Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 24, Problem 21AP

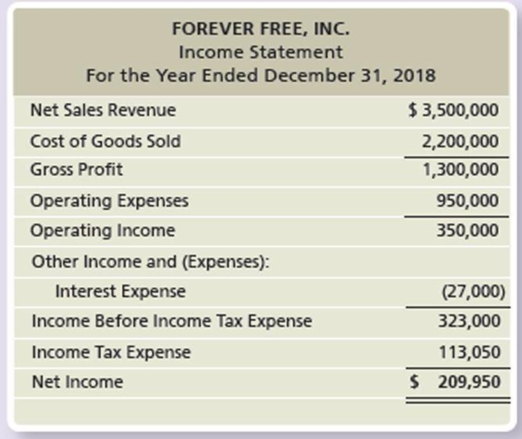

Consider the following condensed financial statements of Forever Free, Inc. The company’s target

Requirements

- 1. Calculate the company’s

ROI . Round all of your answers to four decimal places. - 2. Calculate the company’s profit margin ratio. Interpret your results.

- 3. Calculate the company’s asset turnover ratio. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

- 5. Calculate the company’s RI. Interpret your results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your Task…

Using your assigned financial statements calculate the required ratios below

Indicate if the change from year to year is favorable or unfavorable.

All values should be accurate to at least two decimal places.

The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer.

All calculations are to be represented.

Analysis of Profitability

Gross Profit Ratio

Operating Profit Ratio

Net Profit Ratio

Sales to Total Assets Ratio

Return on Total Assets

Return on Equity

Earnings Per Share

Calculate the missing values for each unique company. (Enter your ROI and Profit Margin percentage answers to one decimal place,

(1.e., 0.123 should be entered as 12.3%). Round your Investment Turnover answers to 2 decimal places.)

Profit

Investment

Turnover

ROI

Margin

8.8 %

Company 1

Company 2

Company 3

Company 4

3.00

20.0 %

5.00

22.0 %

11.0 %

13.0 %

3.00

You have been asked by your CEO to evaluate, analyze and calculate commonly used ratios relating to a company’s profitability, liquidity, solvency and management efficiency.

Requirement:

Complete the balance sheet and sales data (fill in the blanks), using the following financial data:

Debt/net worth 60% x 37,000 = 22,200 (debt) = AP

Acid test ratio 1.2 x 22,200 = 26,640

Asset turnover 1.5 times

Day sales outstanding in accounts receivable 40 days

Gross profit margin 30%

Inventory turnover 6 times

Balance sheet

Cash…

Chapter 24 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 24 - Prob. 1TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 3TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 5TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 7TICh. 24 - Prob. 8TICh. 24 - Prob. 9TICh. 24 - Prob. 10TI

Ch. 24 - Prob. 11TICh. 24 - Prob. 12TICh. 24 - Prob. 13TICh. 24 - Match the responsibility center to the correct...Ch. 24 - Prob. 15TICh. 24 - Prob. 16TICh. 24 - Prob. 17TICh. 24 - Prob. 18TICh. 24 - Prob. 19TICh. 24 - Prob. 20TICh. 24 - Sheffield Company manufactures power tools. The...Ch. 24 - Prob. 22TICh. 24 - Which is not one of the potential advantages of...Ch. 24 - The Quaker Foods division of PepsiCo is most...Ch. 24 - Which of the following is not a goal of...Ch. 24 - Which of the following balanced scorecard...Ch. 24 - The performance evaluation of a cost center is...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Penn Company has a division that manufactures a...Ch. 24 - Explain the difference between a centralized...Ch. 24 - Prob. 2RQCh. 24 - List the disadvantages of decentralization.Ch. 24 - What is goal congruence?Ch. 24 - Prob. 5RQCh. 24 - What is the purpose of a responsibility accounting...Ch. 24 - Prob. 7RQCh. 24 - Prob. 8RQCh. 24 - Prob. 9RQCh. 24 - What are the goals of a performance evaluation...Ch. 24 - Prob. 11RQCh. 24 - How is the use of a balanced scorecard as a...Ch. 24 - What is a key performance indicator?Ch. 24 - What are the four perspectives of the balanced...Ch. 24 - Explain the difference between a controllable and...Ch. 24 - Prob. 16RQCh. 24 - What are two key performance indicators used to...Ch. 24 - Prob. 18RQCh. 24 - Prob. 19RQCh. 24 - Prob. 20RQCh. 24 - Prob. 21RQCh. 24 - Prob. 22RQCh. 24 - What is the biggest advantage of using RI to...Ch. 24 - What are some limitations of financial performance...Ch. 24 - Prob. 25RQCh. 24 - Prob. 26RQCh. 24 - Prob. 27RQCh. 24 - Prob. 1SECh. 24 - Prob. 2SECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - Management by exception is a term often used in...Ch. 24 - Consider the following data, and determine which...Ch. 24 - XTreme Sports Company makes snowboards, downhill...Ch. 24 - Prob. 8SECh. 24 - Using ROI and RI to evaluate investment centers...Ch. 24 - Henderson Company manufactures electronics. The...Ch. 24 - Prob. 11ECh. 24 - Prob. 12ECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - One subunit of Harris Sports Company had the...Ch. 24 - The accountant for a subunit of Speed Sports...Ch. 24 - Zims, a national manufacturer of lawn-mowing and...Ch. 24 - Refer to the data in Exercise E24-17. Calculate...Ch. 24 - Prob. 19ECh. 24 - One subunit of Racer Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 22APCh. 24 - The Harris Company is decentralized, and divisions...Ch. 24 - One subunit of Track Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 26BPCh. 24 - The Hernandez Company is decentralized, and...Ch. 24 - Prob. 28PCh. 24 - This problem continues the Piedmont Computer...Ch. 24 - The Trolley Toy Company manufactures toy building...Ch. 24 - Dixie Irwin is the department manager for...Ch. 24 - Prob. 1FCCh. 24 - In 150 words or fewer, list each of the four...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The initial analysis should include the following: The ratio equation The calculation of the ratio using the equation with the financial data from the two assigned companies. Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Then explain whether this is a good result or a result that needs improving. The original post should include at least three (3) sentences but no more than seven (7) sentences.arrow_forward5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Diusitech Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Diusitech Inc.'s income statement for the last two years. The company had assets of $4,700 million in the first year and $7,518 million in the second year. Common equity was equal to $2,500 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Diusitech Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 2,540 2,000 1,610 1,495 127 80 1,737 803 80 723 181 542 Net Sales Operating costs except depreciation and…arrow_forwardProfit Margin, Investment Turnover, and ROI Cash Company has income from operations of $19,754, invested assets of $83,000, and sales of $282,200. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forward

- The initial analysis should include the following: The ratio equation The calculation of the ratio using the equation and the pre-assigned Quick Study or Exercise from the textbook. Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Then explain whether this is a good result or a result that needs improving. The original post should include at least 7 sentencesarrow_forwardRefer to the information for Jasper Company on the previous page.Required:1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for eachline item on the income statement. (Note: Round percentages to the nearest tenth of a percent.)2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the incomestatement created for Requirement 1 to better control costs.arrow_forwardThe initial analysis should include the following: The ratio equation The calculation of the ratio using the equation and the pre-assigned Quick Study or Exercise from the textbook. (See below) Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Then explain whether this is a good result or a result that needs improving. Use citations to cite any outside sources used. The original post should include at least three (3) sentences but no more than seven (7) sentences. SHOW WORKarrow_forward

- The initial analysis should include the following: The ratio equation The calculation of the ratio using the equation and the pre-assigned Quick Study or Exercise from the textbook. Use the result in a sentence; i.e. For every dollar invested in assets the company is earning 22.4 cents or 22.4% in net income. Then explain whether this is a good result or a result that needs improving. Use citations to cite any outside sources used. The original post should include at least three (3) sentences but no more than seven (7) sentences.arrow_forwardBustamante Company has income from operations of $24,480, invested assets of $85,000, and sales of $204,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forwardYou have been asked by your CEO to evaluate, analyze and calculate commonly used ratios relating to a company’s profitability, liquidity, solvency and management efficiency. Requirement: Complete the balance sheet and sales data (fill in the blanks), using the following financial data: Debt/net worth 60% Acid test ratio 1.2 Asset turnover 1.5 times Day sales outstanding in accounts receivable 40 days Gross profit margin 30% Inventory turnover 6 times Balance sheet Cash ________ Accounts…arrow_forward

- You have been asked by your CEO to evaluate, analyse and calculate commonly used ratios relating to a company’s profitability, liquidity, solvency and management efficiency. Requirement: ⦁ Complete the balance sheet and sales data (fill in the blanks), using the following financial data: Debt/net worth 60%Acid test ratio 1.2Asset turnover 1.5 timesDay sales outstanding in accounts receivable 40 daysGross profit margin 30%Inventory turnover 6 times Balance sheet Cash ________ Accounts payable ________Accounts receivable ________ Common stock RM15,000Inventories ________ Retained earnings RM22,000Plant & equipment ________ Total assets ________ Total liabilities ________& capitalSales ________Cost of goods sold ________ ⦁ Explain how do analysts use ratios to analyse a firm’s leverage? Which ratios convey more important information to a credit analyst those revolving around the levels of indebtedness or those measuring the ability to service debt? What is the relationship between…arrow_forwardYou have been asked by your CEO to evaluate, analyse and calculate commonly used ratios relating to a company’s profitability, liquidity, solvency and management efficiency. Requirement: Complete the balance sheet and sales data (fill in the blanks), using the following financial data: Debt/net worth 60% Acid test ratio 1.2 Asset turnover 1.5 times Day sales outstanding in accounts receivable 40 days Gross profit margin 30% Inventory turnover 6 times Balance sheet Cash ________ Accounts…arrow_forwardProfit Margin, Investment Turnover, and ROI Briggs Company has operating income of $13,824, invested assets of $96,000, and sales of $230,400. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ? b. Investment turnover ? c. Return on investment ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License