Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

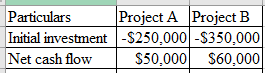

- An IT company receives two new project proposals. Project A will cost $250,000 to develop and is expected to have an annual net cash flow of $50,000. Project B will cost $350,000 to develop and is expected to have an annual net cash flow of $60,000. Analyzing the two projects from a cashflow perspective using the payback period, which project is better? Why? Write the answers in the “Payback" tab of the attached EXCEL template. You may use the Payback Period template if you wish to.

Note: Enter your criteria, weights, and scores in the template below

Insert or clear rows and columns as needed. Double check formulas and results.

| Criteria | Project 1 | Project 2 | Project 3 | Project 4 | Project 5 | |

| Sponsor Support | ||||||

| Strategic Alliance | ||||||

| Urgency | ||||||

| Fills a market gap | ||||||

| Sales | ||||||

| Competition | ||||||

| Weighted Project Scores | 0.00 | 0 | 0 | 0 | 0 | 0 |

Expert Solution

arrow_forward

Step 1

Given:

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- The Mansford Co. Evaluates projects using payback. Suppose that a project requiring an outlay of $816 dollars is followed by the following inflows for the next four years: Year 1 312 Year 2 459 Year 3 78 Year 4 210 What is the payback for this project to two significant places?arrow_forwardAfter analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forwardPlease last follow instructionsarrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,500 $23,000 $5,500 $61,000 Beta Project 8,000 23,000 28,000 59,000 (Click here to see present value and future value tables) https://openstax.org/books/principles-managerial-accounting/pages/time-value-of-money A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project...? Beta Project...?arrow_forwardRahularrow_forwardYour company is planning to purchase a new log splitter for its lawn and garden business. The new splitter has an initial investment of $320,000. It is expected to generate $40,000 of annual cash flows, provide incremental cash revenues of $215,760, and incur incremental cash expenses of $130,000 annually. What is the payback period and accounting rate of return (ARR)? Round your answers to 1 decimal place. Payback period years ARR %arrow_forward

- Please provide full and authentic solution. Please ensure the working out eases the eyes. Please dont make mistakes. Please double check when done. Greatly Appreciated!!. Please know that it is not 1000 on Project Beta it was 10,000. I was told that Project Alpha had higher IRR and higher net present value. Please confirm if it is true.arrow_forwardcan you answer this question for me as Excel formula ?arrow_forwardSince the beginning of the fiscal year 2009, Texas Department of Transportation invest one million each year to build up the transportation management database system in one of the Southern Texas city regions. TxDot is planning to transfer this database system to the city authority by the end of the fiscal year 2020. If the rate of return is 12% per year during the investment period, what is the total value of this database system when transferring?arrow_forward

- Greater Findlay Development Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay a fixed amount of rent plus a percentage of the gross sales generated each year. The cash flows from each of the businesses has approximately the same amount of risk. The business names, annual expected cash flows, and initial capital outflow for each of the businesses that would like to lease space in the strip mall are provided below. Greater Findlay Development Consortium uses a 12% hurdle rate which is its cost of capital. All business will be evaluated based on 4-year term because the contract will expire in four years. Video Now Apple Garden Croger Mart Horizon Wireless Initial Capital Outlay ($200,000) ($298,000) ($248,000) ($272,000) Annual Net Cash Flows Year 1 65,000 100,000 80,000…arrow_forwardIn my accounting class I am learning to find accounting rate of return. To solve for this I subtracted net cash flow- the salvage value divided by the initial investment. Have I done something incorrect?arrow_forwardPlease provide correct solution for correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education