Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 10EA

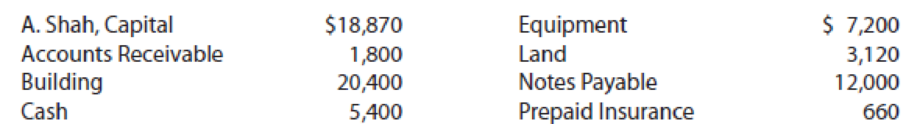

The list that follows presents Shah Company’s accounts (in alphabetical order) as of March 31, 2014. The list does not include the amount of Accounts Payable.

Prepare a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

(a) On March 1, journalize the entry to record the write-off, assuming that the direct write-off method is used. Refer to the Chart of Accounts for exact wording of account titles.PAGE 1JOURNALACCOUNTING EQUATIONDATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY12(b) On March 1, journalize the entry to record the write-off, assuming that the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles.PAGE 1JOURNALACCOUNTING EQUATIONDATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY12

Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on theinformation presented and balance off each account.3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for theAccounts Receivable.4. Assume that the aging of accounts receivable method was used by the company and that$7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. Youare now required to:a. Determine the amount to be charged to uncollectible expense (show yourworkings for the computation of this figure).b. Prepare the balance sheet extract to show the net realizable value of the AccountsReceivable as at December 31

Johnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.

Prepare journal entries for each transaction.

Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.

Chapter 2 Solutions

Principles of Accounting

Ch. 2 - A company incurs a cost for a part that is needed...Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - Prob. 4DQCh. 2 - How are assets and expenses related, and why are...Ch. 2 - Prob. 6DQCh. 2 - Prob. 7DQCh. 2 - Prob. 8DQCh. 2 - Tell whether each of the following accounts is an...Ch. 2 - Prob. 2SE

Ch. 2 - Prob. 3SECh. 2 - Prob. 4SECh. 2 - Prob. 5SECh. 2 - Prob. 6SECh. 2 - Prob. 7SECh. 2 - Prepare a general journal form like the one in...Ch. 2 - Prepare three ledger account forms like the one in...Ch. 2 - Prob. 10SECh. 2 - Prob. 11SECh. 2 - Prob. 12SECh. 2 - Which of the following events would be recognized...Ch. 2 - You are given the following list of accounts with...Ch. 2 - The following ledger accounts are for Afocentric...Ch. 2 - Prob. 4EACh. 2 - The accounts that follow are applicable to Harolds...Ch. 2 - Prob. 6EACh. 2 - Prob. 7EACh. 2 - Prob. 8EACh. 2 - After recording the transactions in E6A, prepare a...Ch. 2 - The list that follows presents Shah Companys...Ch. 2 - Which of the following errors would cause a trial...Ch. 2 - Prob. 12EACh. 2 - Record the transactions in E6A in the general...Ch. 2 - Prob. 14EACh. 2 - Prob. 15EACh. 2 - Prob. 16EACh. 2 - Highland Design Company creates radio and...Ch. 2 - The following accounts are applicable to Georges...Ch. 2 - Jennifer Lopez opened a school for administrative...Ch. 2 - Sid Patel bid for and won a concession to rent...Ch. 2 - Nordtown Company is a marketing firm. The companys...Ch. 2 - Prob. 6APCh. 2 - The following accounts are applicable to Raymonds...Ch. 2 - Prob. 8APCh. 2 - David Roberts began an upholstery cleaning...Ch. 2 - Prob. 10APCh. 2 - Prob. 1CCh. 2 - Prob. 2CCh. 2 - Prob. 3CCh. 2 - Prob. 4CCh. 2 - Prob. 5CCh. 2 - Prob. 6CCh. 2 - Prob. 7C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maddie Inc. has the following transactions for its first month of business. A. What are the individual account balances, and the total balance, in the accounts receivable subsidiary ledger? B. What is the balance in the accounts receivable general ledger (control) account?arrow_forwardBased on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Sunrise Enterprises, which had a 480 beginning balance. In addition, there were no collections during the period. a. Set up a T account for Accounts Receivable and T accounts for the four accounts b. needed in the customer ledger. c. Post to the T accounts. d. Determine the balance in the accounts. e. Prepare a listing of the accounts receivable customer balances as of March 31, 2016.arrow_forwardThe following account balances were included in Bromley Companγs balance sheet on December 31, 2018: Prepare journal entries to record all the preceding events. Unless otherwise indicated, assume the company makes all payment's in cash.arrow_forward

- On December 31, 2023, Bridgeport Co. performed environmental consulting services for Indigo Co. Indigo was short of cash, and Bridgeport Co. agreed to accept a $165,000 zero-interest-bearing note due December 31, 2025, as payment in full. Indigo is somewhat of a credit risk and typically borrows funds at a rate of 11%. Bridgeport is much more creditworthy and has various lines of credit at 6%. Click here to view factor tables Prepare the journal entry to record the transaction of December 31, 2023, for Bridgeport Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places, e.g. 5,275.25. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Notes Receivable Discount on Notes Receivable Service Revenue Debit 165000…arrow_forwardJohnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable. 4. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to:a. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure).b. Prepare the balance sheet extract to show the net realizable value of the…arrow_forwardJohnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.arrow_forward

- Presented below are transactions related to Cullumber Company. On December 3, Cullumber Company sold $ 621,900 of merchandise on account to Bramble Co., terms 2/10, n/30, FOB destination. Cullumber paid $ 430 for freight charges. The cost of the merchandise sold was $ 365,200. 1. On December 8, Bramble Co. was granted an allowance of $ 23,200 for merchandise purchased on December 3. On December 13, Cullumber Company received the balance due from Bramble Co. 2. 3. Prepare the journal entries to record these transactions on the books of Cullumber Company using a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Crei 1. (To record credit sale) (To record cost of merchandise sold) (To record freight charges) 2. > 3.arrow_forwardHow to calculate the total outstanding receivables?? For example if at the Dec 31 2013, total sales on account and invoiced during the year, the account receivable balance outstanding at the year end, the date when the invoice was issued and the date when the invoice was paid off was given!arrow_forwardAt January 1, 2018, Winding Mountain Flagpoles had Accounts Receivable of $27,000, and Allowance for Bad Debts had a credit balance of $4,000. During the year, Winding Mountain Flagpoles recorded the following: Requirement 2. Post Winding's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. Enter the beginning balances and the journal entries, and then compute the unadjusted balance of each account.arrow_forward

- Also, at what amount will accounts receivable bre reported on Lewis’s December 31 Balance Sheet (what is the Net Realizable Value of its accounts receivables)arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardBased on the data presented in Exercise 5-1, assume that the beginning balances for the customer accounts were zero, except for Tillman Inc., which had a 590 beginning balance. In addition, there were no collections during the period. a. Set up a T account for Accounts Receivable and T accounts for the four accounts needed in the customer ledger. b. Post to the T accounts. c. Determine the balance in the accounts. d. Prepare a listing of the accounts receivable customer balances as of May 31, 20Y3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License