Concept explainers

Preparing an operating budget—sales, production, direct materials, direct labor,

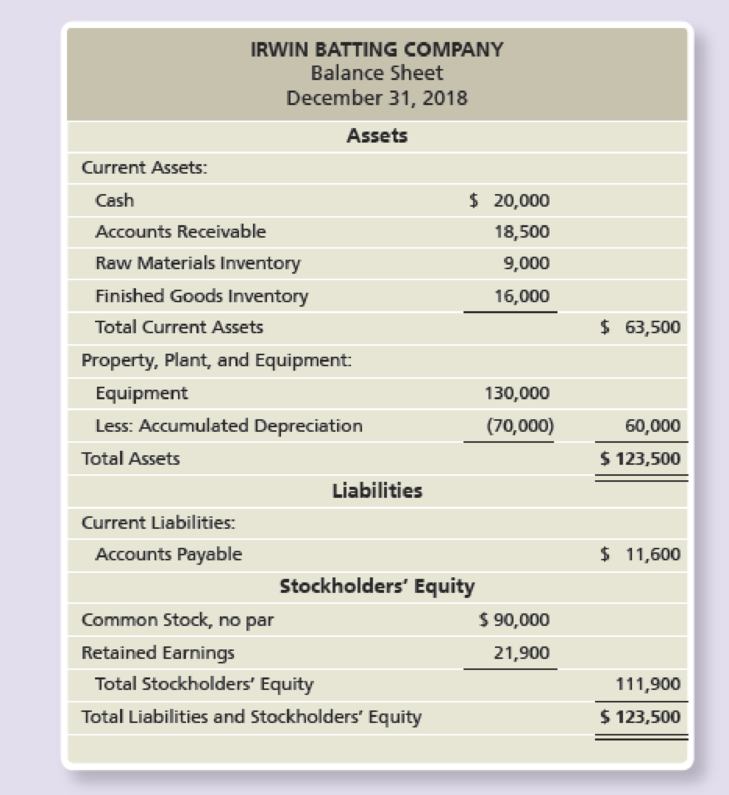

The Irwin Batting Company manufactures wood baseball bats Irwin’s two primary products are a youth bat, designed for children and young teens, and an adult bat, designed for high school and college-aged players. Irwin sells the bats to sporting goods stores, and all sales are on account. The youth bat sells for $35; the adult bat sells for $50. Irwin’s highest sales volume is in the first three months of the year as retailers prepare for the spring baseball season. Irwin’s balance sheet for December 31, 2018, follows:

Other data for Irwin Batting Company for the first quarter of 2019:

- a. Budgeted sales are 1,400 youth bats and 3,300 adult bats.

- b. Finished Goods Inventory on December 31, 2018, consists of 700 youth bats at $15 each and 550 adult bats at $10 each.

- c. Desired ending Finished Goods Inventory is 220 youth bats and 300 adult bats; FIFO inventory costing method is used.

- d. Direct materials requirements are 40 ounces of wood for youth bats and 70 ounces of wood for adult bats. The cost of wood is $0.10 per ounce.

- e. Raw Materials Inventory on December 31, 2018, consists of 90,000 ounces of wood at $0.10 per ounce.

- f. Desired ending Raw Materials Inventory is 90,000 ounces (indirect materials are insignificant and not considered for budgeting purposes).

- g. Each bat requires 0.4 hours of direct labor; direct labor costs average $26 per hour.

- h. Variable manufacturing overhead is $0.30 per bat.

- i. Fixed manufacturing overhead includes $1,300 per quarter in depreciation and $14,977 per quarter for other costs, such as insurance and property taxes.

- j. Fixed selling and administrative expenses include $13,000 per quarter for salaries; $3,500 per quarter for rent; $1,400 per quarter for insurance; and $450 per quarter for depreciation.

- k. Variable selling and administrative expenses include supplies at 1% of sales.

Requirements

- 1. Prepare Irwin’s sales budget for the first quarter of 2019.

- 2. Prepare Irwin’s production budget for the first quarter of 2019.

- 3. Prepare Irwin’s direct materials, direct labor budget, and manufacturing overhead budget for the first quarter of 2019. Round the predetermined overhead allocation rate to two decimal places. The overhead allocation base is direct labor hours.

- 4. Prepare Irwin’s cost of goods sold budget for the first quarter of 2019.

- 5. Prepare Irwin’s selling and administrative expense budget for the first quarter of 2019.

Want to see the full answer?

Check out a sample textbook solution

Chapter 22 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Financial Accounting

Fundamentals Of Financial Accounting

Managerial Accounting: Creating Value in a Dynamic Business Environment

Managerial Accounting: Tools for Business Decision Making

Intermediate Accounting

Financial Accounting, Student Value Edition (5th Edition)

- Learn Co Learn Co manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget The sales budget often uses the prior year's sales as starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected industry and general economic conditions.…arrow_forwardAnalyze Adventure Park’s Staffing Budget Describe and illustrate the use of staffing budgets for nonmanufacturing businesses. Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size is a function of the number of daily vehicles. Adventure Park has determined from historical experience that a staff member is needed for every 200 vehicles. Adventure Park estimates staff for both school days and non school days. Non school days are higher attendance days than school days. The number of expected vehicles for each day is as follows: School Days Nonschool Days Number of vehicles per day 3,000 8,000 Number of days per year 165 200 Parking fees are $10 per vehicle. Each parking lot employee is paid $110 per day. Determine the annual parking lot staff budget for school…arrow_forwardLearnCo LearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget The sales budget often uses the prior year’s sales as a starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected industry and general economic conditions.…arrow_forward

- LearnCo PARAGRAPH IS FOR ASSISTANCE TO HELP WITH THE QUESTIONS IN THE IMAGES ONLY WANT THE IMAGES ANWSERED LearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. Sales Budget The sales budget often uses the prior year’s sales as a starting point, and then sales quantities are revised for various factors such as planned advertising…arrow_forwardThe Ferico store is a neighborhood convenience store. The accountant is preparing its activity-based budget for January 2023. The Ferico has three product categories: child clothes (35% of cost of goods sold) women's clothes (25% of cost of goods sold) and men's clothes (40% of cost of goods sold). The following table shows the four activities that consume indirect resources at the Ferico store, the cost drivers and their rates, and the cost-driver amount budgeted to be consumed by each activity in January 2025. Activity Ordering Delivery Shelf stocking Customer support Average contribution margin Cost driver Number of purchase orders Number of deliveries Hours of stocking time Number of items sold Budgeted cost driver rate $50 $40 $12 $1 Children clothes 15 10 20 5000 $30 Women's clothes 180 35,000 $50 Men's clothes 15 20 100 Required: a. Calculate the total budgeted indirect cost at the Ferico store in January 2023 b. Calculate the budgeted operating income of the company based on…arrow_forwardLearnCo manufactures and sells one product, an abacus for classroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1, 20Y1, and is planning for 20Y2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Y2. You have been asked to assist the controller of LearnCo in preparing the 20Y2 budgets. The sales budget often uses the prior year’s sales as a starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected industry and general economic conditions. LearnCo has…arrow_forward

- Indicate which of the following descriptions is most likely to describe each cost listed below.Description CostsEngineered cost Cost of ingredients in a breakfast cereal Committed cost Cost of advertising for a credit card company Discretionary cost Depreciation on an insurance company’s computer Cost of charitable donations that are budgeted as 1 percent of sales revenue Research and development costs, which have been budgeted at $45,000 per yeararrow_forward1. Question Content Area Sales Budget FlashKick Company manufactures and sells soccer balls for teams of children in elementary and high school. FlashKick’s best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ball line (high-performance soccer balls used in games). In the first four months of next year, FlashKick expects to sell the following: Practice Balls Match Balls Units Selling Price Units Selling Price January 50,000 $8.25 7,000 $16.00 February 58,000 $8.25 8,000 $16.00 March 80,000 $8.25 13,000 $16.00 April 100,000 $8.25 18,000 $16.00 Required: Question Content Area 1. Construct a sales budget for FlashKick for the first three months of the coming year. Show total sales for each product line by month and in total for the first quarter. If required, round your answers to the nearest cent. FlashKick CompanySales BudgetFor the First Quarter of Next Year…arrow_forwardCase Study for REX Company.Comprehensive operating budget. REX, Inc., manufactures and sells snowboards. REXmanufactures a single model, the Pipex. In the summer of 2018, REXS accountant gatheredthe following data to prepare budgets for 2019:Materials and labor requirementsDirect materials:Wood 5 board feet per snowboardFiberglass 6 yards per snowboardDirect manufacturing labor 5 hours per snowboardREX’ CEO expects to sell 1,000 snow boards during 2019 at an estimated retail price of$ 450 per board. Further, he expects 2019 beginning inventory of 100 boards, and would liketo end 2019 with 200 snowboards in stock.Direct materials inventories Beginning Inventory Ending Inventory1/1/2019 12/31/2019________________________________________________________Wood 2,000 1,500Fiberglass 1,000 2,000Variable manufacturing overhead is allocated is allocated at the rate $ 7 per directmanufacturing labor-hour. There are also $ 66,000 in fixed manufacturing overhead costsbudgeted for 2019.REX combines…arrow_forward

- Novo, Inc., wants to develop an activity flexible budget for the activity of moving materials. Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also used to move materials from stores to the production area. The forklifts are obtained through an operating lease that costs 18,000 per year per forklift. Novo employs 25 forklift operators who receive an average salary of 50,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production. Crates are disposed of after one cycle (two moves), where a cycle is defined as a move from receiving to stores to production. Each crate costs 1.80. Fuel for a forklift costs 3.60 per gallon. A gallon of gas is used every 20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50 weeks per year. Required: 1. Prepare a flexible budget for the activity of moving materials, using the number of cycles as the activity driver. 2. Calculate the activity capacity for moving materials. Suppose Novo works at 80 percent of activity capacity and incurs the following costs: Prepare the budget for the 80 percent level and then prepare a performance report for the moving materials activity. 3. Calculate and interpret the volume variance for moving materials. 4. Suppose that a redesign of the plant layout reduces the demand for moving materials to one-third of the original capacity. What would be the budget formula for this new activity level? What is the budgeted cost for this new activity level? Has activity performance improved? How does this activity performance evaluation differ from that described in Requirement 2? Explain.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardCase Study for Slopes Company.Comprehensive operating budget. Slopes, Inc., manufactures and sells snowboards. Slopesmanufactures a single model, the Pipex. In the summer of 2018, Slope’s accountant gatheredthe following data to prepare budgets for 2019:Materials and labor requirementsDirect materials:Wood 5 board feet per snowboardFiberglass 6 yards per snowboardDirect manufacturing labor 5 hours per snowboardSlopes’ CEO expects to sell 1,000 snow boards during 2019 at an estimated retail price ofRM 450 per board. Further, he expects 2019 beginning inventory of 100 boards, and would liketo end 2019 with 200 snowboards in stock.Direct materials inventoriesBeginning Inventory Ending Inventory1/1/2019 12/31/2019________________________________________________________Wood 2,000 1,500Fiberglass 1,000 2,000Variable manufacturing overhead is allocated is allocated at the rate RM 7 per directmanufacturing labor-hour. There are also RM 66,000 in fixed manufacturing overhead costsbudgeted for…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning