitations of the cash...Ch. 26 - Why would the average rate of return differ from...Ch. 26 - Prob. 4DQCh. 26 - Prob. 5DQCh. 26 - Prob. 6DQCh. 26 - Prob. 7DQCh. 26 - Two projects have an identical net present value...Ch. 26 - Prob. 9DQCh. 26 - What are the major disadvantages of the use of the...

Ch. 26 - Prob. 11DQCh. 26 - Prob. 12DQCh. 26 - Average rate of return Determine the average rate...Ch. 26 - Cash payback period A project has estimated annual...Ch. 26 - Prob. 3BECh. 26 - Internal rate of return A project is estimated to...Ch. 26 - Net present valueunequal lives Project 1 requires...Ch. 26 - Average rate of return The following data are...Ch. 26 - Average rate of returncost savings Maui...Ch. 26 - Average rate of returnnew product Hana Inc. is...Ch. 26 - Determine cash flows Natural Foods Inc. is...Ch. 26 - Prob. 5ECh. 26 - Cash payback method Lily Products Company is...Ch. 26 - Prob. 7ECh. 26 - Prob. 8ECh. 26 - Net present value methodannuity for a service...Ch. 26 - Net present value methodannuity Jones Excavation...Ch. 26 - Prob. 11ECh. 26 - Prob. 12ECh. 26 - Net present value method and present value index...Ch. 26 - Average rate of return, cash payback period, net...Ch. 26 - Prob. 15ECh. 26 - Internal rate of return method The internal rate...Ch. 26 - Prob. 17ECh. 26 - Internal rate of return methodtwo projects Munch N...Ch. 26 - Net present value method and internal rate of...Ch. 26 - Identify error in capital investment analysis...Ch. 26 - Prob. 21ECh. 26 - Prob. 22ECh. 26 - Prob. 1PACh. 26 - Cash payback period, net present value method, and...Ch. 26 - Prob. 3PACh. 26 - Net present value method, internal rate of return...Ch. 26 - Alternative capital investments The investment...Ch. 26 - Capital rationing decision for a service company...Ch. 26 - Prob. 1PBCh. 26 - Prob. 2PBCh. 26 - Net present value method, present value index, and...Ch. 26 - Net present value method, internal rate of return...Ch. 26 - Prob. 5PBCh. 26 - Clearcast Communications Inc. is considering...Ch. 26 - San Lucas Corporation is considering investment in...Ch. 26 - Assume San Lucas Corporation in MAD 26-1 assigns...Ch. 26 - Prob. 3MADCh. 26 - Prob. 4MADCh. 26 - Home Garden Inc. is considering the construction...Ch. 26 - Assume Home Garden Inc. in MAD 26-5 assigns the...Ch. 26 - Ethics in Action Danielle Hastings was recently...Ch. 26 - Prob. 4TIFCh. 26 - Prob. 5TIFCh. 26 - Prob. 6TIFCh. 26 - Foster Manufacturing is analyzing a capital...Ch. 26 - Staten Corporation is considering two mutually...Ch. 26 - Prob. 3CMACh. 26 - Prob. 4CMA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are a project manager for your company and you are faced with five potential projects that you can invest in. Free cash flow projections and additional relevant data are given for each project in the table below. Assume that there are no cash flows after year 3. Assume that you can only take each project once and that you can only choose one project. Which project would you invest in? Select the best answer. Project Project A Project B Project C Project D Project E O I. Project A II. Project B III. Project C IV. Project D O V. Project E FCF Forecasts by Year (in $1,000) 0 2 1 500 (400) (400) (300) (250) (300) 75 60 75 135 115 175 3 650 210 190 200 Interest Rate (EAR) 8.0% 10.0% 10.0% 12.0% 12.0% IRR 25.00% 17.57% 15.92% 17.81% 19.96%arrow_forwardPlease answer the following questions using the information below: NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected? Consider the following cash flows: Year 0 1 2 3 4 5 6 Cash Flow -$8,000 $3,000 $3,600 $2,700 $2,500 $2,100 $1,600 Payback. The company requires all projects to payback within 3 years. Calculate the payback period. Should it be accepted or rejected? Discounted Payback. Calculate the discounted payback using a discount rate of 10%. Should it be accepted or rejected? IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected? NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?…arrow_forwardUse the format in the figure below to perform a financial analysis. Create a spreadsheet to perform the analysis and show the NPV, ROI, and year in which payback occurs. + Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as fol- lows: Estimated costs are $200,000 in Year 1 and $30,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $100,000 each year in Years 2, 3, and 4. Use a 9 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the companion website to cal- culate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Discount rate 8% Assume the project is completed in Year 0 0 Costs Discount factor…arrow_forward

- Cash payback period, net present value method, and analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Each project requires an investment of $900,000. A rate of 15% has been selected for the net present value analysis. Instructions 1. Compute the following for each product: a. Cash payback period. b. The net present value. Use the present value of $1 table appearing in this chapter (Exhibit 2). 2. Prepare a brief report advising management on the relative merits of each project.arrow_forwardA project has initial costs of $1,000 and subsequent cash inflows of $700, 200, 200 and 200. The company's 10% cost of capital is an appropriate discount rate for this average risk project. Calculate the following: 1. Payback Period 2. NPV 3. Profitability Index 4. IRR 5. MIRR Please number/label each of your answers as shown above. Be sure to show your TVM function calculator inputs, and four decimal places.arrow_forwardPerform a financial analysis for an IT Project which requires an initial investment of $32,000, but it is expected to generate revenues of $10,000, $20,000 and $15,000 for the first, second and third years respectively. The target rate of return is 12%. Write the formula and calculate the Net Present Value (NPV). In addition, Justify your result. (For this question Write the answer on the paper and take photo and upload OR Type in the MS Word document and upload the file)arrow_forward

- Perform a financial analysis for an IT Project which requires an initial investment of $32,000, but it is expected to generate revenues of S10,000, $20,000 and $15,000 for the first, second and third years respectively. The target rate of return is 12%. Write the formula and calculate the Net Present Value (NPV). In addition, Justify your result. (For this question Write the answer on the paper and take photo and upload OR Type in the MS Word document and upload the file) tach File Browse My Computerarrow_forwardThere are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,017 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,000 $22,000 $4,500 $58,500 Beta Project 8,000 24,000 27,106 59,106 A. Calculate the internal rate of return on both projects. Use the IRR spreadsheet function to calculate internal rate of return. Alpha Project fill in the blank 1% Beta Project fill in the blank 2% B. Make a recommendation on which one to accept. .arrow_forwardFinancial Manager of Timmy Company is considering two projects (project A and project H), which have cash flows as follows: Year Cash Flow of Project A (in $) Cash Flow of Project H (in $) 0 -100 -100 1 10 70 2 60 50 3 80 20 Timmy Company’s cost of capital is 10 percent. Calculate payback, NPV, IRR, and MIRR for both projects. (Please have a step by step format to your answer with explainations. Thanks (=)arrow_forward

- An IT company receives two new project proposals. Project A will cost $250,000 to develop and is expected to have an annual net cash flow of $50,000. Project B will cost $350,000 to develop and is expected to have an annual net cash flow of $60,000. Analyzing the two projects from a cashflow perspective using the payback period, which project is better? Why? Write the answers in the “Payback" tab of the attached EXCEL template. You may use the Payback Period template if you wish to. Note: Enter the discounted costs and benefits for your project below. Add and delete rows as needed. Year Costs Benefits Cumulative Costs Cumulative Benefits 1 2 3 4arrow_forwardAn IT company receives two new project proposals. Project A will cost $250,000 to develop and is expected to have an annual net cash flow of $50,000. Project B will cost $350,000 to develop and is expected to have an annual net cash flow of $60,000. Analyzing the two projects from a cashflow perspective using the payback period, which project is better? Why? Write the answers in the “Payback" tab of the attached EXCEL template. You may use the Payback Period template if you wish to. Note: Enter your criteria, weights, and scores in the template below Insert or clear rows and columns as needed. Double check formulas and results. Criteria Project 1 Project 2 Project 3 Project 4 Project 5 Sponsor Support Strategic Alliance Urgency Fills a market gap Sales Competition Weighted Project Scores 0.00 0 0 0 0 0arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License