Concept explainers

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5. Download the workbook containing this form from Connect, where you will also find instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

2. Change the total fixed

Selling price: The cost incurred by selling the product in the market is known as the selling price.

Determine the missing figures in the sheet. After finding the missing figures determine the selling price of Job 408 by replacing the current data with the data given in the question.

Answer to Problem 2AE

Solution: The selling price of Job 408 using current data is $4348.75 and the selling price of Job 408 after replacing the current data with the given data is $2800.

Explanation of Solution

This calculation is done in the workbook and it is explained below,

Part -1- The missing figures in the sheet is determined here.

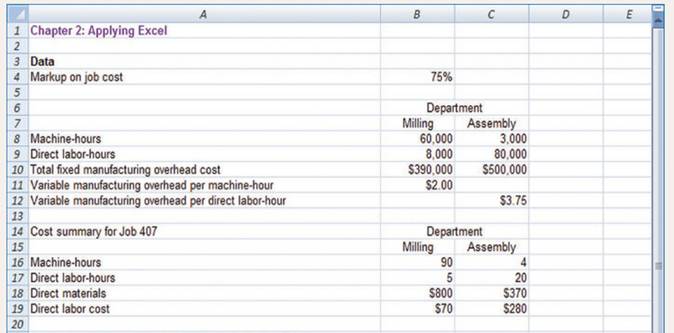

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $ 3.75 |

| Cost Summary for job 407 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 90 | 4 |

| 7 | Direct Labour Hours | 5 | 20 |

| 8 | Direct Materials | $800.00 | $370.00 |

| 9 | Direct Labour cost | $70.00 | $280.00 |

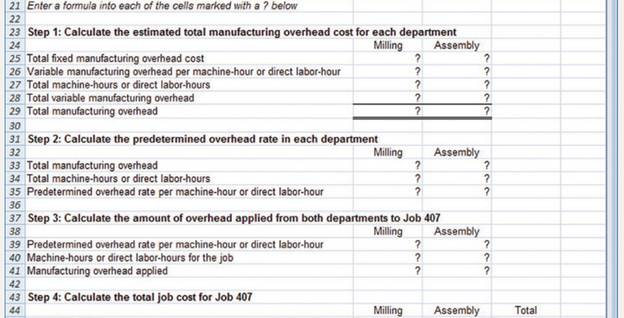

| Enter a formula into each of the cells marked with? below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,90,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead (10 + 13) | $5,10,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $5,10,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $8.50 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 407 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $8.50 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 90 | 20 |

| 20 | Manufacturing overhead applied (18 x 19) | $765.00 | $200.00 |

| Step 4: Calculate the total job cost for Job 407 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $800.00 | $370.00 |

| 22 | Direct Labour cost (given) | $70.00 | $280.00 |

| 23 | Manufacturing overhead applied (20) | $765.00 | $200.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,635.00 | $850.00 |

| Total cost of Job 407 (Milling + Assembly) | $2,485.00 | ||

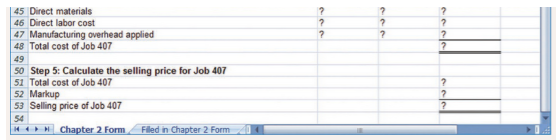

| Step 5: Calculate the selling price for Job 407 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,635.00 | $850.00 |

| 26 | Mark-up (24 x 75%) | $1,226.25 | $637.50 |

| 27 | Selling price of Job 407 (25 + 26) | $2,861.25 | $1,487.50 |

| Total Selling Price (Milling + Assembly) | $4,348.75 | ||

Part 2 - The selling price of Job 408 by replacing the current data with data given

| Chapter 2: Applying Excel | |||

| Data | |||

| Mark-up on job cost | 75% | ||

| Department | |||

| Milling | Assembly | ||

| 1 | Machine hours | 60000 | 3000 |

| 2 | Direct Labour Hours | 8000 | 80000 |

| 3 | Total fixed manufacturing overhead cost | $3,90,000.00 | $5,00,000.00 |

| 4 | Variable manufacturing overhead per machine hour | $2.00 | $ - |

| 5 | Variable manufacturing overhead per direct labour hour | $ - | $3.75 |

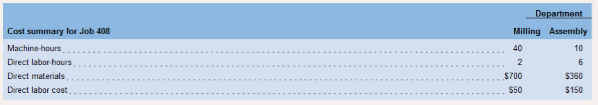

| Cost Summary for job 408 | Department | ||

| Milling | Assembly | ||

| 6 | Machine hours | 40 | 10 |

| 7 | Direct Labour Hours | 2 | 6 |

| 8 | Direct Materials | $700.00 | $360.00 |

| 9 | Direct Labour cost | $50.00 | $150.00 |

| Enter a formula into each of the cells marked with? Below | |||

| Step 1: Calculate the estimated total manufacturing overhead cost for each department | |||

| Milling | Assembly | ||

| 10 | Total fixed manufacturing overhead (given) | $3,00,000.00 | $5,00,000.00 |

| 11 | Variable manufacturing overhead per machine hour or direct labour hour (given) | $2.00 | $3.75 |

| 12 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 13 | Total Variable manufacturing overhead (11 x 12) | $1,20,000.00 | $3,00,000.00 |

| 14 | Total manufacturing overhead (10 + 13) | $4,20,000.00 | $8,00,000.00 |

| Step 2: Calculate the pre-determined overhead rate in each department | |||

| Milling | Assembly | ||

| 15 | Total manufacturing overhead (14) | $4,20,000.00 | $8,00,000.00 |

| 16 | Total machine hours or direct labour hours (given) | 60000 | 80000 |

| 17 | Pre-determined overhead rate per machine hour or direct labour hour (15 divided by 16) | $7.00 | $10.00 |

| Step 3: Calculate the amount of overhead applied to both departments to Job 408 | |||

| Milling | Assembly | ||

| 18 | Pre-determined overhead rate per machine hour or direct labour hour (17) | $7.00 | $10.00 |

| 19 | Machine hours or direct labour hours for the job (given) | 40 | 6 |

| 20 | Manufacturing overhead applied (18 x 19) | $280.00 | $60.00 |

| Step 4: Calculate the total job cost for Job 408 | |||

| Milling | Assembly | ||

| 21 | Direct Materials (given) | $700.00 | $360.00 |

| 22 | Direct Labour cost (given) | $50.00 | $150.00 |

| 23 | Manufacturing overhead applied (20) | $280.00 | $60.00 |

| 24 | Total cost of Job 407 (21 + 22 + 23) | $1,030.00 | $570.00 |

| Total cost of Job 407 (Milling + Assembly) | $1,600.00 | ||

| Step 5: Calculate the selling price for Job 408 | |||

| Milling | Assembly | ||

| 25 | Total cost of Job 407 ( 24) | $1,030.00 | $570.00 |

| 26 | Mark-up (24 x 75%) | $772.50 | $427.50 |

| 27 | Selling price of Job 407 (25 + 26 ) | $1,802.50 | $997.50 |

| 28 | Total Selling Price of Job 408 (Milling + Assembly) | $2,800.00 | |

Thus, the selling price of Job 408 after replacing the current data with the given data is $2800.

Want to see more full solutions like this?

Chapter 2 Solutions

EBK INTRODUCTION TO MANAGERIAL ACCOUNTI

- Hazelnut Corporation manufactures lawn ornaments. It currently has two product lines, the basic and the luxury. Hazelnut has a total of $143,484 in overhead. The company has identified the following information about its overhead activity pools and the two product lines: Quantity or Amount Consumed by Basic Activity Pools Materials handling Quality control Machine maintenance Cost Driver Number of moves Number of inspections Number of machine hours Required 1 Complete this question by entering your answers in the tabs below. Basic Model Luxury Model Required 2 Required 3 Required 4 Required: 1. Suppose Hazelnut used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the activity rates for each activity pool in Hazelnut's ABC system. 3. Calculate the amount of overhead that Hazelnut will assign to the basic line if it uses an ABC system. 4. Determine the amount of overhead Hazelnut will assign…arrow_forwardBumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forward

- Build a spreadsheet: Construct and excel spreadsheet to solve all of the preceding requirements. Show how both cost schedules and the income statement will change if raw material purchases amounted to $190,000 and indirect labor was $20,000.arrow_forwardThe cost of direct materials transferred into the Rolling Department of Kraus Company is $3,087,000. The conversion cost for the period in the Rolling Department is $124,600. The total equivalent units for direct materials and conversion are 4,200 tons and 890 tons, respectively. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Determine the direct materials and conversion costs per equivalent unit. Round your answers to the nearest dollar. Direct materials cost per equivalent unit: $fill in the blank 2 per ton Conversion cost per equivalent unit: $fill in the blank 3 per tonarrow_forwardBob Randall, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs), studying manufacturing capabilities, improving manufacturing process, training, employees, and designing tools. The resources costs (from the general ledger) and the times to perform one unit of each activity are provided below: Resource Cost Activities Unit Time Driver Salaries $500,000 Creating BOMs 0.5 hr. No. of BOMs Equipment 100,000 Designing Tools 5.4 hr. No. of tools designs Supplies 30,000 Improving processes 1.0 hr. Process improvement hrs Total $630,000 Training employees 2.0 hr. No. of training sessions Studying capabilities 1.0 hr. Study hrs. Total machine and labor hours (at practical capacity):…arrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $246,250 in the Molding department and $206,250 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Number of Molding Department Units Hours per Unit Total Hours Trimming Department Hours per Unit Total Hours Part Z Part X Totals 3,000 2.0 MH per unit 4,000 2.5 MH per unit 6,000 MH 10,000 MH 16,000 MH 3 DLH per unit 9,000 DLH 4 DLH per unit 16,000 DLH 25,000 DLH Exercise 17-7 (Algo) Plantwide overhead rate LO P1 Required: 1. Compute the plantwide overhead rate using direct labor hours as the allocation base. 2. Determine the overhead cost per unit for each part using the…arrow_forwardUSE THIS INFORMATION FOR THE NEXT FEW QUESTIONS: We find the following information for the Welding Department WIP Account of BNSF line. After the Welding Department, the costs will flow into the next WIP department which is Track Installation. All materials are placed in process at the beginning of the production cycle. Work In Process – Welding Beg. Bal: 9,000 Units, 40% complete Direct Materials: 40,000 units @ $6.80 Direct Labor Factory Overhead Bal. ?? Units, 30% Complete $72.360 $272,000 $80,000 To Track WIP Department, 41,500 Units $?? $40,450 $??? 16: Calculate the Whole Units (Step 1 as we learned it). 17: Calculate the Equivalent Units with respect to Material and Conversion Costs Materials: Conversion: 18: Calculate the Cost Per Equivalent Unit for Materials and for Conversion Materials: Conversion:arrow_forwardUSE THIS INFORMATION FOR THE NEXT FEW QUESTIONS: We find the following information for the Welding Department WIP Account of BNSF line. After the Welding Department, the costs will flow into the next WIP department which is Track Installation. All materials are placed in process at the beginning of the production cycle. Work In Process – Welding Beg. Bal: 9,000 Units, 40% complete Direct Materials: 40,000 units @ $6.80 Direct Labor Factory Overhead Bal. ?? Units, 30% Complete $72.360 $272,000 $80,000 $40,450 To Track WIP Department, 41,500 Units $?? $???arrow_forward

- Please show your computations using good accounting form through excel. Thank you! Problem: By products In Department III of SAMCIS Company, a portion of the materials (a by-product) is removed further processed and sold. The Company uses the reversal cost method to account for the by-product. Data for June include: Amount of by-product removed is 2,000 units; Estimated sales price of by-product after processing further is P1.20/unit. Estimated processing cost after separation is P0.30 per unit and estimated selling expenses is 10% of the sales price. The estimated profit margin is 5% of the sales price. What is the gain (loss) on sale of the by-product if all of the units are sold at P1.50?arrow_forwardUse the following information for the Exercises below. (Algo) Skip to question [The following information applies to the questions displayed below.]Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $248,750 in the Molding department and $208,750 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Number of Units Molding Department Trimming Department Hours per Unit Total Hours Hours per Unit Total Hours Part Z 3,000 2.0 MH per unit 6,000 MH 3 DLH per unit 9,000 DLH Part X 4,000 2.5 MH per unit 10,000 MH 4 DLH per unit 16,000 DLH Totals 16,000 MH 25,000 DLH Exercise 17-8 (Algo) Departmental overhead rates LO P2 Required:1. Compute a departmental overhead rate for the Molding department based on machine hours and a departmental overhead rate…arrow_forwardLowry Music manufacturers music books. They use an ABC costing system. The relevant cost information is provided below: Activity Cost Driver Estimated cost pool Estimated cost driver Printing DL hours $310,000 20,000 DL hours Finishing machine hours $260,000 13,000 machine hours Movement # moves $80,000 10 movements Total The actual cost driver information is as follows: 21,000 machine hours 12,500 DL hours 5 moves Calculate the total applied manufacturing overhead costs. Please provide your answer to the nearest whole dollar. Do not include the "$" sign. incorrect answer: 615500arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College