Concept explainers

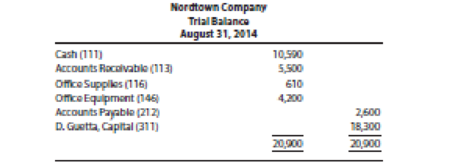

Nordtown Company is a marketing firm. The company’s

During the month of September, the company completed the following transactions:

Sept. 2 Paid rent for September, $650.

3 Received cash from customers on account, $2,300.

7 Ordered supplies, $380.

10 Billed customers for services provided, $2,800.

12 Made a payment on accounts payable, $1,300.

14 Received the supplies ordered on September 7 and agreed to pay for them in 30 days, $380.

17 Discovered some of the supplies were not as ordered and returned them for full credit, $80.

19 Received cash from a customer for services provided, $4,800.

24 Paid the utility bill for September, $250.

26 Received a bill, to be paid in October, for advertisements placed in the local newspaper during the month of September to promote Nordstrom Company, $700.

29 Billed a customer for services provided, $2,700.

30 Paid salaries for September, $3,800.

30 Made a cash withdrawal of $1,200.

Required

- 1. Open accounts in the ledger for the accounts in the trial balance plus the following accounts: D. Guetta, Withdrawals (313); Marketing Fees (411); Salaries Expense (511); Utilities Expense (512); Rent Expense (514); and Advertising Expense (516).

- 2. Enter the August 31, 2014, account balances from the trial balance.

- 3. Enter the September transactions in the general journal (page 22).

- 4.

Post the journal entries to the ledger accounts. Be sure to make the appropriate posting references in the journal and ledger as you post. - 5. Prepare a trial balance as of September 30, 2014.

- 6. Business Application ▶ Examine the transactions for September 3, 10, 19, and 29. What were the revenues, and how much cash was received from the revenues? What business issues might you see arising from the differences in these numbers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Principles of Accounting

- Kelley Company has completed the following October sales and purchases journals: a. Total and post the journals to T accounts for the general ledger and the accounts receivable and accounts payable ledgers. b. Complete a schedule of accounts receivable for October 31, 20--. c. Complete a schedule of accounts payable for October 31, 20--. d. Compare the balances of the schedules with their respective general ledger accounts. If they are not the same, find and correct the error(s).arrow_forwardGuardian Services Inc. had the following transactions during the month of April: a. Record the June purchase transactions for Guardian Services Inc. in the following purchases journal format: b. What is the total amount posted to the accounts payable and office supplies accounts from the purchases journal for April? c. What is the April 30 balance of the Officemate Inc. creditor account assuming a zero balance on April 1?arrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forward

- Global Services Company had the following transactions during the month of August: a. Record the August revenue transactions for Global Services Company into the following revenue journal format: b. What is the total amount posted to the accounts receivable and fees earned accounts from the revenue journal for August? c. What is the August 31 balance of the Morgan Corp. customer account assuming a zero balance on August 1?arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe transactions completed by Revere Courier Company during December, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardPrepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. If using QuickBooks or general ledger, ignore Steps 2, 3, and 4. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Summary Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts?arrow_forward

- During the month of October 20--, The Pink Petal flower shop engaged in the following transactions: Selected account balances as of October 1 were as follows: The Pink Petal also had the following subsidiary ledger balances as of October 1: REQUIRED 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger, accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardReview the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning