Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

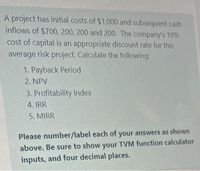

Transcribed Image Text:A project has initial costs of $1,000 and subsequent cash

inflows of $700, 200, 200 and 200. The company's 10%

cost of capital is an appropriate discount rate for this

average risk project. Calculate the following:

1. Payback Period

2. NPV

3. Profitability Index

4. IRR

5. MIRR

Please number/label each of your answers as shown

above. Be sure to show your TVM function calculator

inputs, and four decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Below are four cases that you will have to solve using Excel spreadsheets. 2nd case The COMPETIDORA SA company has the possibility of investing in three different projects . The projections show us the following information on which a decision must be made: PROJECT X Y Initial Z$310,000 It is requested: investment $180,000 $250,000 Year 1 cash flows $50,000 $80,000 $150,000 1. Determine the internal rate of return. 2. Determine the present value. Year 2 cash flows 3. Determine the recovery period. 4. Define which is the most viable project. $70,000 $80,000 $120,000 The discount rate for the project will be 9% and the investors propose a MARR of 22%. Year 3 cash flows $80,000 $80,000 $100,000 Year 4 cash flows $100,000 $80,000arrow_forwarduse excel 9. A firm faces three investment opportunities A, B and C: A. NPV = $3m, investment = $1m B. NPV = $2m, investment = $2m C. NPV = $2.5m, investment = $3m Given a total of $4m initial resources, which one(s) should the firm take? Explain.arrow_forwardUse the format in the figure below to perform a financial analysis. Create a spreadsheet to perform the analysis and show the NPV, ROI, and year in which payback occurs. + Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as fol- lows: Estimated costs are $200,000 in Year 1 and $30,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $100,000 each year in Years 2, 3, and 4. Use a 9 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the companion website to cal- culate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Discount rate 8% Assume the project is completed in Year 0 0 Costs Discount factor…arrow_forward

- Please provide full and authentic solution. Please ensure the working out eases the eyes. Please dont make mistakes. Please double check when done. Greatly Appreciated!!. Please know that it is not 1000 on Project Beta it was 10,000. I was told that Project Alpha had higher IRR and higher net present value. Please confirm if it is true.arrow_forwardComplete the following 6 Wk 3 Financial Exercises: Problem Set 1, Part 2 problems: 1. Calculate the net present value (NPV) of the following cash flow stream if the required rate is 12%: Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not. Insert your answer. 2. Calculate the NPV of the following cash flow projections based on a required rate of 10.5%: Insert your NPV calculation. Year Cash Flow Is this a good project for the business to accept? Explain why or why not. Insert your answer. 3. A company needs to decide if it will move forward with 2 new products that it is evaluating. The 2 initiatives have the following cash flow projections: Project A Project B Year Cash Flow Year Cash Flow Based on the risk of each project, the company has a required rate of return of 11% for Project A and 11.5% for Project B. The company has a $1.5 million budget to spend on new projects for the year. Should the company move forward…arrow_forwardAnswer all four of the required questions!arrow_forward

- Below are four cases that you will have to solve using Excel spreadsheets. 1st case The company COMERCIAL SA has two investment alternatives that present the following information: PROJECT A B It is requested Initial investment. $25,000 $22,000 Cash flows year 1 1. Determine the internal rate of return. 2. Determine the present value. $7,000 $12,000 The discount rate for the project will be 10% and the MARR will be 20%. 3. Determine the recovery period. 4. Define which is the most viable project. Year 2 cash flows $15,000 $8,000 Year 3 cash flows $18,000 $12,000arrow_forward(Click on the following icon in order to copy its contents into a spreadsheet.) Year 1 Year 2 Year 3 Year 0 -$50 -$101 $26 $20 $22 $22 $39 $49 Project A B Year 4 $16 $62 You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRs of the two projects? b. If your discount rate is 5.2%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently?arrow_forwardI need help with the attached empty fields Laurman, Incorporated is considering a new project and has provided the details of the project. The Controller has asked you to compute various capital budgeting methods to help aid in the decision to pursue the investment. Cell Reference: Allows you to refer to data from another cell in the worksheet. If you entered “=B5” into a blank cell, the formula would output the value from cell B5. Basic Math Functions: Allow you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add), - (minus sign to subtract), * (asterisk sign to multiply), and / (forward slash to divide). For example, if you entered “=B4+B5” in a blank cell, the formula would add the values from those cells and output the result. SUM Function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges. If you entered “=SUM(C4,C5,C6)” into a blank cell, the formula…arrow_forward

- Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Determine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Future Amount $ 25,000 $ 19,000 $ 30,000 $ 45,000 ¡= 6% 10% 12% 11% n = 11 14 29 10 Present Valuearrow_forwardDetermine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3 4. Invested Amount 15,000 20,000 30,000 50,000 $ $ $ U $ i = 6% 8% 12% 4% n = 12 10 20 12 Future Valuearrow_forwardDetermine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2. 3. 4. Invested Amount 15,500 23,000 35,000 56,000 $ 67 67 $ $ $ i = 5% 5% 11% 6% n = 12 6 18 14 Future Valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education