Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 44P

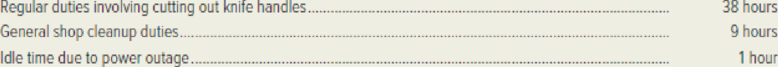

Highlander Cutlery manufactures kitchen knives. One of the employees, whose job is to cut out wooden knife handles, worked 48 hours during a week in January. The employee earns $12 per hour for a 40-hour week, and overtime is paid after 40 hours. For additional hours, the employee is paid an overtime rate of $18 per hour. The employee’s time was spent as follows:

Required:

- 1. Calculate the total cost of the employee’s wages during the week described above.

- 2. Determine the portion of this cost to be classified in each of the following categories:

- a. Direct labor

- b. Manufacturing

overhead (idle time) - c. Manufacturing overhead (overtime premium)

- d. Manufacturing overhead (indirect labor)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Highlander Cutlery manufactures kitchen knives. One of the employees, whose job is to cut out wooden knife handles, worked 48 hours during a week in January. The employee earns $12 per hour for a 40-hour week, and overtime is paid after 40 hours. For additional hours, the employee is paid an overtime rate of $18 per hour. The employee’s time was spent as follows:

Regular duties involving cutting out knife handles..................................38 hoursGeneral shop cleanup duties..............................................................................9 hoursIdle time due to power outage..........................................................................1 hour

2. Total cost of wages: $624

Required:1. Calculate the total cost of the employee’s wages during the week described above.2. Determine the portion of this cost to be classified in each of the following categories:a. Direct laborb. Manufacturing overhead (idle time)c. Manufacturing overhead (overtime premium)d.…

A foundry employee worked a normal 40-hour shift, but four hours were idle due to a small fire in the plant. The employee earns $18 per hour.Required:1. Calculate the employee’s total compensation for the week.2. How much of this compensation is a direct-labor cost? How much is overhead?

Calculate the total cost of the employee's wages during the week described above.

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 2 - Distinguish between product costs and period...Ch. 2 - Why are product costs also called inventoriable...Ch. 2 - What is the most important difference between a...Ch. 2 - List several product costs incurred in the...Ch. 2 - Prob. 5RQCh. 2 - Why is the cost of idle time treated as...Ch. 2 - Explain why an overtime premium is included in...Ch. 2 - Prob. 8RQCh. 2 - Give examples to illustrate how the city of Tampa...Ch. 2 - Distinguish between fixed costs and variable...

Ch. 2 - How does the fixed cost per unit change as the...Ch. 2 - Prob. 12RQCh. 2 - Distinguish between volume-based and...Ch. 2 - Would each of the following characteristics be a...Ch. 2 - List three direct costs of the food and beverage...Ch. 2 - List three costs that are likely to be...Ch. 2 - Which of the following costs are likely to be...Ch. 2 - Distinguish between out-of-pocket costs and...Ch. 2 - Define the terms sunk cost and differential cost.Ch. 2 - Distinguish between marginal and average costs.Ch. 2 - Prob. 21RQCh. 2 - Two years ago the manager of a large department...Ch. 2 - Indicate whether each of the following costs is a...Ch. 2 - For each case below, find the missing amount.Ch. 2 - A foundry employee worked a normal 40-hour shift,...Ch. 2 - A loom operator in a textiles factory earns 16 per...Ch. 2 - Consider the following costs that were incurred...Ch. 2 - Alexandria Aluminum Company, a manufacturer of...Ch. 2 - Prob. 30ECh. 2 - A hotel pays the phone company 100 per month plus...Ch. 2 - Prob. 32ECh. 2 - Orbital Communications, Inc. manufactures...Ch. 2 - The state Department of Education owns a computer...Ch. 2 - Prob. 35ECh. 2 - List the costs that would likely be included in...Ch. 2 - Consider the following cost items: 1. Salaries of...Ch. 2 - The following selected information was extracted...Ch. 2 - Prob. 39PCh. 2 - Mason Corporation began operations at the...Ch. 2 - Determine the missing amounts in each of the...Ch. 2 - The following cost data for the year just ended...Ch. 2 - The following data refer to San Fernando Fashions...Ch. 2 - Highlander Cutlery manufactures kitchen knives....Ch. 2 - Cape Cod Shirt Shop manufactures T-shirts and...Ch. 2 - Heartland Airways operates commuter flights in...Ch. 2 - San Diego Sheet Metal, Inc. incurs a variable cost...Ch. 2 - Hightide Upholstery Company manufactures a special...Ch. 2 - For each of the following costs, indicate whether...Ch. 2 - Indicate for each of the following costs whether...Ch. 2 - Water Technology, Inc. incurred the following...Ch. 2 - The following terms are used to describe various...Ch. 2 - Several costs incurred by Bayview Hotel and...Ch. 2 - Refer to Exhibit 23, and answer the following...Ch. 2 - Roberta Coy makes custom mooring covers for boats....Ch. 2 - The Department of Natural Resources is responsible...Ch. 2 - Prob. 57PCh. 2 - Prob. 58PCh. 2 - CompTech, Inc. manufactures printers for use with...Ch. 2 - You just started a summer internship with the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate was 14.00 for the first 40 hours, and his pay rate was 11.80 for the other 7 hours. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay__________ b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be________arrow_forwardBruce Eaton is paid 10 cents per unit under the piece-rate system. During one week, Eaton worked 46 hours and produced 5,520 units. Compute the following: 1. The piecework earnings ________ 2. The regular hourly rate ________ 3. The overtime hourly rate ________ 4. The overtime earnings ________ 5. The total earnings ________arrow_forwardDetermine the gross pay for each employee listed below. a. Clay Jones is paid time-and-a-half for all hours over 40. He worked 45 hours during the week. His regular pay rate is 25 per hour. b. Mary James worked 48 hours during the week. She is entitled to time-and-a-half for all hours in excess of 40 per week. Her regular pay rate is 20 per hour. c. Lori Terry is paid a commission of 10 percent of her sales, which amounted to 23,650. d. Nicole Smiths yearly salary is 95,500. During the week, she worked 46 hours, and she is entitled to time-and-a-half for all hours over 40.arrow_forward

- Huron Manufacturing Co. uses a job order cost system to cost its products. It recently signed a new contract with the union that calls for time-and-a-half for all work over 40 hours a week and double-time for Saturday and Sunday. Also, a bonus of 1% of the employees earnings for the year is to be paid to the employees at the end of the fiscal year. The controller, the plant manager, and the sales manager disagree as to how the overtime pay and the bonus should be allocated. An examination of the first months payroll under the new union contract provisions shows the following: Analysis of the supporting payroll documents revealed the following: a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime. b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers. The controller believes that the overtime premiums and the bonus should be charged to factory overhead and spread over all production of the accounting period, regardless of when the jobs were completed. The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense. The sales manager states that the overtime premiums and bonus are not factory costs chargeable to regular production but are costs created from administrative policies and, therefore, should be charged only to administrative expense. Required: 1. Evaluate each positionthe controllers, the plant managers, and the sales managers. If you disagree with all of the positions taken, present your view of the appropriate allocation. 2. Prepare the journal entries to illustrate the position you support, including the accrual for the bonus.arrow_forwardA loom operator in a textiles factory earns $16 per hour. By contract, the employee earns $24 (time and a half) for overtime hours. The operator worked 45 hours during the first week of May, and overtime is paid after the usual 40 hours.Required:1. Compute the loom operator’s compensation for the week.2. Calculate the employee’s total overtime premium for the week.3. How much of the employee’s total compensation for the week is direct-labor cost? How much is overhead?arrow_forwardWhat is the amount to be charged to Manufacturing Overhead Control account? Four factory workers and a supervisor make a team in the Machining Department. The supervisor earns P100 per hour, and the combined hourly charge of the four workers is P320. Each employee is entitled to a 2-week paid vacation and a bonus equal to 4 week's wages each year. Vacation pay and bonuses are treated as indirect costs and are accrued over the 50 week work year. A provision in the union contract does not allow these employees to work in excess of 40 hours per week.arrow_forward

- Mr. Koala, a factory worker is paid $150 per hour for a regular work of 40 hours. During the week, Mr. Koala worked 45 hours and earned time and a half for overtime hours. a. If overtime premium is charged to the jobs worked during the overtime hours, how much is the amount charged to Work in Process account? b. If the overtime premium is not charged to specific jobs, How much is the amount charged to Factory overhead?arrow_forwardMarrell is employed on the assembly line of a manufacturing company where she assembles a component part of one of teh company's products. She is paid P16 per hour for regular time and time and a half for all work in excess of 40 hours per week. Marrell works 50 hours in a given week but is idle for 4 hours during the week to equip breakdowns. The allocation of Marrell's wages for the week for direct labor is;arrow_forwardKipley Company is a small manufacturing firm located in Pittsburgh, Pennsylvania. The company has a workforce of both hourly and salaried employees. Each employee is paid for hours actually worked during each week, with the time worked being recorded in quarter-hour increments. The standard workweek consists of 40 hours, with all employees being paid time and one-half for any hours worked beyond the 40 regular hours. Requirement: Record the regular hours and the overtime hours worked for each employee, using the time clerk's report as your reference. Complete the Regular Earnings columns (Rate per Hour and Amount) for hourly employees. For only hourly employees that worked overtime, complete the Overtime Earnings columns (Rate per Hour and Amount).For salaried workers, complete the Regular Earnings column and show the hourly overtime rate and earnings only if overtime was worked. Record the Total Earnings for each employee by adding the Regular Earnings and the Overtime Earnings.…arrow_forward

- Determine the portion of this cost to be classi ed in each of the following categories.Estimate the values of X1, X2, X3, X4 and X5.arrow_forwardDoreen George, a stocker at Dender Factory Outlet, is paid on an hourly basis and earns $10 hours, During a one-week period, she worked 39 hours and 30 minutes. How much would her gross pay be under the quarter-hour system?arrow_forwardJon Stone is paid $20 an hour for an 8-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, 5 days a week. Overtime premium is charged to Factory Overhead. Required: Using the labor-time record below: a. Compute Jerrod's total earnings for the week. b. Present the journal entry to distribute Jerrod's total earnings. Sunday Monday Tuesday Wednesday Thursday Friday Saturday ТОTAL Job F2 3 5 4 31 Job M1 1 3 6 14 Admin 1 3 6 TOTAL 8. 8. 8 10 51arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License