Concept explainers

Preparing an operating budget—sales, production, direct materials, direct labor,

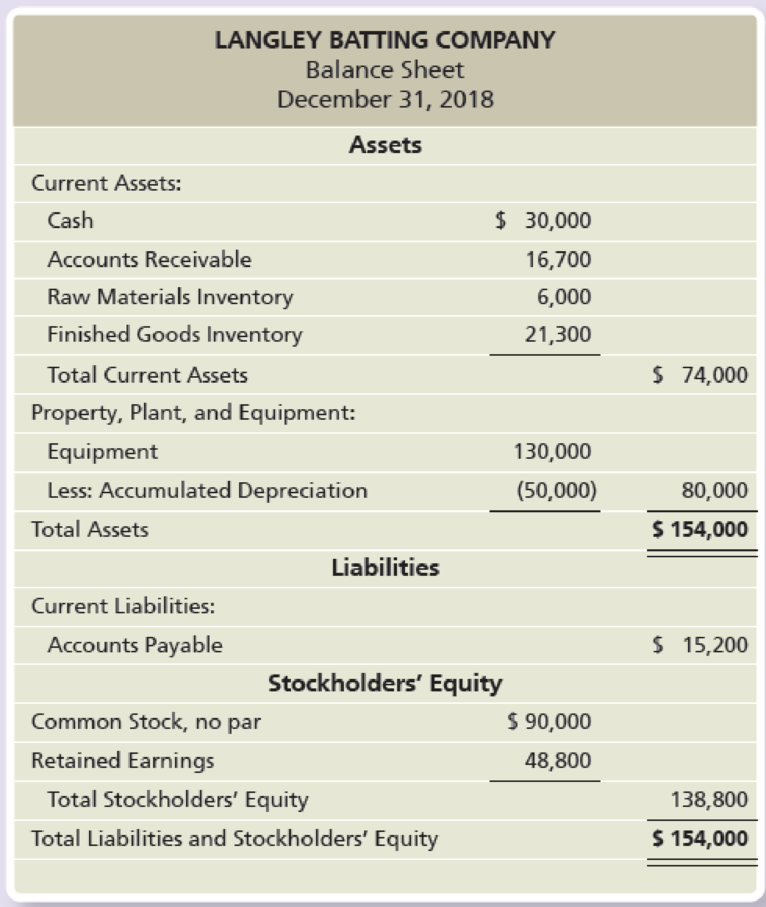

The Langley Batting Company manufactures wood baseball bats. Langley’s two primary products are a youth bat, designed for children and young teens, and an adult bat, designed for high school and college-aged players. Langley sells the bats to sporting goods stores, and all sales are on account. The youth bat sells for $40; the adult bat sells for $65. Langley’s highest sales volume is in the first three months of the year as retailers prepare for the spring baseball season. Langley’s balance sheet for December 31, 2018, follows:

Other data for Langley Batting Company for the first quarter of 2019:

- a. Budgeted sales are 1,200 youth bats and 2,600 adult bats.

- b. Finished Goods Inventory on December 31, 2018, consists of 300 youth bats at $14 each and 950 adult bats at $18 each.

- c. Desired ending Finished Goods Inventory is 350 youth bats and 300 adult bats; FIFO inventory costing method is used.

- d. Direct materials requirements are 48 ounces of wood per youth bat and 56 ounces of wood per adult bat. The cost of wood is $0.25 per ounce.

- e. Raw Materials Inventory of December 31, 2018, consists of 24,000 ounces of wood at $0.25 per ounce.

- f. Desired ending Raw Materials Inventory is 24,000 ounces (indirect materials are insignificant and not considered for budgeting purposes).

- g. Each bat requires 0.7 hours of direct labor; direct labor costs average $18 per hour.

- h. Variable manufacturing overhead is $0.30 per bat.

- i. Fixed manufacturing overhead includes $1,300 per quarter in depreciation and $20,140 per quarter for other costs, such as insurance and property taxes.

- j. Fixed selling and administrative expenses include $9,000 per quarter for salaries; $2,500 per quarter for rent; $1,000 per quarter for insurance; and $200 per quarter for depreciation.

- k. Variable selling and administrative expenses include supplies at 2% of sales.

Requirements

- 1. Prepare Langley’s sales budget for the first quarter of 2019.

- 2. Prepare Langley’s production budget for the first quarter of 2019.

- 3. Prepare Langley’s direct materials budget, direct labor budget, and manufacturing overhead budget for the first quarter of 2019. Round the predetermined overhead allocation rate to two decimal places. The overhead allocation base is direct labor hours.

- 4. Prepare Langley’s cost of goods sold budget for the first quarter of 2019.

- 5. Prepare Langley’s selling and administrative expense budget for the first quarter of 2019.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Cost Accounting (15th Edition)

INTERMEDIATE ACCOUNTING

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Principles of Accounting Volume 2

- Bruer Jeep Tours operates Jeep tours in the heart of the Colorado Rockies. The company bases its budgets on two measures of activity (I.e., cost drivers), namely guests and Jeeps. One vehicle used in one tour on one day counts as a jeep. Each Jeep has one tour guide. The company uses the following data in its budgeting: Guests Jeeps Revenue Expenses: Fixed element per month Revenue $0 Tour guide wages Vehicle expenses $ 6,000 Administrative expenses $ 3,100 In November, the company budgeted for 370 guests and 165 Jeeps. The actual activity for the month was 384 guests and 150 Jeeps. Tour guide wages Vehicle expenses Administrative expenses Total expense Net operating income Variable element per guest $183 Required: Prepare a report showing the company's activity variances for November. Label each varlance as favorable (F) or unfavorable (U). (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero varlance). Input…arrow_forwardLearn Co Learn Co manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget The sales budget often uses the prior year's sales as starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected industry and general economic conditions.…arrow_forwardAnalyze Adventure Park’s Staffing Budget Describe and illustrate the use of staffing budgets for nonmanufacturing businesses. Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size is a function of the number of daily vehicles. Adventure Park has determined from historical experience that a staff member is needed for every 200 vehicles. Adventure Park estimates staff for both school days and non school days. Non school days are higher attendance days than school days. The number of expected vehicles for each day is as follows: School Days Nonschool Days Number of vehicles per day 3,000 8,000 Number of days per year 165 200 Parking fees are $10 per vehicle. Each parking lot employee is paid $110 per day. Determine the annual parking lot staff budget for school…arrow_forward

- LearnCo PARAGRAPH IS FOR ASSISTANCE TO HELP WITH THE QUESTIONS IN THE IMAGES ONLY WANT THE IMAGES ANWSERED LearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget The sales budget often uses the prior year’s sales as a starting point, and then sales quantities are revised for various factors such as planned advertising…arrow_forwardLearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. The sales budget often uses the prior year’s sales as a starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected industry and general economic conditions. LearnCo has…arrow_forwardAssume University Athletic Oriole Club sells T-shirts for $22 and anticipates selling 5,500 shirts during football season. The club purchases the shirts from a local dealer for $17.00. Budgeted foxed costs of $23,000 are made up of $2.500 of selling expense and the remainder is $16.500 administrative expense. The selling expenses include a sales commission of $0.10 per shirt. All other selling costs are fixed. Prepare an income statement in the contribution margin format. University Athletic Oriole Club Income Statementarrow_forward

- Ozark Bird Hunters (OBH) conducts birding tours in the local area. The company owners create a management budget using two measures of activities (also referred to as cost drivers): Customers and Jeeps. Each tour conducted includes one field guide with one jeep. OBH uses the following data to create the budget: Fixed cost Variable cost per Variable cost per per month Customer Jeep Revenue $ 650 Field Guide fee $ 275 Jeep expenses $ 3,500 Administrative expenses $ 1,500 In April, the company budgeted for 500 customers and 100 jeeps. The actual activity for the month was 524 customers and 110 jeeps. Create a report showing the activity variances for April. The FORMAT of your report should look EXACTLY like the report in your textbook in Exhibit 9-6 on page 411. Label each variance as favorable (F) or Unfavorable (U). If rounding is required, round to the nearest whole dollar (for example, $10.666666667 would be $11)arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $179,400, and 13,800 orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. per sales order b. Determine the amount of sales order processing cost that Nozama.com would receive if it had 7,900 sales orders.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- Case Study for REX Company.Comprehensive operating budget. REX, Inc., manufactures and sells snowboards. REXmanufactures a single model, the Pipex. In the summer of 2018, REXS accountant gatheredthe following data to prepare budgets for 2019:Materials and labor requirementsDirect materials:Wood 5 board feet per snowboardFiberglass 6 yards per snowboardDirect manufacturing labor 5 hours per snowboardREX’ CEO expects to sell 1,000 snow boards during 2019 at an estimated retail price of$ 450 per board. Further, he expects 2019 beginning inventory of 100 boards, and would liketo end 2019 with 200 snowboards in stock.Direct materials inventories Beginning Inventory Ending Inventory1/1/2019 12/31/2019________________________________________________________Wood 2,000 1,500Fiberglass 1,000 2,000Variable manufacturing overhead is allocated is allocated at the rate $ 7 per directmanufacturing labor-hour. There are also $ 66,000 in fixed manufacturing overhead costsbudgeted for 2019.REX combines…arrow_forwardAnalyze Adventure Park’s staffing budget Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size is a function of the number of daily vehicles. Adventure Park has determined from historical experience that a staff member is needed for every 200 vehicles. Adventure Park estimates staff for both school days and nonschool days. Nonschool days are higher attendance days than school days. The number of expected vehicles for each day is as follows:arrow_forwardAnalyze Adventure Park's staffing budget Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size is a function of the number of daily vehicles. Adventure Park has determined from historical experience that a staff member is needed for every 200 vehicles. Adventure Park estimates staff for both school days and nonschool days. Nonschool days are higher attendance days than school days. The number of expected vehicles for each day is as follows: School Days Nonschool Days Number of vehicles per day 3,000 8,000 Number of days per year 165 200 Parking fees are $10 per vehicle. Each parking lot employee is paid $110 per day. a. Determine the annual parking lot staff budget for school days, nonschool days, and total. School Days Nonschool Days Total Total parking lot staff expense $ b. Determine the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education