Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 21SP

Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbook’s Web site.

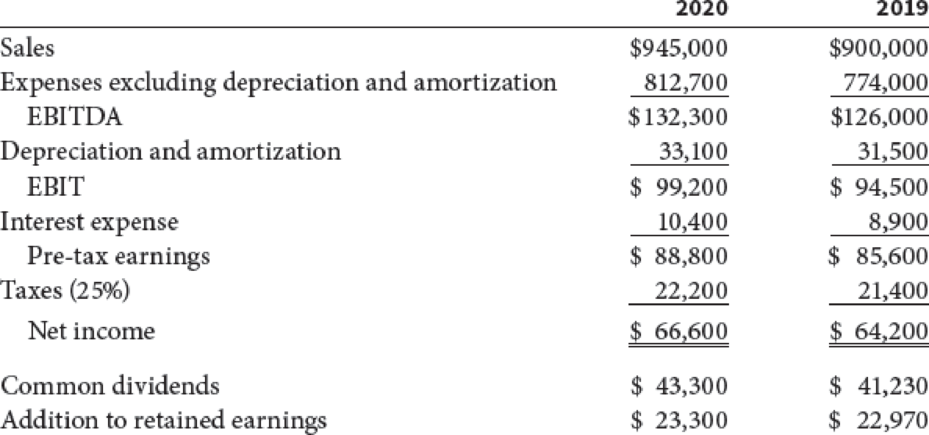

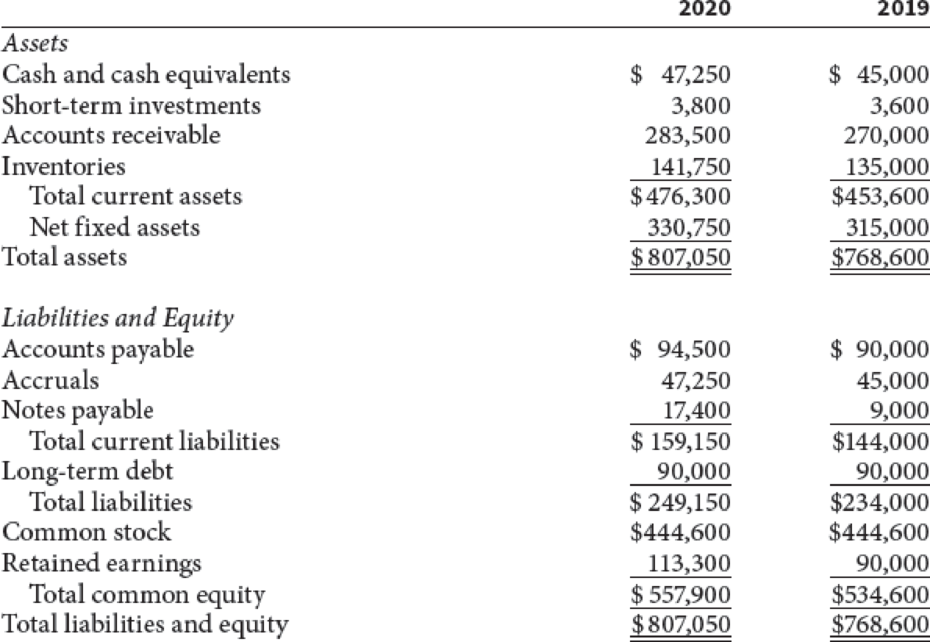

- a. Using the financial statements shown here for Lan & Chen Technologies, calculate net operating working capital, total

net operating capital, net operating profit after taxes,free cash flow , andreturn on invested capital for 2020. The federal-plus-state tax rate is 25%. - b. Assume there were 15 million shares outstanding at the end of 2019, the year-end closing stock price was $65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2020.

Lan & Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars)

Lan & Chen Technologies: December 31 Balance Sheets (Thousands of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Start with the partial model in Ch07 P26 Build a Model.xlsx on the textbook’s Web site. Traver-Dunlap Corporation has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million, and its total net operating capital is $970 million. The following table shows estimates of the forecasted growth rates, operating profitability ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third year. Use this information to answer the following questions:a. Use the data to forecast sales, net operating profit after taxes (NOPAT), total net operating capital (OpCap), free cash flow (FCF), growth rate in FCF, and return on invested capital (ROIC) for the next 3 years. What is the FCF growth rate for Year 3, and how does it compare with the growth rate in sales? What is the ROIC for Year 3 and how does it compare with the 15% WACC?b. What is the value of operations at Year 3, Vop,3? What is the current…

Use your own words to answer the following questions:

Write the formula for the P/E ratio and what it measures?

Should you invest in a company with high P/E or low P/E?

A company has the following items for the fiscal year 2020:

Revenue = 10 million

Net income = 4 million

The company has 2 million shares of stock

Stock price per share = $70

Calculate the company’s earnings per share and P/E ratio

Start with the partial model in Ch07 P26 Build a Model.xlsx on the textbook’s Web site. Traver-Dunlap Corporation has a 15% weighted average cost of capital (WACC). Its most recent sales were $980 million, and its total net operating capital is $970 million. The following table shows estimates of the forecasted growth rates, operating profitability ratios, and capital requirement ratios for the next three years. All of these ratios are expected to remain constant after the third year. Use this information to answer the following questions:

Estimated Base Case Data for Traver-Dunlap CorporationForecast Year1 2 3Annual sales growth rate 20% 6% 6%Operating profitability (NOPAT/Sales) 12% 10% 10%Capital requirement (OpCap/Sales) 80% 80% 80%Tax rate 35% 35% 35%

Return the growth rates to the original values. Now suppose that the capital requirement ratio can be decreased to 60% for all three years and thereafter. What is the new value of operations? Did it go up or down relative to the…

Chapter 2 Solutions

Financial Management: Theory & Practice

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Athenian Venues Inc. just reported the following selected portion of its financial statements for the end of 2020. Your assistant has already calculated the 2020 end-of-year net operating working capital (NOWC) from the full set of financial statements (not shown here), which is 13 million. The total net operating capital for 2019 was 50 million. What was the 2020 net investment in operating capital? Athenian Venues Inc.: Selected Balance Sheet Information as of December 31 (Millions of Dollars)arrow_forwardQ2: For example, a firm's financial data shows the following: Equity = $8,000 Debt = $2,000 Re = 12.5% Rd = 6% Tax rate = 30% Calculate the WACC, enter the values into the equation and solve:arrow_forwardTechnology Inc. expects to have the following data during the coming year. What is Hernandez's expected ROE? Also, discuss the importance of the ROE to a company and to shareholders. $200,000 Interest rate 65% Tax rate Assets 8% D/A 40% EBIT $25,000arrow_forward

- Net profit of Lily Fashion House Ltd in the current year is $2,575, 000. The company is planningto launch a project that will requires an investment of $745 000 next year. Today the company’sstock has market value of $22/share. Lily Fashion House has the current capital structure of 60%in equity and 40% in debt. Required: b. How much dividend Lily Fashion House can pay its shareholders this year and what isdividend payout ratio of the company. Assume the Residual Dividend Payout Policyapplies?arrow_forwardMunich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $74 a share. The before- tax cost of debt is 5% and the tax rate is 34%. The target capital structure consists of 50% debt and 50% equity. Training Attempt 1/5 for Part 1 What is the company's weighted average cost of capital?arrow_forwardPlz complete using excel showing formula of work !! The common stock of ABX, Inc. has a beta of 0.90. The Treasury bill rate is 4% and the market risk premium is estimated at 8%. The debt-to-equity ratio of the company is 0.35, the cost of debt is 6%, and the tax rate is 21%. The company is considering a project that will result in initial after-tax cash savings of $5 million at the end of the first year, and these savings will grow at a rate of 4% per year indefinitely. The project is less risky than the usual project the firm undertakes. Management uses the subjective approach and applies an adjustment factor of -1% to the overall cost of capital for similar projects. If the project requires an initial investment of $20 million, what is the NPV?arrow_forward

- I attached the image in this question in which you can see 2 years Financial Progress Of company Assume the unlevered beta of the company is 1.5 for all 2 years Tax Rate 35% Assume Total Liabilities shown on balance sheet as Total Debt Requirements: Calculate the Levered Beta of assigned company for last 2 years. Comment in the industry outlook the company is operating.arrow_forwardAssume there are two firms with a MV of $50,000,000. Firm A consists of 10% debt and 90% equity. Firm B consists of 40% debt and 60% equity. Assume perfect capital markets and M&M Proposition 2 holds. Which firm will have a higher expected return for equity holders? Why? For the toolhar prace ALT+F10/PC or ALT+FN+F10 (Mac).arrow_forwardA4) Finance You estimate that the net income for a company next year is a uniform distribution with a minimum of $106 million and a maximum of $127 million. What is the probability that the company's net income is less than or equal to $117 million? Enter answer in percents, to two decimal places.arrow_forward

- suppose you manage a $200,000 company that consist of the following invest: A $50,000 beta .095 B $50,000 beta 0.80 C $50,000 beta 1.00 D $50,000 beta 1.20 what is holding of company beta?arrow_forwardConsider a simple firm that has the following market-value balance sheet: Assets Liabilities & Equity $1,000 Debt $400 Equity 600 Next year, there are two possible values for its assets, each equally likely: $1,190 and $960. Its debt will be due with 5.1% interest. Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 40% in the firm's debt and 60% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's WACC is the same as the expected return on its assets. If the assets will be worth $1,190 in one year, the expected return on assets will be 19 %. (Round to one decimal place.) If the assets will be worth $960 in one year, the expected return on assets will be 4%. (Round to one decimal place.) -…arrow_forwardYou are looking to purchase Company A. Your projections for the EBITDA of Company A are as follows: EBITDA $21.51 Year 1 $2.0 O $19.77 $21.78 Your cost of capital is 20%. Your investment banker shows you the EBITDA multiples for the following comparable companies: Company x 5.0x Company y 5.50x Company z 6.0x Year 2 $3.0 Given the above information what is the price that you would like to offer to Company A shareholders? Not enough information Year 3 $3.5 None of the above Year 4 $4.0 Year 5 $5.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economic Value Added EVA - ACCA APM Revision Lecture; Author: OpenTuition;https://www.youtube.com/watch?v=_3hpcMFHPIU;License: Standard Youtube License