Concept explainers

Service Green Pastures is a 400-acre farm on the outskirts of the Kentucky Bluegrass, specializing in the boarding of broodmares and their foals. A recent economic downturn in the thoroughbred industry has made the boarding business extremely competitive. To meet the competition, Green Pastures planned in 2020 to entertain clients, advertise more extensively, and absorb expenses formerly paid by clients such as veterinary and blacksmith fees.

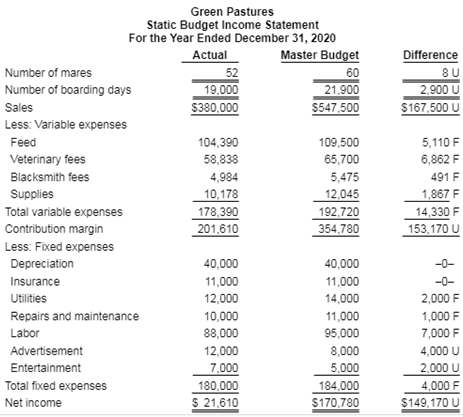

The budget report for 2020 follows. As shown, the static income statement budget for the year is based on an expected 21,900 boarding days at $25 per mare. The variable expenses per mare per day were budgeted: feed $5. veterinary fees $3. blacksmith fees $0.25, and supplies $0.55. All other budgeted expenses were either semifixed or fixed.

During the year, management decided not to replace a worker who quit in March, but it did issue a new advertising brochure and did more entertaining of clients.1

Instructions

With the class divided into groups, answer the following.

a. Based on the static budget report:

1. What was the primary cause(s) of the decline in net income?

2 Did management do a good, average, or poor job of controlling expenses?

3 Were management’s decisions to stay competitive sound?

b. Prepare a flexible budget report for the year.

c. Based on the flexible budget report, answer the three questions in part (a) above.

d. What course of action do you recommend for the management of Green Pastures?

Want to see the full answer?

Check out a sample textbook solution

Chapter 25 Solutions

EBK ACCOUNTING PRINCIPLES

- BioGrow Sdn. Bhd is a retail fertilizer to farmers in Jitra. The company has approached its Bankers to provide funding for next year’s operations. In considering their funding application, a three - month master budget has been requested for review by the bankers. As a freelance accounting service provider, you have been approached by the management as a consultant to prepare the 1st quarter budget for the banker’s consideration for its next year’s (2021) operations. Below is the information as at the end of accounting year of December 2020: Details RM Debtors 23,000 Bank 55,000 Fixed asset at cost 698,000 Accumulated depreciation 98,000 Creditors 48,000 Operating expenses for December 60,000 Sales for December 400,000 Ending inventory 20,000 Retained earnings 120,000 The following additional information was also provided to assist your work. Depreciation is provided at the rate of 5% on cost of…arrow_forwardBioGrow Sdn. Bhd is a retail fertilizer to farmers in Jitra. The company has approached its Bankers to provide funding for next year’s operations. In considering their funding application, a three - month master budget has been requested for review by the bankers. As a freelance accounting service provider, you have been approached by the management as a consultant to prepare the 1st quarter budget for the banker’s consideration for its next year’s (2021) operations. Below is the information as at the end of accounting year of December 2020: Details RM Debtors 23,000 Bank 55,000 Fixed asset at cost 698,000 Accumulated depreciation 98,000 Creditors 48,000 Operating expenses for December 60,000 Sales for December 400,000 Ending inventory 20,000 Retained earnings 120,000 The following additional information was also provided to assist your work. i) Depreciation is provided at the rate of 5% on cost of…arrow_forwardSouth Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent of…arrow_forward

- South Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent of…arrow_forwardSouth Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent…arrow_forwardSouth Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers:South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent of…arrow_forward

- South Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent…arrow_forwardSouth Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. • The average academic staff salary is $120,000 per annum including on-costs. • South Hampton's academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent of…arrow_forwardSouth Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches the equivalent…arrow_forward

- South Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the comingyear, despite an increase in fees to $2,000 per subject. The following additional information has beengathered from an examination of university records and conversations with university managers:South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. SouthHampton operates 2 semesters per year.The average academic staff salary is $220,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administrationand professional/community service. Each of the academic staff teaches the equivalent of…arrow_forwardQuantum Logistics, Inc., a wholesale distributor, is considering the construction of a new warehouse to serve the southeastern geographic region near the Alabama–Georgia border. There are three cities beingconsidered. After site visits and a budget analysis, the expected income andcosts associated with locating in each of the cities have been determined. Thelife of the warehouse is expected to be 12 years and MARR is 15%/yr. Based on an internal rate of return analysis, which city should be recommended?arrow_forwardKat Martin, the CFO of Kelley Power Products (KPP) has requested your assistance in evaluating a capital budgetingproposal. The proposal involves the production of a new line of gearboxes for use in heavy freight applications. Researchand development costs to develop this new line of gearboxes were $320,000 last year (2019). Production of the newproduct would require investment in new machinery. The machinery to be purchased would cost $6,000,000, and wouldhave a useful life of 5 years. KPP has conferred with its tax accountant and has been informed that they must depreciatethe machinery straight-line for a 4-year period to a value of 0. The machinery is expected to be sold for a market value of$500,000 at the end of the 5th year.Management expects to sell 5,000 gearboxes in years 1 and 2, and 6,000 gearboxes in each of the remaining three years.The sales price per gearbox is projected to be $1000 in year one, and management believes that the sales price willincrease by 2% per year…arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning