PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 3PS

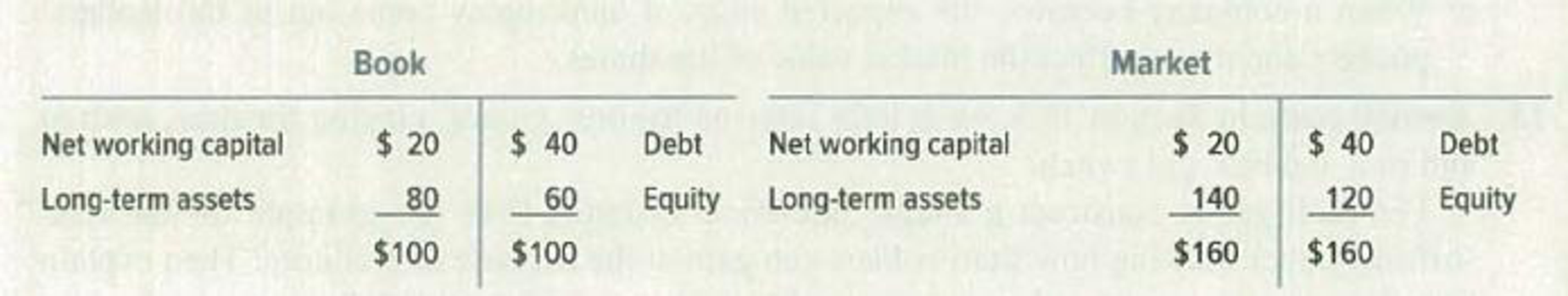

Tax shields Here are book and market value balance sheets of the United Frypan Company (UF):

Assume that MM’s theory holds with taxes. There is no growth, and the $40 of debt is expected to be permanent. Assume a 40% corporate tax rate.

- a. How much of the firm’s value in dollar terms is accounted for by the debt-generated tax shield?

- b. How much better off will UF’s shareholders be if the firm borrows $20 more and uses it to repurchase stock?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

An all equity firm announces that it is going to borrow $11 million in debt and then keep that debt at a constant value relative to the overall value of the company. What would be the appropriate discount rate for the expected interest tax shields generated by this additional debt?

A. Required return on debt

B. Required return on equity

C. Required return on Assets

D. WACC

Please show your work for the following

Suppose that your firm's current unlevered value, V*, is $800,000, and its marginal corporate tax rate is 21 percent. Also, you model the firm's PV of financial distress as a function of its debt level according to the relation: PV of financial distress = 800,000 × (D/V*)2. What is the firm's levered value if it issues $200,000 of perpetual debt to buy back stock?

Multiple Choice

A) $920,000.

B) $869,555.

C) $792,000.

D) $350,000.

Assume that there is corporate tax, but no other frictions. Based on the propositions of Modigliani and Miller, which statement is the least accurate?

Oa. The weighted cost of capital decreases as the leverage ratio increases.

D. The cost of debt increases as the leverage ratio increases.

C. Firm value increases as the firm takes on more debts.

d. The cost of equity increases as the leverage ratio increases.

O e. The optimal structure is 100% debt.

Chapter 18 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 18 - Prob. 1PSCh. 18 - Tax shields Compute the present value of interest...Ch. 18 - Tax shields Here are book and market value balance...Ch. 18 - Tax shields Look back at the Johnson Johnson...Ch. 18 - Prob. 5PSCh. 18 - Tax shields The firm cant use interest tax shields...Ch. 18 - Prob. 7PSCh. 18 - Tax shields The trouble with MMs argument is that...Ch. 18 - Bankruptcy costs On February 29, 2019, when PDQ...Ch. 18 - Financial distress This question tests your...

Ch. 18 - Prob. 12PSCh. 18 - Agency costs Let us go back to Circular Files...Ch. 18 - Agency costs The Salad Oil Storage (SOS) Company...Ch. 18 - Agency costs The possible payoffs from Ms....Ch. 18 - Prob. 17PSCh. 18 - Prob. 18PSCh. 18 - Prob. 20PSCh. 18 - Pecking-order theory Fill in the blanks: According...Ch. 18 - Financial slack For what kinds of companies is...Ch. 18 - Financial slack True or false? a. Financial slack...Ch. 18 - Debt ratios Rajan and Zingales identified four...Ch. 18 - Leverage targets Some corporations debtequity...Ch. 18 - Prob. 26PSCh. 18 - Trade-off theory The trade-off theory relies on...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following would reduce a firm's WACC after tax? a. A firm invests in an average-risk project using equity, rather than debt financing. b. A supermarket chain decides to establish hardware stores which increases its systematic risk. c. A firm issues shares and uses the proceeds to pay off a bank loan. d. A firm issues bonds and uses the proceeds to repurchase stock. e. A firm significantly improves its operating cost control to boost profits.arrow_forwardHow does the WACC DCF methodology mechanically incorporate interest tax shields (select the best answer)? Group of answer choices By estimating free cash flows that incorporate the tax benefits of debt. By adding the tax benefits of interest payments to the value of the firm. By adding the PV of the interest tax shields to the value of the firm. By estimating a discount rate that incorporates the tax benefits of debt.arrow_forwardIn this question, you will calculate the value of a levered firm with corporate taxes. Assume that The Best Diagnostics Lab Inc. is subject to 30% federal-plus-state tax rate and its unlevered value is $25 million. If the firm has $15 million in debt, what is its total market value (VL)? 26.3 Million 29.5 Million 52.3 Million None of the abovearrow_forward

- Assume that a company borrows at a cost of 0.08. Its tax rate is 0.35. What is the minimum after-tax cost of capital for a certain cash flow if a. 100 percent debt is used? b. 100 percent common stock? (assume that the stockholders will accept 0.08)arrow_forwardSuppose the firm makes the change but its competitors react by making similar changes to their own credit terms, with the net result being that gross sales remain at the current 1,000,000 level. What would be the impact on the firms after-tax profitability?arrow_forwardAntwerp Co. has a debt-to-equity ratio of 1.4, a corporate tax rate of 30%, pays 4% interest on its debt and has a required rate of return on equity of 12%. What is II’s WACC? How much does the debt tax shield reduce II’s WACC? What is the required rate of return on firm assets?arrow_forward

- Given the following information, how much value will leverage will add to, or subtract from, the firm if the firm were to add one additional pound of debt? Corporate tax = 15% Personal tax on debt = 30% Personal tax on equity = 10% Select one: -0.09 0.00 0.30 0.55 None of the abovearrow_forwardWHICH OF THE FOLLOWING STATEMENTS IS MOST CORRECT? A. IF A FIRM'S EXPECTED BASIC EARNING POWER (BEP) IS CONSTANT FOR ALL ITS ASSETS AND EXCEES INTEREST RATE ON ITS DEBT, THEN ADDING ASSETS FINANCING THEM WITH DEBT WILL RAISE THE FIRM'S EXPECTED RATE OF RETURN ON COMMON EQUITY (ROE)? B. THE HIGHER ITS TAX RATE, THE LOWER A FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. C. THE HIGHER THE INTEREST RATE ON ITS DEBT, THE LOWER THE FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. D. THE HIGHER ITS DEBT RATIO, THE LOWER THE FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. E. STATEMENT A IS FALSE, BUT B, C AND D ARE ALL TRUE.arrow_forwardWhich statement about capital structure is the most correct? a. The more the company borrows, the lower will be the after-tax WACC. This increases the present value of the firm free cash flows which represents the value of the levered firm. Therefore, a firm should always seek to borrow as much debt as possible. b. The more the company borrows, the higher will be its tax shields, therefore a company will always prefer to issue debt than equity. c. Because the cost of debt is cheaper than the cost of equity, a company should use as much debt as possible to finance their projects d. Lenders rank ahead of shareholders when the company goes bankrupt. This increased risk for shareholders means the cost of equity is higher than the cost of debt. e. A company should always try to reduce its debt because of the high bankruptcy risk associated with debt. A company should aim to have 100% equity financing if it is possible.arrow_forward

- K1. The Lazy Corporation has marginal corporate tax rate of 21%. Assume that investors in Lazy pay a 15% tax rate on income from equity and a 21% tax rate on interest income. Lazy wants to issue risk-free perpetual debt to reduce its corporate tax burden by $1 million per year in each subsequent year. Assume the risk-free rate is 7%. What is the value added to the firm by this debt issuance.arrow_forward2. Business and financial risk The impact of financial leverage on return on equity and earnings per share Consider the following case of Purple Panda Importers: Suppose Purple Panda Importers is considering a project that will require $350,000 in assets. • The company is small, so it is exempt from the interest deduction limitation under the new tax law. • The project is expected to produce earnings before interest and taxes (EBIT) of $60,000. • Common equity outstanding will be 25,000 shares. • The company incurs a tax rate of 25%. If the project is financed using 100% equity capital, then Purple Panda Importers's return on equity (ROE) on the project will be addition, Purple Panda's earnings per share (EPS) will be Alternatively, Purple Panda Importers's CFO is also considering financing the project with 50% debt and 50% equity capital. The company's debt will be 10%. Because the company will finance only 50% of the project with equity, it will have only 12,500 shar Panda…arrow_forward4. North Inc has a perpetual expected EBIT of $200. The interest rate on debt is 12%. Assume that there are no taxes. a. what is the value of North Inc if the debt/equity ratio is .25 and its weighted average cost of capital is 16%? What's the value of North's equity? What is the value of North's debt? What is the firm's cost of equity? b. Suppose the corporate tax is 30% and North has $400 in debt outstanding. If the unlevered cost is 20%, what's the value of North? What is the value of the firm's equity? What is the Wacc?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial leverage explained; Author: The Finance story teller;https://www.youtube.com/watch?v=GESzfA9odgE;License: Standard YouTube License, CC-BY