Concept explainers

Preparing

Floyds Auto Repair Shop uses a job order Cost System to track the cost of each repair. Floyd's applies its garage or shop

* Because an auto shop does not manufacture a product, the overhead cost includes all of the indirect costs that are incurred in the garage or Shop that cannot be traced to a specific repair job.

The following transactions occurred during the most recent month:

(a) Purchased raw (parts and supplies) on account $16,000.

(b) Used $14,000 in raw materials (parts and supplies). Of this, $10,000 was for major parts that were traceable to individual repair jobs, and the remainder was for incidental supplies such as lubricants, rags, fuel. and so on.

(c) Recorded a total of $12,000 in direct cost (for 500 hours) that are not yet paid.

(d) Applied overhead to repair jobs at a rate of $20 per direct hour.

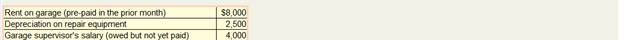

(e) Recorded the following actual overhead costs:

(f) Completed repair

Prepare journal entries for transactions (a) through (f) using the account names shown and other appropriate accounts such as Cash, payables,

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- provide correct answer mearrow_forwardgeneral accountingarrow_forwardE3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method) [LO 3-2] Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of the manufacturing process. Units . • Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion. 14,600 units started during the period. Ending Inventory of 4,200 units that are 14 percent complete for conversion. Manufacturing Costs Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs). Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied overhead). Assume the company uses Weighted-Average Method. Required: 1. Calculate the number of equivalent units of production for materials and conversion for March. 2. Calculate the cost per equivalent unit for materials and conversion for March. 3. Determine the…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,