PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 24PS

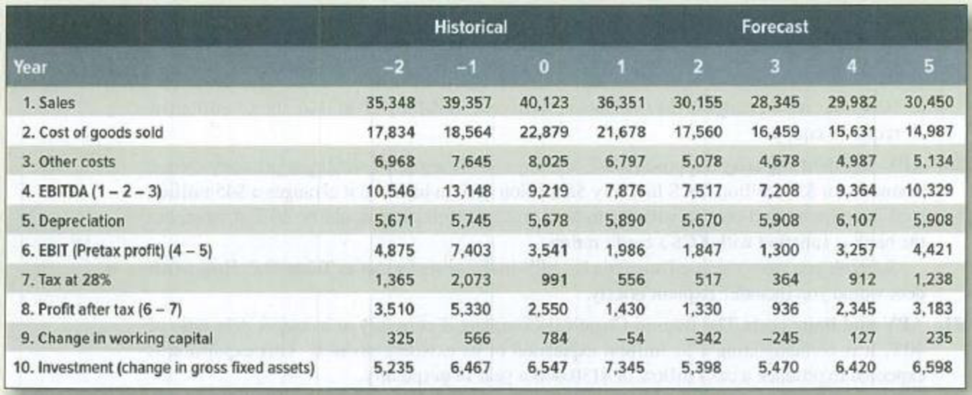

Company valuation Chiara Company’s management has made the projections shown in Table 19.5. Use this table as a starting point to value the company as a whole. The WACC for Chiara is 12%, and the

TABLE 19.5 Cash flow projections for Chiara Corp. (ZAR thousands)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Valuation of companies can be done by forecasting a series of cash flows and then estimating a horizon value.

Your firm projects net cash flow in years 1 through 5 as follows:

Year 1

Year 2

Year 3

Year 4

Year 5

100 Million $

120 Million $

135 Million $

140 Million $

147 Million $

Assume that the company is expecting a growth rate of 6% starting year 5 and a discount rate of 12%; compute the PV of the company?

Show the details of all your calculations.

Using the AFN formula in financial forecasting approach, Determine the following for Piano Co. given the following accounting information assuming that the firm’s profit margin remains constant and the company is at full capacity. · Sales this year is P6,000,000· Percentage increase projected for next year sales = 20%· Net income this year amounts to P600,000· Retention ratio = 50%· Accounts payable = P1,100,000· Notes payable = P180,000· Accrued expenses = P500,000· Projected excess funds available next year is determined to be P200,000

Questions:

1. Determine the spontaneous liabilities increase.

2. How much is the increase in Retained Earnings?

3. How much is the total assets?

Question

North-Ireland Cooling’s management has made the projections shown in Table below. Use this table as a starting point to value the company. The WACC for North-Ireland Cooling is 10% and the long-run growth rate after year 4 is 7%. The company has $15,000 debt and 850 shares outstanding. Tax rate is 0.30.

a) Calculate the free cash flows to the firm

b) What is the firm value?

c) What is the equity value?

d) What is the intrinsic value of share?

Show your steps in your calculations.

Please answer as soon as possible

Chapter 19 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 19.A - The U.S. government has settled a dispute with...Ch. 19.A - You are considering a five-year lease of office...Ch. 19 - WACC True or false? Use of the WACC formula...Ch. 19 - WACC The WACC formula seems to imply that debt is...Ch. 19 - Prob. 3PSCh. 19 - Prob. 4PSCh. 19 - WACC Whispering Pines Inc. is all-equity-financed....Ch. 19 - WACC Table 19.3 shows a book balance sheet for the...Ch. 19 - WACC Table 19.4 shows a simplified balance sheet...Ch. 19 - Prob. 8PS

Ch. 19 - WACC Nevada Hydro is 40% debt-financed and has a...Ch. 19 - Flow-to-equity valuation What is meant by the...Ch. 19 - APV True or false? The APV method a. Starts with a...Ch. 19 - APV A project costs 1 million and has a base-case...Ch. 19 - APV Consider a project lasting one year only. The...Ch. 19 - APV Digital Organics (DO) has the opportunity to...Ch. 19 - Prob. 17PSCh. 19 - Prob. 18PSCh. 19 - Prob. 19PSCh. 19 - Prob. 20PSCh. 19 - Prob. 22PSCh. 19 - Company valuation Chiara Companys management has...Ch. 19 - Prob. 26PSCh. 19 - Prob. 27PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume the firm has a constant dividend payout ratio and a projected sales increase of 10 percent. All costs, assets, and current liabilities vary directly with sales. The firm is currently at full production. What is the external financing need? Currently, the firm’s sales =$5,700, net income is $520, total assets=8890, dividends=156, A/P =990, LTD= 3730, and common stock=2980, and retained earnings =1200. $146.00 $251.20 $379.60 $421.60 $550.30arrow_forwardA firm in the IT sector is considering how to set its dividend policy. It has a capital budget of €3,000. The company wants to maintain a target capital structure that is 15% debt and 85% equity. The company forecasts that its net income this year will be €3,500. If the company follows a residual dividend policy, what will be its total dividend payment and its payout ratio? Dividends = Net income – [(target equity ratio) *(total capital budget)].arrow_forwardMajong Inc. forecasts that it will have the free cash flows shown below. The free cash flows are expected to grow by 5% per year after year 3. Year 1 2 3 CF (S million) - 20 48 54 The weighted average cost of capital is 13%. The firm has $55 million of debt and 10 million shares outstanding. What is the firm value today (in $ million)? What is a good estimate of Majong's value per share?arrow_forward

- Based on the information in the table, what is the growth duration for Georgia Gauge? Report your answer rounded to one decimal place. P/E Ratio Expected Growth Rate Dividend Yield Answer: S&P Industrials Georgia Gauge, Inc. 25 0.16 0.02 16 0.05 0.04arrow_forwardGrowth Tech Inc., has earned $ 40 as Earnings Per Share. It proposes to pay $10 as dividend and reinvest the remaining. The return on investment by the firm is 20%. What is the growth rate of the firm’s earnings and dividends assuming a constant payout ratio and return on investment? A. 20% B. 18% C. 15% D. 12%arrow_forwardValue in Valuation, Inc. is assessing the value of two companies, Company A and Company B, which projects average net cashflows in the next five years of P4,000,000 and 3,000,000, respectively. The required rate of return is both 8%. Which of the following has the higher equity value and by how much? And assuming that Company A is being sold at P48,000,000 while Company B is being sold at P36,500,000, what should be Value in Valuation’s best recommendation among the following choices: 1. To buy Company A because the selling price is higher than its equity value 2. To buy Company A because it is being sold at a discount of P2,000,000 3. To buy Company B because the selling price is lower than its equity value 4. To buy Company B because it is being sold at a premium of P1,000,000arrow_forward

- The forecast for Global Exports' free cash flows for next year is provided in the table below. Selected Financial Information Global Exports Inc. ($000s) Operating Cash Flow Net Working Capital CAPEX Debt Shares Outstanding O $7.32 O $6.74 Assume that free cash flow is paid at the end of each year and we are at the beginning of next year. Last year's values are for the year end yesterday. Analysts expect Global Exports' cash flow to grow at 1% in perpetuity. The WACC for Global is 8%. What is the fair price for Global Exports' shares today? O $6.14 Last Year 93,435 325,000 22,876 450,255 50,000 O $6.85 Next Year 103,462 344,000 28,975 485,850 50,000arrow_forwardA company projects a rate of return of 20% on new projects. Management plans to plow back 20% of all earnings into the firm. Earnings this year will be $6 per share, and investors expect a rate of return of 12% on stocks facing the same risks as this company. What is the sustainable growth rate? What is the stock price? What is the present value of growth opportunities (PVGO)? What is the P/E ratio? What would the price and P/E ratio be if the firm paid out all earnings as dividends? Please show workings with formulas.arrow_forwardThe forecast for Global Exports’ free cash flows for next year is provided in the table below. Selected Financial Information Global Exports Inc. ($000s) Last Year Next Year Operating Cash Flow 74,230 78,076 Net Working Capital -12,240 -13,460 CAPEX 8,720 15,400 Debt 80,100 100,200 Shares Outstanding 10,000 10,000 Assume that free cash flow is paid at the end of each year and we are at the beginning of next year. Last year’s values are for the year end yesterday. Analysts expect Global Exports’ cash flow to grow at 3% in perpetuity. The WACC for Global is 11%. What is the fair price for Global Exports’ shares today? Responses $62.37 $62.37 $69.85 $69.85 $73.27 $73.27 $71.86 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Suppose a firm has had the following historic sales figures. Year: 2016 2017 2018 2019 2020 Sales $1,530,000 $1,720,000 $1,560,000 $2,100,000 $1,850,000 What would be the forecast for next year’s sales using FORECAST.ETS to estimate a trend? Note: Round your answer to the nearest whole dollar.arrow_forwardAn analyst is trying to estimate the intrinsic value of Blue Co. that has a weighted average cost of capital at 10%. The estimated free cash flows for the company for the following years are: Year 1 P3,000 Year 2 P4,000 Year 3 P5,000 The analyst estimates that after three years, free cash flow will grow at a constant annual percentage of 6%. What is the total intrinsic value of the company's common stock if combined debt and preferred stock has a P25,000 market value? *arrow_forwardA company projects a rate of return of 20% on new projects. Management plans to plow back 20% of all earnings into the firm. Earnings this year will be $6 per share, and investors expect a rate of return of 12% on stocks facing the same risks as the company.a) What is the sustainable growth rate?b) What is the stock price?c) What is the present value of growth opportunities (PVGO)?d) What is the P/E ratio?e) What would the price and P/E ratio be if the firm paid out all earnings as dividends?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY