Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 7CE

Jean and Tom Perritz own and manage Happy Home Helpers. Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings:

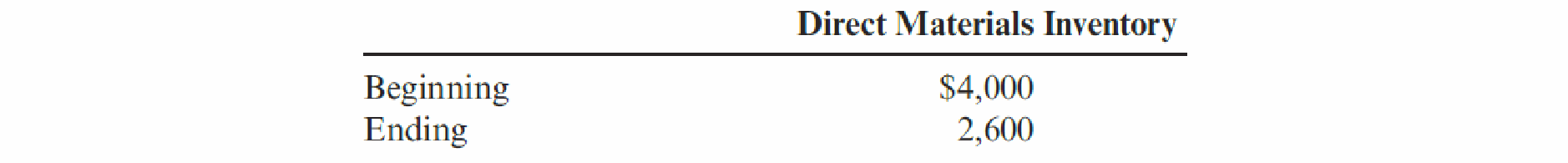

Next year, HHH expects to purchase $25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows:

There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day.

Required:

- 1. Prepare a statement of cost of services sold in good form.

- 2. How does this cost of services sold statement differ from the cost of goods sold statement for a manufacturing firm?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Danford Company, a manufacturer of farm equipment, currently produces 20,000 units of gas filters per

year for use in its lawn-mower production. The costs, based on the previous year's production, are

reported below. It is anticipated that gas-filter production will last five years. If the company continues to

produce the product in-house, annual direct material costs will increase $3000/year (For example,

annual material costs during the first production year will be $63,000.) Direct labor will also increase by

$5000/year. However, variable overhead costs will increase at the rate of $2000/year and the fixed

overhead will remain at its current level over the next five years. John Holland Company has offered to

sell Danford 20,000 units of gas filters for $25 per unit. If Danford accepts the offer, some of the

manufacturing facilities currently used to manufacture the filter could be rented to a third party for

$35,000 per year. The firm's interest rate is known to be 15%. What is the…

ChimneySweep provides cleaning services for residential chimneys and fireplaces. The cleaning service requires $35 in variable costs for cleaning materials. The fixed costs of labor, the company’s truck, and administrative support are $165,000 per year. ChimneySweep averages 100 service calls per month.

What is the average cost per cleaning service call? Round your answer to 2 decimal places.

Tim Urban, owner/manager of Urban's Motor Court in Key West, is considering outsourcing the daily room cleanup for his motel to Duffy's Maid Service. Tim rents an average of 50 rooms for each of

365 nights (365 x 50 equals the total rooms rented for the year). Tim's cost to clean a room is $13.00. The Duffy's Maid Service quote is $18.00 per room plus a fixed cost of $26,000 for sundry items

such as uniforms with the motel's name. Tim's annual fixed cost for space, equipment, and supplies is $61,000.

Based on the given information related to costs for each of the options, the crossover point for Tim = ☐ room nights (round your response to the nearest whole number).

Chapter 2 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 2 - What is an accounting information system?Ch. 2 - What is the difference between a financial...Ch. 2 - What are the objectives of a cost management...Ch. 2 - Define and explain the two major subsystems of the...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - Prob. 6DQCh. 2 - What is a direct cost? An indirect cost?Ch. 2 - Prob. 8DQCh. 2 - What is allocation?Ch. 2 - Explain how driver tracing works.

Ch. 2 - What is a tangible product?Ch. 2 - Prob. 12DQCh. 2 - Give three examples of product cost definitions....Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Pietro Frozen Foods, Inc., produces frozen pizzas....Ch. 2 - For next year, Pietro predicts that 50,000 units...Ch. 2 - Pietro expects to produce 50,000 units and sell...Ch. 2 - Refer to Cornerstone Exercises 2.2 and 2.3. Next...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Prob. 9ECh. 2 - The following items are associated with a cost...Ch. 2 - Nizam Company produces speaker cabinets. Recently,...Ch. 2 - Three possible product cost definitions were...Ch. 2 - Wyandotte Company provided the following...Ch. 2 - For each of the following independent situations,...Ch. 2 - LeMans Company produces specialty papers at its...Ch. 2 - Kildeer Company makes easels for artists. During...Ch. 2 - Anglin Company, a manufacturing firm, has supplied...Ch. 2 - Lakeesha Barnett owns and operates a package...Ch. 2 - Millennium Pharmaceuticals, Inc. (MPI), designs...Ch. 2 - Jazon Manufacturing produces two different models...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Orinder Company provided the following information...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - The ability to assign a cost directly to a cost...Ch. 2 - Selected information concerning the operations of...Ch. 2 - Brody Company makes industrial cleaning solvents....Ch. 2 - Wright Plastic Products is a small company that...Ch. 2 - The following items are associated with a...Ch. 2 - The actions listed next are associated with either...Ch. 2 - Spencer Company produced 200,000 cases of sports...Ch. 2 - Prob. 33PCh. 2 - Mason, Durant, and Westbrook (MDW) is a tax...Ch. 2 - Orman Company produces neon-colored covers for...Ch. 2 - High drug costs are often in the news. Consumer...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. HHH expects to sell 15,000 cleanings at a price of 45 each next year. Total selling expense is projected at 22,000, and total administrative expense is projected at 53,000. Required: 1. Prepare an income statement in good form. 2. What if Jean and Tom increased the price to 50 per cleaning and no other information was affected? Explain which line items in the income statement would be affected and how.arrow_forwardTim Urban, owner/manager of Urban's Motor Court in Key West, is considering outsourcing the daily room cleanup for his motel to Duffy's Maid Service. Tim rents an average of 50 rooms for each of 365 nights (365 × 50 equals the total rooms rented for the year). Tim's cost to clean a room is $13.00. The Duffy's Maid Service quote is $19.00 per room plus a fixed cost of $26,000 for sundry items such as uniforms with the motel's name. Tim's annual fixed cost for space, equipment, and supplies is $61,000. Based on the given information related to costs for each of the options, the crossover point for Tim = room nights (round your response to the nearest whole number).arrow_forwardTim Urban, owner/manager of Urban's Motor Court in Key West, is considering outsourcing the daily room cleanup for his motel to Duffy's Maid Service. Tim rents an average of 50 rooms for each of 365 nights (365 × 50 equals the total rooms rented for the year). Tim's cost to clean a room is $12.50. The Duffy's Maid Service quote is $18.50 per room plus a fixed cost of $25,000 for sundry items such as uniforms with the motel's name.Tim's annual fixed cost for space, equipment, and supplies is $60,000. Based on the given information related to costs for each of the options, the crossover point for Tim =_________ room nights (round your response to the nearest whole number).arrow_forward

- Milliken uses a digitally controlled dyer for placing intricate patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the 1st year and drop by $44,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the 1st year, increasing by 7% per year. Maintenance costs are only $8,000 the 1st year but will increase by 37% each year thereafter. Milliken’s MARR is 20%. Determine the optimum replacement interval (years) for the dyerarrow_forwardSanta Fe Company, a farm-equipment manufacturer, currently produces 20,000 units of gas filters for use in its lawnmower production annually. The following costs are reported according to the previous year's production: It is anticipated that gas-filter production will last five years. If the company continues to produce the product in-house, annual direct-material costs will increase at a rate of 5%. (For example, the annual direct-material costs during the first production year will be $63,000.) In addition, direct-labor costs will increase at a rate of 6% per year, and variable-overhead costs will increase at a rate of 3% while fixed-overhead costs will remain at the current level over the next five years. Tompkins Company has offered to sell Santa Fe Company 20,000 units of gas filters for $25 per unit. If Santa Fe accepts the offer, some of the facilities currently used to manufacture the gas filters could be rented to a third party at an annual rate of $35,000. In addition,…arrow_forwardBrittany is co-oping this semester at Regency Aircraft, which customizes the interiors of private and corporate jets. Her first assignment is to developthe specifications for a new machine to cut, shape, and sew leather or vinyl covers and trims. The first cost is not easy to estimate due to many options,but the annual revenue and M&O costs should net out at $15,000 per year over a 10-year life. Salvage is expected to be 20% of the first cost. Determine what can be paid for the machine now to recover the cost and an MARR of 8% per year under two scenarios:I: No outside revenue will be developed.II: Outside contracting will occur with estimated revenue of $10,000 the first year, increasing by $5000 per year thereafter. Solve using (a) tabulated factors, and (b) a spreadsheet and the GOAL SEEK tool.arrow_forward

- 1. Eddie is a production engineer for a major supplier of component parts for cars. He has determined that a robot can be installed on the production line to replace one employee. The employee earns $20 per hour and benefits worth $8 per hour for a total annual cost of $58,240 this year. Eddie estimates this cost will increase 6% each year. The robot will cost $16,500 to operate for the first year with costs increasing by $1500 each year. The firm uses an interest rate of 15% and a 10- year planning horizon. The robot costs $75,000 installed and will have a salvage value of $5000 after 10 years. Should Eddie recommend that purchase of the robot?arrow_forwardAyayai Company, a manufacturer of audio systems, started its production in October 2022. For the preceding 3 years, Ayayai had been a retailer of audio systems. After a thorough survey of audio system markets, Ayayai decided to turn its retail store into an audio equipment factory. Raw material costs for an audio system will total $75 per unit. Workers on the production lines are on average paid $13 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,000 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,800. Factory janitorial costs are $1,400 monthly. Advertising costs for the audio system will be $8,600 per month. The factory building depreciation expense is $6,000 per year. Property taxes on the factory building will be $8,400 per year. (a) Assuming that Ayayai manufactures, on average, 1,500 audio systems per month,…arrow_forwardTim Urban, owner/manager of Urban's Motor Court in Key West, is considering outsourcing the daily room cleanup for his motel to Duffy's Maid Service. Tim rents an average of 50 rooms for each of 365 nights (365x 50 equals the total rooms rented for the year). Tim's cost to clean a room is $13.00. The Duffy's Maid Service quote is $18.00 per room plus a fixed cost of $25.000 for sundry items such as uniforms with the motel's name. Tim's annual fixed cost for space, equipment, and supplies is $61,000. Based on the given information related to costs for each of the options, the crossover point for Tim-room nights (round your response to the nearest whole number) if the number of room nights is less than the crossover point, then is the best option available to Tim Based on the given room nights that Tim expects to rent (18,250), the best option isarrow_forward

- Elliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of$25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk usesa PC and laser printer in processing orders. Time available on each PC system is sufficient toprocess 6,500 orders per year. The cost of each PC system is $1,100 per year. In addition to thesalaries, Elliott spends $27,560 for forms, postage, and other supplies (assuming 26,000 purchaseorders are processed). During the year, 25,350 orders were processed.Required:1. Classify the resources associated with purchasing as (1) flexible or (2) committed.2. Compute the total activity availability, and break this into activity usage and unused activity.3. Calculate the total cost of resources supplied (activity cost), and break this into the cost ofactivity used and the cost of unused activity.4. (a) Suppose that a large special order will cause an additional 500 purchase orders. Whatpurchasing costs are…arrow_forwardJason Bartlett is the managing partner of a business that has just finished building a 60-room motel. Bartlett anticipates that he will rent these rooms for 15,000 nights next year (or 15,000 room-nights). All rooms are similar and will rent for the same price. Bartlett estimates the following operating costs for next year: Variable operating costs $ 5 per room-night Fixed costs Salaries and wages $171,000 Maintenance of building and pool 42,000 Other operating and administration costs 162,000 Total fixed costs $375,000 The capital invested in the motel is $900,000. The partnership's target return on investment is 25%. Bartlett expects demand for rooms to be uniform throughout the year. He plans to price the rooms at full cost plus a markup on full cost to earn the target return on investment. 1. What price should Bartlett charge for a room-night? What is the markup as a percentage of the full cost of a room-night? 2.…arrow_forwardPERBANAS, Inc. installs heating systems in new homes built in the southern tier counties of New York state. Jobs are priced using the time and materials method. The president of PERBANAS, Fenturini, is pricing a job involving the heating systems for six houses to be built by a local developer. He has made the following estimates. Material cost $ 30,000 Labor hours 200 The following predictions pertain to the company’s operations for the next year. Labor rate, including fringe benefits $ 8.00 per hour Annual labor hours 6,000 hours Annual overhead costs: Material handling and storage $ 12,500 Other overhead costs $ 54,000 Annual cost of materials used $ 125,000 Perbanas adds a markup of $ 2 per hour on its time charges, but there is no markup on material costs. Required: 1. Calculate the company's time charges and the material charges percentage. 2. Compute the price for the job 3. What would be the price of the job if Perbanas also added a markup of 5 % on all material charges…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY