PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 7PS

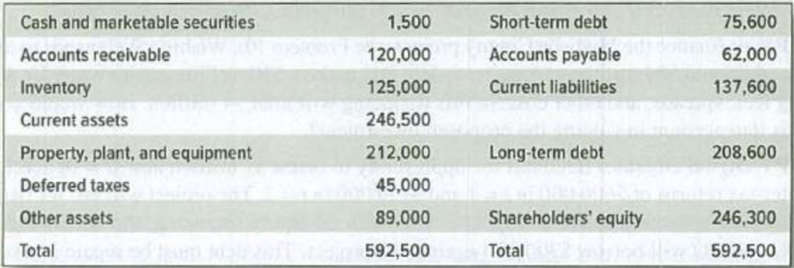

WACC Table 19.4 shows a simplified balance sheet for the Dutch manufacturer Rensselaer Felt. Calculate this company’s weighted-average cost of capital. The debt has just been refinanced at an interest rate of 6% (short term) and 8% (long term). The expected

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a) Table below shows the simplified balance sheet information for Jess Elton Enterprise. The debt has just been

refinanced at an interest rate of 6% (short term) and 8% (long term). The expected rate of return on the company's

shares is 15%. There are 7.46 million shares outstanding, and the shares are trading at $46. The tax rate is 35%.

Calculate this company's weighted-average cost of capital (WACC) based on the market weighted scheme.

1,500 Short-term debt

75,600

Cash and marketable

securities

Accounts receivable

Inventory

Current assets

Property, plant, and

equipment

Other assets

Total

120,000 Accounts payable

125,000

Current liabilities

246,500

302,000 Long-term debt

89,000 Shareholders' equity

637,500

Total

62,000

137,600

208,600

637,500

246,300

b) Discuss the different funding strategies a company may follow in order to finance its cumulative working capital

requirements.

Napa plc has 100 million £0.25 ordinary shares in issue with a current market value of £1.20 per share. The cost of ordinary shares is estimated at 12 per cent. The business also has 6 per cent irredeemable loan notes in issue with a nominal value of £75 million. These are currently quoted at £80 per £100 nominal value. The tax rate is 20 per cent.

What is the weighted average cost of capital of the business?

Sainsbury is financed by both debt and equity. Using the following information and calculate the weighted average cost of capital (WACC) of Sainsbury. (HINT)the average of recent yearly returns of FTSE100 as proxy of UK market is 7.5%; UK corporate tax rate is 19%).

Debt 748,000

Equity 6,604,000

Risk free rate 1.971%

Beta 0.27

Current Debt 258,000

Total liabilities and stockholders' equity 25,162,000

Chapter 19 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 19.A - The U.S. government has settled a dispute with...Ch. 19.A - You are considering a five-year lease of office...Ch. 19 - WACC True or false? Use of the WACC formula...Ch. 19 - WACC The WACC formula seems to imply that debt is...Ch. 19 - Prob. 3PSCh. 19 - Prob. 4PSCh. 19 - WACC Whispering Pines Inc. is all-equity-financed....Ch. 19 - WACC Table 19.3 shows a book balance sheet for the...Ch. 19 - WACC Table 19.4 shows a simplified balance sheet...Ch. 19 - Prob. 8PS

Ch. 19 - WACC Nevada Hydro is 40% debt-financed and has a...Ch. 19 - Flow-to-equity valuation What is meant by the...Ch. 19 - APV True or false? The APV method a. Starts with a...Ch. 19 - APV A project costs 1 million and has a base-case...Ch. 19 - APV Consider a project lasting one year only. The...Ch. 19 - APV Digital Organics (DO) has the opportunity to...Ch. 19 - Prob. 17PSCh. 19 - Prob. 18PSCh. 19 - Prob. 19PSCh. 19 - Prob. 20PSCh. 19 - Prob. 22PSCh. 19 - Company valuation Chiara Companys management has...Ch. 19 - Prob. 26PSCh. 19 - Prob. 27PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Shoobee, Inc. has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average of capital. The WACC it to be measured by using the following weights: 50% long term, 10% preferred stock, and 40% common stock equity (retained earnings, new common stock issuance, or both). The firm tax is 25%. Debt: The firm can sell for P980, a 10-year, P1,000 par value bond paying annual interest at 13% coupon rate. A flotation cost of 3% of the par value is required in addition to the discount of P20 per bond. Preferred stock: 8 percent (annual dividend) preferred stock having a par value of P100 can be sold for P65. An additional fee of P2.00 per share must be paid to the underwriters. Common stock: The firm’s common stock is currently selling for P50 per share. The recent dividend paid was P4.00 per share. Its dividend payments which have approximately 60% of earnings per share in each past 6 years follows: Year Dividend 2021 P4.00 2020 3.75…arrow_forwardConsider the following information for Federated Junkyards of America. Debt: $65,000,000 book value outstanding. The debt is trading at 86% of book value. The yield to maturity is 9%. Equity: 1,500,000 shares selling at $32 per share. Assume the expected rate of return on Federated’s stock is 18%. Taxes: Federated’s marginal tax rate is Tc = 0.21. Calculate the weighted-average cost of capital (WACC).arrow_forwardSuppose you are estimating the WACC for Columbus Inc. It has the following data from its balance sheet: total debt = $200 million; total equity=$120 million. It has 20 million shares outstanding, and its stock is trading at $32 per share. Your analysis shows that the company's current borrowing rate is 7%, and that the cost of equity is 13%. If the company marginal tax rate is 30%, what is its WACC?arrow_forward

- Consider the following information for Federated Junkyards of America. Debt: $76,000,000 book value outstanding. The debt is trading at 91% of book value. The yield to maturity is 10%. Equity: 2,600,000 shares selling at $43 per share. Assume the expected rate of return on Federated’s stock is 19%. Taxes: Federated’s marginal tax rate is Tc = 0.21. Calculate the weighted-average cost of capital (WACC). (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardPercy's Wholesale Supply has earnings before interest and taxes of €106,000. Both the book and the market value of debt is €170,000. The unlevered cost of equity is 15.5 per cent while the pre-tax cost of debt is 8.6 per cent. The tax rate is 28 per cent. What is the firm's weighted average cost of capital? Show your steps.arrow_forwardHere is Icknield’s market-value balance sheet (figures in $ millions): Net working capital $550 Debt $800 long term assets $2,150 Equity $1,900 value of firm $2,700 $2,700 The debt is yielding 7%, and the cost of equity is 14%. The tax rate is 21%. Investors expect this level of debt to be permanent. a. What is Icknield’s WACC? b. How would the market-value balance sheet change if Icknield retired all its debt?arrow_forward

- A company has 35% of its balance sheet as debt with a total amount of assets of EUR 17,000,000.If the company's cost of equity is 4% and its cost of debt 2%, and considering the corporate tax rate of 30%, what is the company's WACC (Weighted average cost of capital)?arrow_forwardGive typing answer with explanation and conclusion A company has an expected EBIT of $18,000 in perpetuity, a tax rate of 35%, and a debt-to- equity ratio of 0.75. The interest rate on the debt is 9.5%. The firm’s WACC is 9%. a) If the company has not debt, what would be the unlevered cost of capital and firm value? b) Suppose now the company has $55,714.29 in outstanding debt. Using your answer to part a) and M&M Proposition I with taxes, what is the value of this levered firm?arrow_forwardAruz Berhad sells its product at RM45 per unit. Fixed cost per year is RM220,000 while variable cost is RM15 per unit. The firm has debt capital of RM450,000 and its interest rate is 7%. Firm tax rate is 30% and the total number of shares issued is 300,000 units. You are required to: i. Calculate earnings before interest and tax (EBIT) and earnings per share (EPS) at total sales of 15,000 units. ii. Calculate the degree of financial leverage at sales level of 15,000 units.arrow_forward

- Oblib Inc. has a debt-equity ratio of 2, and a weighted average flotation cost of 4%. What is the dollar flotation cost if the company were to raise $1.5 million in the capital market? Please if you can, show all calculationsarrow_forwardFind the WACC given the following information: A firm has a cost of equity of 8% and cost of debt of 6.5%. The debt - toequity ratio is 0.75. The tax rate is 15%.arrow_forwardA. ABC Corp., expects a net income of Php. 250,000. The company has 10% of 5,000,000 Debentures. The equity capitalization rate of the company is 10%. 1. Calculate the value of the firm and overall capitalization rate according to the net income approach (ignoring income tax). 2. If the debenture debt is increased to Php. 750,000 and interest of debt is change to 8%. What is the value of the firm and overall capitalization rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

FIN 300 Lab 1 (Ryerson)- The most Important decision a Financial Manager makes (Managerial Finance); Author: AllThingsMathematics;https://www.youtube.com/watch?v=MGPGMWofQp8;License: Standard YouTube License, CC-BY

Working Capital Management Policy; Author: DevTech Finance;https://www.youtube.com/watch?v=yj-XbIabmFE;License: Standard Youtube Licence