Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 22, Problem 54BP

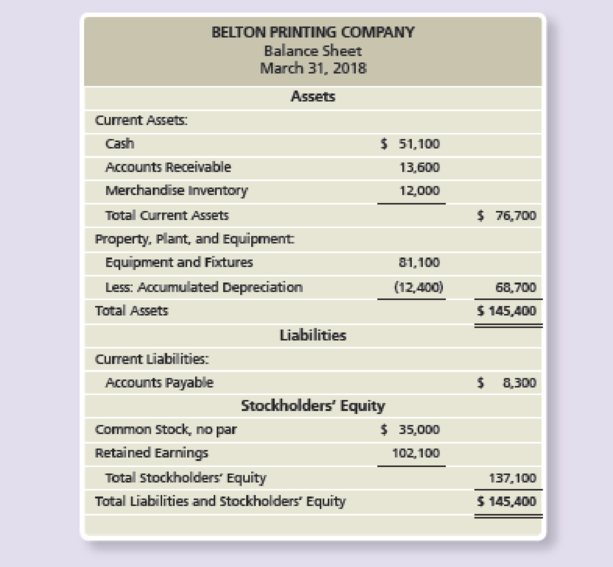

Belton Printing Company of Baltimore has applied for a loan. Its bank has requested a

As Belton Printing’s controller, you have assembled the following additional information:

- a. April dividends of $7,000 were declared and paid.

- b. April capital expenditures of $17,000 budgeted for cash purchase of equipment.

- c. April depreciation expense, $800.

- d. Cost of goods sold, 55% of sales.

- e. Desired ending inventory for April is $24,800.

- f. April selling and administrative expenses includes salaries of $29,000, 20% of which will be paid in cash and the remainder paid next month.

- g. Additional April selling and administrative expenses also include miscellaneous expenses of 10% of sales, all paid in April.

- h. April budgeted sales, $86,000, 80% collected in April and 20% in May.

- i. April cash payments of March 31 liabilities incurred for March purchases of inventory; $8,300.

- j. April purchases of inventory; $22,900 for cash and $37,200 on account. Half the credit purchases will be paid in April and half in May.

Requirements

- 1. Prepare the sales budget for April.

- 2. Prepare the inventory; purchases; and cost of goods sold budget for April.

- 3. Prepare the selling and administrative expense budget for April.

- 4. Prepare the schedule of cash receipts from customers for April.

- 5. Prepare the schedule of cash payments for selling and administrative expenses for April.

- 6. Prepare the

cash budget for April. Assume the company does not use short-term financing to maintain a minimum cash balance. - 7. Prepare the budgeted income statement for April.

- 8. Prepare the budgeted balance sheet at April 30, 2018.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for

April

2024

and budgeted balance sheet at

April

30,

2024.

The

March

31,

2024,

balance sheet follows:

As

Tune

Printing Supply's controller, you have assembled the following additional information:

a.

April

dividends of

$6,000

were declared and paid.

b.

April

capital expenditures of

$16,200

budgeted for cash purchase of equipment.

c.

April

depreciation expense,

$500.

d.

Cost of goods sold,

45%

of sales.

e.

Desired ending inventory for

April

is

$22,800.

f.

April

selling and administrative expenses include salaries of

$32,000,

30%

of which will be paid in cash and the remainder paid next month.

g.

Additional

April

selling and administrative expenses also include miscellaneous expenses of

15%

of sales, all paid in

April.

h.

April

budgeted sales,

$86,000,

50%

collected in

April

and

50%

in

May.

i.

April…

Tune Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for April 2024 and budgeted balance sheet at April 30, 2024. The March 31, 2024, balance sheet follows:

As Tune Printing Supply's controller, you have assembled the following additional information:

a.

April dividends of $6,000 were declared and paid.

b.

April capital expenditures of $16,200 budgeted for cash purchase of equipment.

c.

April depreciation expense, $500.

d.

Cost of goods sold, 45% of sales.

e.

Desired ending inventory for April is $22,800.

f.

April selling and administrative expenses include salaries of

$32,000, 30% of which will be paid in cash and the remainder paid next month.

g.

Additional April selling and administrative expenses also include miscellaneous expenses of 15% of sales, all paid in April.

h.

April budgeted sales, $86,000, 50% collected in April and 50% in May.

i.

April cash payments of…

Fairview Medical Supply has applied for a loan. First American Bank has requested a budgeted balance sheet as of April 30, and a combined cash budget for April. As Fairview Medical Supply's controller, you have assembled the following information:

a.

March 31 equipment balance, $52,700; accumulated depreciation, $41,100.

b.

April capital expenditures of $42,700 budgeted for cash purchase of equipment.

c.

April depreciation expense, $500.

d.

Cost of goods sold, 60% of sales.

e.

Other April operating expenses, including income tax, total $13,400, 30%of which will be paid in cash and the remainder accrued at April 30.

f.

March 31 owners' equity, $93,600.

g.

March 31 cash balance, $40,100.

h.

April budgeted sales, $91,000, 70% of which is for cash. Of the remaining

30%, half will be collected in April and half in May.

i.

April cash collections on March sales, $29,200.

j.

April cash payments of March 31 liabilities incurred…

Chapter 22 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 22 - Managers are required to think about future...Ch. 22 - Prob. 2TICh. 22 - Managers use results to evaluate employees...Ch. 22 - Managers work with managers in other divisions.Ch. 22 - Prob. 5TICh. 22 - Match the budget types to the definitions.Ch. 22 - Prob. 7TICh. 22 - Prob. 8TICh. 22 - Prob. 9TICh. 22 - Prob. 10TI

Ch. 22 - Prob. 11TICh. 22 - Prob. 12TICh. 22 - Prob. 13TICh. 22 - Prob. 14TICh. 22 - Prob. 15TICh. 22 - Prob. 16TICh. 22 - A company can expect to receive which of the...Ch. 22 - A company prepares a five-year budget. This budget...Ch. 22 - Which of the following is the cornerstone of the...Ch. 22 - Prob. 4QCCh. 22 - Suppose Iron City manufactures cast iron skillets....Ch. 22 - Prob. 6QCCh. 22 - Use the following information to answer questions...Ch. 22 - The budgeted income statement is part of which...Ch. 22 - Prob. 9QCCh. 22 - Use the following information to answer questions...Ch. 22 - Suppose Mallcentral sells 1,000 hardcover books...Ch. 22 - Prob. 12QCCh. 22 - Information technology has made it easier for...Ch. 22 - Prob. 1RQCh. 22 - Prob. 2RQCh. 22 - Prob. 3RQCh. 22 - What is budgetary slack? Why might managers try to...Ch. 22 - Explain the difference between strategic and...Ch. 22 - Explain the difference between static and flexible...Ch. 22 - What is a master budget?Ch. 22 - In a manufacturing company, what are the three...Ch. 22 - Why is the sales budget considered the cornerstone...Ch. 22 - Prob. 10RQCh. 22 - What is the formula used to determine the amount...Ch. 22 - What are the two types of manufacturing overhead?...Ch. 22 - How is the predetermined overhead allocation rate...Ch. 22 - What is the capital expenditures budget?Ch. 22 - Prob. 15RQCh. 22 - What are the budgeted financial statements? How do...Ch. 22 - How does the master budget for a merchandising...Ch. 22 - What is the formula used to determine the amount...Ch. 22 - What budgets are included in the financial budget...Ch. 22 - What is sensitivity analysis? Why is it important...Ch. 22 - Budgeting benefits List the three key benefits...Ch. 22 - Budgeting types Consider the following budgets and...Ch. 22 - Preparing an operating budgetsales budget Brown...Ch. 22 - Preparing an operating budgetproduction budget...Ch. 22 - Preparing an operating budgetdirect materials...Ch. 22 - Preparing an operating budgetdirect labor budget...Ch. 22 - Preparing an operating budgetmanufacturing...Ch. 22 - Preparing an operating budgetcost of goods sold...Ch. 22 - Berry expects total sales of 359,000 in January...Ch. 22 - Preparing a financial budgetschedule of cash...Ch. 22 - Preparing a financial budgetcash budget Booth has...Ch. 22 - Prob. 12SECh. 22 - Preparing an operating budgetsales budget Trailers...Ch. 22 - Preparing an operating budgetinventory, purchases,...Ch. 22 - Victors expects total sales of 702,000 for January...Ch. 22 - Prob. 16SECh. 22 - Preparing a financial budgetcash budget Wilson...Ch. 22 - Victors expects total sales of 702,000 for January...Ch. 22 - Using sensitivity analysis in budgeting Refer to...Ch. 22 - Using sensitivity analysis in budgeting Riverbed...Ch. 22 - Prob. 21ECh. 22 - Preparing an operating budgetsales budget...Ch. 22 - Preparing an operating budgetsales and production...Ch. 22 - Preparing an operating budgetdirect materials,...Ch. 22 - Preparing an operating budgetcost of goods sold...Ch. 22 - Preparing a financial budgetschedule of cash...Ch. 22 - Prob. 27ECh. 22 - Preparing the financial budgetcash budget Use the...Ch. 22 - Preparing the financial budgetcash budget Hoppy...Ch. 22 - Preparing the financial budgetbudgeted balance...Ch. 22 - Preparing an operating budgetinventory, purchases,...Ch. 22 - Preparing an operating budgetselling and...Ch. 22 - Prob. 33ECh. 22 - Preparing a financial budgetcash budget,...Ch. 22 - Preparing a financial budgetcash budget You...Ch. 22 - Use the following June actual ending balances and...Ch. 22 - Using sensitivity analysis Rucker Company prepared...Ch. 22 - Preparing an operating budgetsales, production,...Ch. 22 - Preparing an financial budgetschedule of cash...Ch. 22 - Preparing a financial budgetbudgeted income...Ch. 22 - Completing a comprehensive budgeting...Ch. 22 - Preparing an operating budgetsales budget;...Ch. 22 - Preparing a financial budgetschedule of cash...Ch. 22 - Preparing a financial budgetbudgeted income...Ch. 22 - Prob. 45APCh. 22 - Prob. 46APCh. 22 - Preparing an operating budgetsales, production,...Ch. 22 - Prob. 48BPCh. 22 - Preparing a financial budgetbudgeted income...Ch. 22 - Completing a comprehensive budgeting...Ch. 22 - Prob. 51BPCh. 22 - Preparing a financial budgetschedule of cash...Ch. 22 - Prob. 53BPCh. 22 - Belton Printing Company of Baltimore has applied...Ch. 22 - Using sensitivity analysis Holly Company prepared...Ch. 22 - Prob. 57PCh. 22 - Before you begin this assignment, read the...Ch. 22 - Prob. 1DCCh. 22 - Patrick works for McGills Computer Repair, owned...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(a) Standard costs are the expected total cost of completing a job. Is this correct? Explain, (b) A standard im...

Managerial Accounting: Tools for Business Decision Making

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hugo Medical Supply has applied for a loan. Pacific Commerce Bank has requested a budgeted balance sheet as of April 30, and a combined cash budget for April. As Hugo Medical Supply's controller, you have assembled the following information: a. March 31 equipment balance, $52,600; accumulated depreciation, $41,300. b. April capital expenditures of $ 42,400 budgeted for cash purchase of equipment. c. April depreciation expense, $700. d. Cost of goods sold, 60%of sales. e. Other April operating expenses, including income tax, total $14,200, 35% of which will be paid in cash and the remainder accrued at April 30. f. March 31 owners' equity, $92,600. g. March 31 cash balance, $40,300. h. April budgeted sales, $90,000, 70% of which is for cash. Of the remaining 30%, half will be collected in April and half in May. i. April cash collections on March sales, $29,100. j. April cash payments of March 31 liabilities incurred for March…arrow_forwardThe controller of Arrowroot Company wishes to improve the company’s control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance $ 122,000 Dividends were declared on June 15* 40,000 Cash expenditures to be paid in July for operating expenses 81,600 Depreciation expense 12,200 Cash collections to be received 194,000 Merchandise purchases to be paid in cash 120,400 Equipment to be purchased for cash 45,800 Arrowroot Company wishes to maintain a minimum cash balance of 62,000 *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ended July 31, 2021, indicating how much, if anything, Arrowroot will need to borrow to meet its minimum cash requirement. Leave no cells blank - be certain to enter "0" wherever requiredarrow_forwardThe controller of Optimum wishes to improve the company’s control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance $ 130,000 Dividends were declared on June 15* 44,000 Cash expenditures to be paid in July for operating expenses 83,600 Depreciation expense 13,000 Cash collections to be received 198,000 Merchandise purchases to be paid in cash 122,400 Equipment to be purchased for cash 47,000 Optimum wishes to maintain a minimum cash balance of 70,000 *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "0" wherever required). 2. Which of the following statement is true? a) The income…arrow_forward

- The controller of Optimum wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance Dividends were declared on June 15 Cash expenditures to be paid in July for operating expenses Depreciation expense Cash collections to be received Herchandise purchases to be paid in cash Equipment to be purchased for cash Optimun wishes to naintain a ninimum cash balance of $ 98,000 28, 000 75,600 9,800 182,000 114,400 42, 200 38,000 DIvidends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "0" wherever required). ARROWROOT COMPANY Cash Budget for July 31, 2021 Total cash available before current financing Less disbursements Total disbursementsarrow_forwardThe controller of Optimum wishes to improve the company’s control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance $ 130,000 Dividends were declared on June 15* 44,000 Cash expenditures to be paid in July for operating expenses 83,600 Depreciation expense 13,000 Cash collections to be received 198,000 Merchandise purchases to be paid in cash 122,400 Equipment to be purchased for cash 47,000 Optimum wishes to maintain a minimum cash balance of 70,000 *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "0" wherever required). The controller of Optimum wishes to improve the company’s control…arrow_forwardThe controller of Optimum wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance Dividends were declared on June 15* $130,000 44, 000 83,600 13,000 198,000 122,400 47,000 70, 000 Cash expenditures to be paid in July for operating expenses Depreciation expense Cash collections to be received Merchandise purchases to be paid in cash Equipment to be purchased for cash Optimum wishes to maintain a minimum cash balance of *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "O" wherever required).arrow_forward

- Dear Bartleby, I need assistance calculating interest for part b. b. Assume that management of SeaTech Inc. desires to maintain a minimum cash balance of $10,000 at the beginning of each month and has arranged a $50,000 line of credit with a local bank at an interest rate of 10% to ensure the availability of funds. Borrowing transactions are to occur only at the end of months in which the budgeted cash balance would otherwise fall short of the $10,000 minimum balance. Repayments of principal and interest are to occur at the end of the earliest month in which sufficient funds are expected to be available for repayment. (Use 360 days year for calculations.) Following are the budgeted income statements for the second quarter of 2019 for SeaTech Inc.: April May June Sales $ 112,000 $ 136,000 $ 152,000 Cost of goods sold* 76,800 91,200 100,800 Gross profit $ 35,200 $ 44,800 $ 51,200 Operating expenses† 17,600 20,000 21,600…arrow_forwardThe controller of Ultramint Company wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2008. June 30, 2008 cash balance ... Dividends to be declared on July 15* Cash expenditures to be paid in July for operating expenses Amortization expense.... Cash collections to be received ... $ 90,000 24,000 73,600 9,000 178,000 112,400 41,000 50,000 Merchandise purchases to be paid in cash Equipment to be purchased for cash. …….. Ulramint Company wishes to maintain a minimum cash balance of .... *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: Prepare a cash budget for the month ended July 31, 2008, indicating how much, if anything, Ultramint will need to borrow to meet its minimum cash requirement.arrow_forwardThe president of the retailer Prime Products has just approached the company's bank with a request for a $47,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $40,000. Accounts receivable on April 1 will total $145,600, of which $124,800 will be collected during April and $16,640 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forward

- The president of the retailer Prime Products has just approached the company's bank with a request for a $77,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: a. On April 1, the start of the loan period, the cash balance will be $36,600. Accounts receivable on April 1 will total $187,600, of which $160,800 will be collected during April and $21,440 will be collected during May. The remainder will be uncollectible. b. Past experience shows that 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forwardThe president of the retailer Prime Products has just approached the company's bank with a request for a $49,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $38,500. Accounts receivable on April 1 will total $148,400, of which $127,200 will be collected during April and $16,960 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forwardThe president of the retailer Prime Products has just approached the company's bank with a request for a $91,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $15,800. Accounts receivable on April 1 will total $176,400, of which $151,200 will be collected during April and $20,160 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY