Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 38P

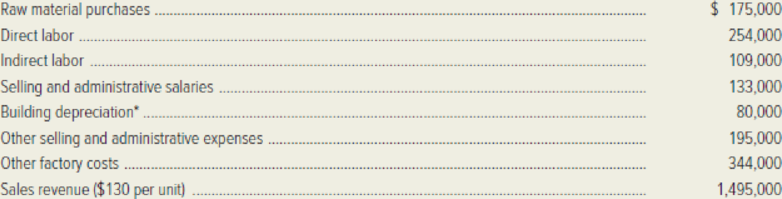

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

*Seventy-five percent of the company’s building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions.

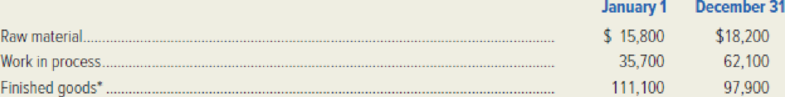

Inventory data:

*The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Required:

- 1. Calculate Lone Oak’s manufacturing overhead for the year.

- 2. Calculate Lone Oak’s cost of goods manufactured.

- 3. Compute the company’s cost of goods sold.

- 4. Determine net income for 20x1, assuming a 30% income tax rate.

- 5. Determine the number of completed units manufactured during the year.

- 6. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: indirect labor is $115,000 and other

factory costs amount to $516,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

[The following information applies to the questions displayed below.]

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

Raw material purchases

Direct labor

Indirect labor

Selling and administrative salaries

Building depreciation*

Other selling and administrative expenses

Other factory costs

Sales revenue ($130 per unit)

*Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used

for selling and administrative functions.

Inventory data:

January 1

$ 15,800

35,700

111,100

December 31

$ 18,200

62,100

97,900

Cost of goods sold

175,000

254,000

109,000

133,000

80,000

195,000

344,000

1,495,000

3. Compute the company's cost of goods sold.

$

Raw material

Work in process

Finished goods*

*The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

The following data are taken from the

general ledger and other records of

Du-sik Manufacturing on January 31,

the end of the first month of

operations in the current fiscal year:

Sales - 75,000; Materials inventory

(January 1) - 25,000; Work in process

inventory (January 1) - 24,000;

Finished goods inventory (January 1) -

32,000: Materials Purchased - 21,000:

Direct labor cost - 18,000; Factory

overhead (including 1,000 of indirect

materials used and 3,000 of indirect

labor cost) - 12,000; Selling and

Administrative expenses - 10,000;

Inventories at January 31: Materials -

22,000; Work in Process - 20,000;

Finished Goods - 30,000. What is the

amount of cost of goods

manufactured? *

Wyandotte Company provided the following information for the last calendar year:

Beginning inventory:Direct materials $25,900Work in process 44,700Ending inventory:Direct materials $18,000Work in process 22,700

During the year, direct materials purchases amounted to $256,900, direct labor cost was$176,000, and overhead cost was $308,400. There were 40,000 units produced.Required:1. Calculate the total cost of direct materials used in production.2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost.3. Of the unit manufacturing cost calculated in Requirement 2, $6.62 is direct materials and$7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 2 - Distinguish between product costs and period...Ch. 2 - Why are product costs also called inventoriable...Ch. 2 - What is the most important difference between a...Ch. 2 - List several product costs incurred in the...Ch. 2 - Prob. 5RQCh. 2 - Why is the cost of idle time treated as...Ch. 2 - Explain why an overtime premium is included in...Ch. 2 - Prob. 8RQCh. 2 - Give examples to illustrate how the city of Tampa...Ch. 2 - Distinguish between fixed costs and variable...

Ch. 2 - How does the fixed cost per unit change as the...Ch. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - Would each of the following characteristics be a...Ch. 2 - List three direct costs of the food and beverage...Ch. 2 - List three costs that are likely to be...Ch. 2 - Which of the following costs are likely to be...Ch. 2 - Distinguish between out-of-pocket costs and...Ch. 2 - Define the terms sunk cost and differential cost.Ch. 2 - Distinguish between marginal and average costs.Ch. 2 - Prob. 21RQCh. 2 - Two years ago the manager of a large department...Ch. 2 - Indicate whether each of the following costs is a...Ch. 2 - For each case below, find the missing amount.Ch. 2 - A foundry employee worked a normal 40-hour shift,...Ch. 2 - A loom operator in a textiles factory earns 16 per...Ch. 2 - Consider the following costs that were incurred...Ch. 2 - Alexandria Aluminum Company, a manufacturer of...Ch. 2 - Prob. 30ECh. 2 - A hotel pays the phone company 100 per month plus...Ch. 2 - Prob. 32ECh. 2 - Orbital Communications, Inc. manufactures...Ch. 2 - The state Department of Education owns a computer...Ch. 2 - Prob. 35ECh. 2 - List the costs that would likely be included in...Ch. 2 - Consider the following cost items: 1. Salaries of...Ch. 2 - The following selected information was extracted...Ch. 2 - Prob. 39PCh. 2 - Mason Corporation began operations at the...Ch. 2 - Determine the missing amounts in each of the...Ch. 2 - The following cost data for the year just ended...Ch. 2 - The following data refer to San Fernando Fashions...Ch. 2 - Highlander Cutlery manufactures kitchen knives....Ch. 2 - Cape Cod Shirt Shop manufactures T-shirts and...Ch. 2 - Heartland Airways operates commuter flights in...Ch. 2 - San Diego Sheet Metal, Inc. incurs a variable cost...Ch. 2 - Hightide Upholstery Company manufactures a special...Ch. 2 - For each of the following costs, indicate whether...Ch. 2 - Indicate for each of the following costs whether...Ch. 2 - Water Technology, Inc. incurred the following...Ch. 2 - The following terms are used to describe various...Ch. 2 - Several costs incurred by Bayview Hotel and...Ch. 2 - Refer to Exhibit 23, and answer the following...Ch. 2 - Roberta Coy makes custom mooring covers for boats....Ch. 2 - The Department of Natural Resources is responsible...Ch. 2 - Prob. 57PCh. 2 - Prob. 58PCh. 2 - CompTech, Inc. manufactures printers for use with...Ch. 2 - You just started a summer internship with the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forwardAt the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forward

- The following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardAn examination of Buckhorn Fabricators records reveals the following transactions: a. On December 31, the physical inventory of raw material was 9,950 gallons. The book quantity, using the weighted average method, was 10,000 gal @ .52 per gal. b. Production returned to the storeroom materials that cost 775. c. Materials valued at 770 were charged to Factory Overhead (Repairs and Maintenance), but should have been charged to Work in Process. d. Defective material, purchased on account, was returned to the vendor. The material returned cost 234. e. Goods sold to a customer, on account, for 5,000 (cost 2,500) were returned because of a misunderstanding of the quantity ordered. The customer stated that the goods returned were in excess of the quantity needed. f. Materials requisitioned totaled 22,300, of which 2,100 represented supplies used. g. Materials purchased on account totaled 25,500. Freight on the materials purchased was 185. h. Direct materials returned to the storeroom amounted to 950. i. Scrap materials sent to the storeroom were valued at an estimated selling price of 685 and treated as a reduction in the cost of all jobs worked on during the period. j. Spoiled work sent to the storeroom valued at a sales price of 60 had production costs of 200 already charged to it. The cost of the spoilage is to be charged to the specific job worked on during the period. k. The scrap materials in (i) were sold for 685 cash. Required: Record the entries for each transaction.arrow_forwardMarzons records show raw materials Inventory had a beginning balance of $200 and an ending balance of $300. If the cost of materials used during the month was $900, what were the purchases made during the month?arrow_forward

- During the year, a company purchased raw materials of $77,321 and incurred direct labor costs of $125,900. Overhead Is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Masonrys records show the raw materials inventory had purchases of $1,000and an ending raw materials inventory balance of $200. If the cost of materials used during the month was $900, what was the beginning inventory?arrow_forwardCost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forwardRexar had 1,000 units in beginning inventory before starting 9.500 units and completing 8,000 units. The beginning work in process inventory consisted of $5,000 in materials and $8,500 in conversion costs before $16,000 of materials and $18,500 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License