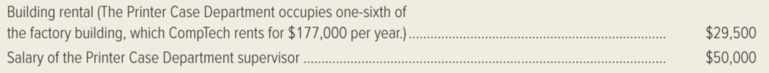

CompTech, Inc. manufactures printers for use with home computing systems. The firm currently manufactures both the electronic components for its printers and the plastic cases in which the devices are enclosed. Jim Cassanitti, the production manager, recently received a proposal from Universal Plastics Corporation to manufacture the cases for CompTech’s printers. If the cases are purchased outside, CompTech will be able to close down its Printer Case Department. To help decide whether to accept the bid from Universal Plastics Corporation, Cassanitti asked CompTech’s controller to prepare an analysis of the costs that would be saved if the Printer Case Department were closed. Included in the controller’s list of annual cost savings were the following items:

In a lunchtime conversation with the controller, Cassanitti learned that CompTech was currently renting space in a warehouse for $39,000. The space is used to store completed printers. If the Printer Case Department were discontinued, the entire storage operation could be moved into the factory building and occupy the space vacated by the closed department. Cassanitti also learned that the supervisor of the Printer Case Department would be retained by CompTech even if the department were closed. The supervisor would be assigned the job of managing the assembly department, whose supervisor recently gave notice of his retirement. All of CompTech’s department supervisors earn the same salary.

Required:

- 1. You have been hired as a consultant by Cassanitti to advise him in his decision. Write a memo to Cassanitti commenting on the costs of space and supervisory salaries included in the controller’s cost analysis. Explain in your memo about the “real” costs of the space occupied by the Printer Case Department and the supervisor’s salary. What types of costs are these?

- 2. Independent of your response to requirement (1), suppose that CompTech’s controller had been approached by his friend Jack Westford, the assistant supervisor of the Printer Case Department.

Westford is worried that he will be laid off if the Printer Case Department is closed down. He has asked his friend to understate the cost savings from closing the department, in order to slant the production manager’s decision toward keeping the department in operation. Comment on the controller’s ethical responsibilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- MSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Co. (MLC) to produce 10,000 units of the module per year for $16 each. The following information pertains to MSI’s production of the control modules: Direct materials $ 9 Direct labor 4 Variable manufacturing overhead 2 Fixed manufacturing overhead 3 Total cost per unit $ 18 MSI has determined that it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSI has no specific use in mind for the space that is currently dedicated to the control module production. Suppose that the MSI space currently used for the modules could be utilized by a new product line that would generate $35,000 in annual profit. Recompute the difference in cost between making and buying under this scenario.arrow_forwardBefore Coronado could give Langston's Landscape Company an answer, the company received a special order from Benson Building & Supply for 13,500 fireplaces. Benson is willing to pay $67 per fireplace but it wants a special design imbedded into the fireplace that increases cost of goods sold by $55,350. The special design also requires the purchase of a part that costs $5,500 and will have no future use for Coronado Company. Benson Building & Supply will pick up the fireplaces so no shipping costs are involved. Due to capacity limitations, Coronado cannot accept both special orders. Which order should be accepted? Document your decision by preparing an incremental analysis for Benson's order. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).)arrow_forwardBefore Coronado could give Langston's Landscape Company an answer, the company received a special order from Benson Building & Supply for 13,500 fireplaces. Benson is willing to pay $67 per fireplace but it wants a special design imbedded into the fireplace that increases cost of goods sold by $55,350. The special design also requires the purchase of a part that costs $5,500 and will have no future use for Coronado Company. Benson Building & Supply will pick up the fireplaces so no shipping costs are involved. Due to capacity limitations, Coronado cannot accept both special orders. Which order should be accepted? Document your decision by preparing an incremental analysis for Benson's order. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Reject order Revenues $ Costs Cost of Goods Sold Operating Expenses Unique part Net Income $ Coronado should accept the order from Accept order $ Net Income Increase (Decrease) $ $ $arrow_forward

- Alderon Enterprises is evaluating a special order it has received for a ceramic fixture to be used in aircraft engines. Alderon has recently been operating at less than full capacity, so the firm's management will accept the order if the price offered exceeds the costs that will be incurred in producing it. You have been asked for advice on how to determine the cost of two raw materials that would be required to produce the order. A) The special order will require 800 gallons of Endor, a highly perishable material that is purchased as needed. Alderon currently has 1,200 gallons of Endor on hand, since the material is used in virtually all of the company's products. The last time endor was purchased, Alderon paid $5.00 per gallon. However, the average price paid for the endor in stock was only $4.75. The market price for the Endor is quite volatile, with the current price at $5.50. If the special order is accepted, Alderon will have to place a new order next week to replace the…arrow_forwardTalladega Company manufactures an electric clock radio. The company expects production of 5,000 units this year. Currently, Talladega produces the clock used in the product. Talladega has received an offer from Daytona, Incoporated to supply the clock. If Talladega discontinues production of the clock, the company will be able to eliminate its product-level costs because no other products along the same line are produced by the company. However, due to its concern for quality, the company will have to inspect each clock. Various costs and items are described below: Required: Select the appropriate classification of the cost item from the drop-down that best describes the item in the context of the described outsourcing decision. A cost varies if the amount of the cost or the incurrence of the cost differs between the two alternatives: continuing to make the clocks or purchasing the clocks from Daytona. Purchase cost of clocks from Daytona Item Income that can be earned from renting the…arrow_forwardClonal Inc., a biotechnology company, developed and patented a diagnostic product called Trouver. Clonal purchased some research equipment to be used exclusively for Trouver and other research equipment to be used on Trouver and subsequent research projects. Clonal defeated a legal challenge to its Trouver patent and began production and marketing operations for the product. Clonal allocated its corporate headquarters’ costs to its research division as a percentage of the division’s salaries. Required: What is the definition of research and of development as defined by GAAP? Briefly indicate the justification for the existing GAAP relating to R&D costs. Explain how Clonal should report the equipment purchased for Trouver on its income statements and balance sheets. Explain how Clonal should report the legal costs incurred in defending Trouver’s patent on its statement of cash flows. Explain how Clonal should classify its corporate headquarters’ costs allocated to the…arrow_forward

- ualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $20.19 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $23.49 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover Plant Annual Budget for Operating Costs Materials $…arrow_forwardQualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $35 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $52 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover PlantAnnual Budget for Operating Costs Materials $ 14,000,000…arrow_forwardTom Belford and Tony Sorrentino own a small business devoted to kitchen and bath granite installations. Recently, building contractors have insisted on up-front bid prices for a house rather than the cost-plus system that Tom and Tony had been using. They worry because natural flaws in the granite make it impossible to tell in advance exactly how much granite will be used on a particular job. In addition, granite can be easily broken, meaning that Tom or Tony could ruin a slab and would need to start over with a new one. Sometimes the improperly cut pieces could be used for smaller installations, sometimes not. All their accounting is done by a local certified public accounting firm headed by Charlene Davenport. Charlene listened to their concerns and suggested that it might be time to implement tighter controls by setting up a standard costing system. Charlene reviewed the invoices pertaining to a number of Tom and Tony's previous jobs to determine the average amount of granite and…arrow_forward

- A local PBS station has decided to produce a TV series on robotic manufacturing. The director of the TV series, Justin Tyme, is currently attempting to analyze some of the projected costs for the series. Tyme intends to take a TV production crew on location to shoot various manufacturing scenes as they occur. If the four-week series is shown in the 8:00-9:00 P.M. prime-time slot, the station will have to cancel a wildlife show that is currently scheduled. Management projects a 10 percent viewing audience for the wildlife show and each 1 percent is expected to bring in donations of $10,000. In contrast, the manufacturing show is expected to be watched by 15 percent of the viewing audience. However, each 1 percent of the viewership will likely generate only $5,000 in donations. If the wildlife show is cancelled, it can be sold to network television for $25,000. Using cost terminology comment on each of the financial amounts mentioned in the scenario above. What are the relative…arrow_forwardUnited Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion. The company's CFO hired a third-party consulting firm to estimate the cost per ton of processing the cardboard. The consulting firm's cost estimate for processing the cardboard was significantly higher than what the CFO had been using in his financial model. Based on the information given, determine which of the statements is correct. O When the CFO adjusts the cost per ton of processing the cardboard, the project's NPV will decrease. O When the CFO adjusts the cost per ton of processing the cardboard, the project's NPV will increase. Which of the following is measured by its effect on the firm's beta coefficient? O Stand-alone risk Beta, or market, risk Corporate, or within-firm, riskarrow_forward“That old equipment for producing carburetors is worn out,” said Bill Seebach, president of Hondrich Company. “We need to make a decision quickly.” The company is trying to decide whether it should rent new equipment and continue to make its carburetors internally or whether it should discontinue production of its carburetors and purchase them from an outside supplier. The alternatives follow: Alternative 1: Rent new equipment for producing the carburetors for $189,000 per year. Alternative 2: Purchase carburetors from an outside supplier for $20.25 each. Hondrich Company’s costs per unit of producing the carburetors internally (with the old equipment) are given below. These costs are based on a current activity level of 30,000 units per year: Direct materials $ 5.70 Direct labour 8.00 Variable overhead 2.40 Fixed overhead ($3.15 supervision, $1.80 depreciation, and $4.00 general company overhead) 8.95 Total cost per…arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning