Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 20SP

Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook’s Web site.

- a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $300 million; depreciation amounted to 10% of net fixed assets; interest expenses were $22 million; the state-plus-federal corporate tax rate was 25%; and it paid 40% of its net income out in dividends. Given this information, construct Britton String’s income statement. Also calculate total dividends and the addition to

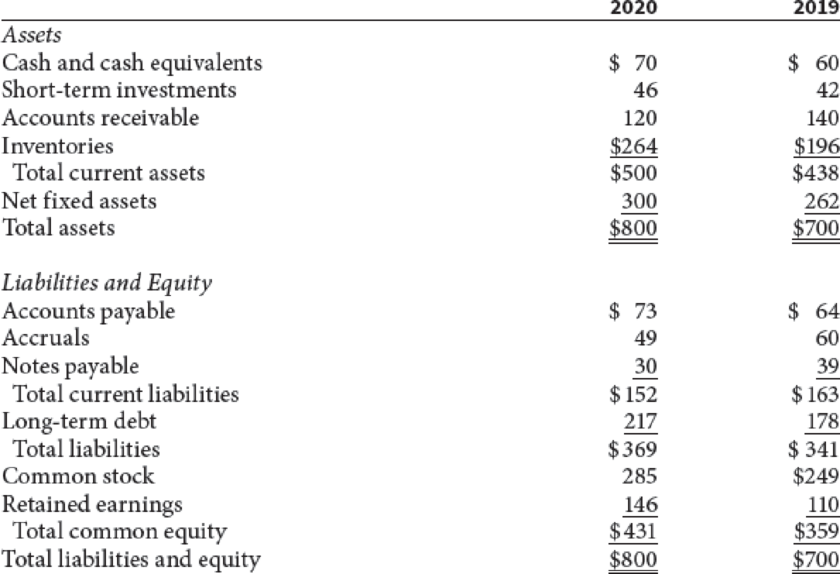

retained earnings . Report all dollar figures in millions. - b. Britton String’s partial

balance sheets follow. Britton issued $36 million of new common stock in the most recent year. Using this information and the results from part a, fill in the missing values for common stock, retained earnings, total common equity, and total liabilities and equity. - c. Construct the statement of cash flows for 2020.

Britton Strings Corp: Balance Sheets as of December 31 (Millions of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

!

Required information

Use the following information for the Quick Study below. (Algo)

[The following information applies to the questions displayed below.]

Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,650 rackets

and sold 5,230. Each racket was sold at a price of $90. Fixed overhead costs are $86,450 per year, and fixed selling and

administrative costs are $66,600 per year. The company also reports the following per unit variable costs for the year.

Direct materials

Direct labor

Variable overhead

Variable selling and administrative expenses

Finished goods inventory under variable costing

QS 19-5 (Algo) Reporting inventory using variable costing LO P2

Compute the cost of ending finished goods inventory reported on the balance sheet using variable costing.

Product cost per unit

Finished goods inventory reported on balance sheet

$

$ 12

8

0

5

2

Felton Co. produces rubber bands for commercial and home use. Felton reported $1 million residualincome (RI) with $20 million net book value (NBV) of assets and $5 million in operating income forthe year. What was the required rate of return?

A chip manufacturer makes video gaming chip that can be sold for $50. The chip material cost is $15 for each chip. The operations costs of the chip manufacturer (administration etc.) is $100000. The chip manufacturing machinery costs $500000 that is depreciated over 10 years to a salvage value of zero.

a) What is the accounting breakeven level of sales in terms of number of chips sold?

b) b. What is the NPV breakeven level of sales assuming a tax rate of 35%, 10-year project life and a discount rate of 12%.

Chapter 2 Solutions

Financial Management: Theory & Practice

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Return to question Required Information Use the following Information for the Quick Study below. (Algo) [The following Information applies to the questions displayed below] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,950 rackets and sold 5,880. Each racket was sold at a price of $90. Fixed overhead costs are $103,350 per year, and fixed selling and administrative costs are $69,200 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses $12 QS 19-6 (Algo) Absorption costing Income statement LO P2 Prepare an Income statement under absorption costing. Answer is complete but not entirely correct. ACE&INCORPORATED Income statement (Absorption Cocting) Sales $ 629,200 Cost of goods sold 223,440 Gross profit 305,760 Selling and administrative expenses 11,760 Income $ 294,000arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,050 rackets and sold 4,930. Each racket was sold at a price of $90. Fixed overhead costs are $78,650 per year, and fixed selling and administrative costs are $65,400 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses QS 19-4 (Algo) Variable costing income statement LO P2 Prepare an income statement under variable costing. ACES INCORPORATED Income Statement (Variable Costing) Sales Less: Variable expenses S 466,200 $12 8 5 2arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below. Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,250 rackets and sold 5,030. Each racket was sold at a price of $90. Fixed overhead costs are $81.250 per year, and fixed selling and administrative costs are $65,800 per year. The company also reports the following per unit variable costs for the year. $ 12 Direct materials Direct labor Variable overhead Variable selling and administrative expenses QS 6-6 (Algo) Absorption costing income statement LO P2 Prepare an income statement under absorption costing. ACES INCORPORATED Income Statement (Absorption Costing) NUEarrow_forward

- With a $100,000 investment in a new injection mouldingmachine, A-Design Inc., a company specialized in thedesign and manufacturing of armrests for wheelchairswas able to achieve an operating income of $36,000 inits first year of production/operation. The interestexpenses on the money A-Design has borrowed were$5,000 per year. 4. With a net unit price of $5 per armrest, how many armrestsmust A-Design sell to break-even with respect to theinvestment?arrow_forwardManagement Science: XY Company manufactures and sells LCD monitor at P5000 each. The production officer reported the following: Sale price: P5000 per monitor direct materials cost: P1000 per unit direct labor cost: P550 per unit other overhead cost P950 per unit Fixed costs related to the production are also reported: salary of management: P200,000 rent for the factory: P150,000, other salaries: P140,000 depreciation of equipment: P12,000Find the break-even sales revenuearrow_forwardManagement Science: XY Company manufactures and sells LCD monitor at P5000 each. The production officer reported the following: Sale price: P5000 per monitor direct materials cost: P1000 per unit direct labor cost: P550 per unit other overhead cost P950 per unit Fixed costs related to the production are also reported: salary of management: P200,000 rent for the factory: P150,000, other salaries: P140,000 depreciation of equipment: P12,000Find the break-even quantityarrow_forward

- Management Science: XY Company manufactures and sells LCD monitor at P5000 each. The production officer reported the following: Sale price: P5000 per monitor direct materials cost: P1000 per unit direct labor cost: P550 per unit other overhead cost P950 per unit Fixed costs related to the production are also reported: salary of management: P200,000 rent for the factory: P150,000, other salaries: P140,000 depreciation of equipment: P12,000Compute the profit functionarrow_forwardQ2. Swagelok Enterprises is a manufacturer of miniature fittings and valves. Over a 5-yearperiod, the costs associated with one product line were as follows: first cost of $20,000, andannual costs of $18,000. Annual revenue was $26,000 and the used equipment was salvagedfor $4,000. What rate of return did the company make on this product? The rate of return that the company made on the product is %.arrow_forwardConsider the information provided below as well as the financial statements and answer the questions that follow.Pearson & Litt is a manufacturing company in the Eastern Cape. Their factory manufactures glass wine bottles for the Blue Valley Beer Co.2019 2020Sales price per unit R15 R19Variable cost per unit R6 R7Fixed cost (FC) per annum R650 000 R 855 500Fixed cost per unit R3 R4 Current assets R450 600 R560 700Current liabilities R510 000 R780 000Retained profit R21 809 R17 600Net Sales R2 900 320 R 3 100 100Cost of sales R390 000 R475 000 b. Recommend one of these budgeting methods to Pearson & Litt and provide reasons for your recommendation (3)arrow_forward

- A general manager wants to know the economic service life of currently owned machines. The market value of the machines and the maintenance and operating costs are shown below. Use the company’s MARR of 15% per year to determine the ESL. Year Market Value Annual Cost Total Annual Worth 0 $40,000 N/A N/A 1 $30,000 $20,000 -$36,000 2 $25,000 $22,000 -$33,907 3 $12,000 $24,000 4 $2,000 $26,000 -$36,263arrow_forwardUse the following information for the Quick Study below. (Algo) Skip to question [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,350 rackets and sold 5, 580. Each racket was sold at a price of $90. Fixed overhead costs are $95, 550 per year, and fixed selling and administrative costs are $ 68,000 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor 8 Variable overhead 5 Variable selling and administrative expenses 2 QS 19-7 (Algo) Reporting inventory using absorption costing LO P2 Compute the cost of ending finished goods inventory reported on the balance sheet using absorption costing.arrow_forwardMagic Realm, Incorporated, has developed a new fantasy board game. The company sold 60,000 games last year at a selling price of $60 per game. Fixed expenses associated with the game total S1,100,000 per year, and variable expenses are $40 per game. Production of the game is entrusted to a printing contractor. Variable expenses consist mostly of payments to this contractor. Required: 1-a. Prepare a contribution format income statement for the game last year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License