PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 14PS

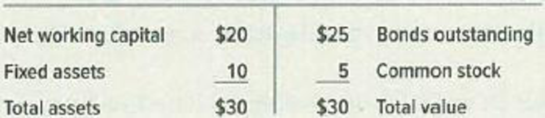

Agency costs* Let us go back to Circular File’s market value balance sheet:

Who gains and who loses from the following maneuvers?

- a. Circular scrapes up $5 in cash and pays a cash dividend.

- b. Circular halts operations, sells its fixed assets, and converts net working capital into $20 cash. Unfortunately the fixed assets fetch only $6 on the secondhand market. The $26 cash is invested in Treasury bills.

- c. Circular encounters an acceptable investment opportunity,

NPV = 0, requiring an investment of $10. The firm borrows to finance the project. The new debt has the same security, seniority, etc., as the old. - d. Suppose that the new project has NPV = +$2 and is financed by an issue of

preferred stock . - e. The lenders agree to extend the maturity of their loan from two years to three in order to give Circular a chance to recover.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose the management of a firm is trying to allocate liquid assets to two accounts, one of

which is riskless but pays no interest, while the other offers a risky return. Assume the rate of

return r on the second account is uniformly distributed over the range [-0.5, 0.5]. Let R

denote the amount currently available for allocation to the two accounts, and S denote the

amount invested in the risky asset.

Suppose management would like to make the next period investment value as large as

possible but subject to the condition that R + Sr not fall below 95% of the original value of R

too often so that if the investment falls below 95% of its original value, it should not do so

more than 25% of the time.

Calculate the ratio of investment and the amount available, that is, a =

R

Which of the following actions should Paperang Inc. take if it wants to reduce its cash conversion cycle?

a. Sell common stock to retire long-term bonds.

b. Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

c. Take steps to reduce the DSO.

d. Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.

e. Increase average inventory without increasing sales.

Jolie Corp.is looking into the following transcations to change its risk profile. Which of the following transcations will for sure increase the risk-estimate of the company (and increase the borrowing interest rate) from the z-score perspective. Mark all that apply; more than one answer could be correct.

Sold held-to maturity investments for a profit

Write-off some obsolete inventory

Collect cash from accounts receivable

Buy long-term investments withcash

Chapter 18 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 18 - Prob. 1PSCh. 18 - Tax shields Compute the present value of interest...Ch. 18 - Tax shields Here are book and market value balance...Ch. 18 - Tax shields Look back at the Johnson Johnson...Ch. 18 - Prob. 5PSCh. 18 - Tax shields The firm cant use interest tax shields...Ch. 18 - Prob. 7PSCh. 18 - Tax shields The trouble with MMs argument is that...Ch. 18 - Bankruptcy costs On February 29, 2019, when PDQ...Ch. 18 - Financial distress This question tests your...

Ch. 18 - Prob. 12PSCh. 18 - Agency costs Let us go back to Circular Files...Ch. 18 - Agency costs The Salad Oil Storage (SOS) Company...Ch. 18 - Agency costs The possible payoffs from Ms....Ch. 18 - Prob. 17PSCh. 18 - Prob. 18PSCh. 18 - Prob. 20PSCh. 18 - Pecking-order theory Fill in the blanks: According...Ch. 18 - Financial slack For what kinds of companies is...Ch. 18 - Financial slack True or false? a. Financial slack...Ch. 18 - Debt ratios Rajan and Zingales identified four...Ch. 18 - Leverage targets Some corporations debtequity...Ch. 18 - Prob. 26PSCh. 18 - Trade-off theory The trade-off theory relies on...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a company with a Reddington Immune cash flow stream of assets and liabilities. The asset payments all occur before the liability payments. What can you say about the present value of the entire cash flow stream if the interest rate increases from its current rate? Select one: The new present value is negative. b. We cannot say anything about the sign of the new present value. The new present value is zero. d. The new present value is positive. a. C.arrow_forwardWhich of the following is false? a. Baumol model helps firm to find out their desirable level of cash balance under certainty b. Any presence of a cash buffer affects the cost of holding cash and ultimately the annual cost of cash for a particular firm c. A higher average daily disbursement float than average daily collection float is more desirable for a firm d. Accounts payable increase the number of days a firm’s resources are tied up in the operating cyclearrow_forwardConsider a company with a Reddington Immune cash flow stream of assets and liabilities. The asset payments all occur before the liability payments. What can you say about the present value of the entire cash flow stream if the interest rate increases from its current rate? a. We cannot say anything about the sign of the new present value. b. The new present value is negative. c. The new present value is positive. d. The new present value is zero.arrow_forward

- Bulldogs inc. will least likely experience which of the following if the firm shifts its credit terms from n/25 to 3/10, n/25 the computed days sales outstanding will decrease the percentage of credit sales from the total sales revenue will increase decrease in short-term borrowings cash conversion cycle will tend to increase The company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from Decrease of debt to asset ratio Increase of return on marketable securities None of the choices is correct Increase in the annual demand for casharrow_forwardWhich of the following statements is not correct? Group of answer choices A)Purchasing fixed assets using cash decreases the current ratio. B)Accruing a commission expense will affect the net profit margin ratio. C)Increasing the financial leverage ratio guarantees the net profit margin ratio will increase. D)Purchasing treasury stock results in a decrease in the current ratio. E)All of the above are correctarrow_forwardYou are a manager in a company and have been noticing that the Cash Conversion Cycle is a problem. One of the following tools could help you manage it: a. The financial leverage ratiosb. The total asset turnover ratio c. The ABC system d. The free cash flow formula e. All of the above f. None of the abovearrow_forward

- When we compute the EV/EBITDA multiple, i.e. the ratio of Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization, we estimate the enterprise value of a firm by adding the values of debt and equity and netting out cash. Could you provide a reason for netting out cash? O a. Cash can be used to pay down debt. O b. Cash is easy to value. O c. None of the given answers is correct. The income from cash is not part of EBITDA. Cash is liquid. O d. O e.arrow_forwardCash Conversion Cycle. Will each of the followingevents increase or decrease cash conversion cycles?(LO2)A-Higher financing rates induce the firm to reduceits level of inventory. b.The firm obtains a new line of credit that enablesit to avoid stretching payables to its suppliers.c-The firm factors its trade receivables.d-A recession occurs andthe firm's customersincreasingly stretch their payables.e.The new production process shortens the timeneeded to manufacture products.arrow_forwardThe company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from Decrease of debt to asset ratio Increase of return on marketable securities None of the choices is correct Increase in the annual demand for casharrow_forward

- True or False The cash conversion cycle is the sum of the inventory conversion period, the receivables collection period, and the days payables outstanding. * True False The best and most comprehensive picture of a firm's liquidity position is obtained by examining its cash budget. * True False A firm's goal should be to lengthen the cash conversion cycle since shorter cash conversion cycles leads firms to increase their dependence on costly external financing. * True False The larger the investment a firm makes in its current assets, the higher its carrying costs will be. * True False Other things held constant, if a firm "stretches" (i.e., delays paying) its accounts payable, this will lengthen its cash conversion cycle (CCC). * True False Short-term financial policies that are flexible with regard to current assets includes keeping large balance of short-term debt. * True False Costs that fall with increases in the level of investment in current assets are called shortage costs. *…arrow_forwardWhich one of the following statements is correct? A. If a firm decreases its inventory period, its accounts receivable period will also decrease. B. The longer the cash cycle, the more cash a firm typically has available to invest. C. A firm would prefer a negative cash cycle over a positive cash cycle. D. Decreasing the inventory period will also decrease the payables period. E. Both the operating cycle and the cash cycle must be positive values.arrow_forwardThe company’s usage of the Baumol model in cash management involves trade-off. A decrease in the optimal transaction size would more likely result from a. Increase of return on marketable securities b. None of the choices is correct c. Increase in the annual demand for cash d. Decrease of debt to asset ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Why do we need accounting?; Author: EconClips;https://www.youtube.com/watch?v=weCXE2wIl90;License: Standard Youtube License