Concept explainers

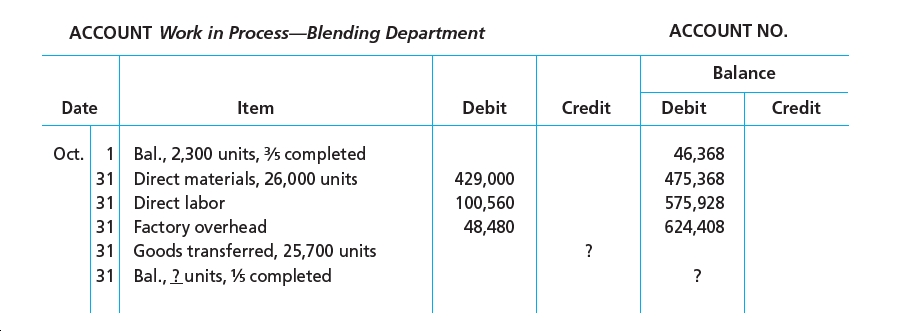

Bavarian Chocolate Company processes chocolate into candy bars. The process begins by placing direct materials (raw chocolate, milk, and sugar) into the Blending Department. All materials are placed into production at the beginning of the blending process. After blending, the milk chocolate is then transferred to the Molding Department, where the milk chocolate is formed into candy bars. The following is a partial work in process account

of the Blending Department at October 31:

Attachment

Instructions

1. Prepare a cost of production report and identify the missing amounts for Work in Process—Blending Department.

2. Assuming that the October 1 work in process inventory includes direct materials of $38,295, determine the increase or decrease in the cost per equivalent unit for direct materials and conversion between September and October.

Trending nowThis is a popular solution!

Step by stepSolved in 10 steps with 8 images

- Hana Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at July 31: ACCOUNT Work in Process—Roasting Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit July 1 Bal., 5,400 units, 1/5 completed 11,448 31 Direct materials, 243,000 units 510,300 521,748 31 Direct labor 97,600 619,348 31 Factory overhead 24,440 643,788 31 Goods transferred, 243,000 units ? 31 Bal., ? units, 2/5 completed ? Required: Question Content Area 1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Roasting Department. If an amount is zero, enter "0". When computing cost per equivalent units, round to two decimal places. Hana Coffee…arrow_forwardDura-Conduit Corporation manufactures plastic conduit that is used in the cable industry.A conduit is a tube that encircles and protects the underground cable. In the process for making the plastic conduit, called extrnsio11, the melted plastic (resin) is pressed through a die to form a tube.Scrap is produced in this process. Information from the cost of production reports for three months is as follows, assuming that inventory remains constant: Assume that there is one-half pound of 1·esin per foot of the finished product. Determine the resin materials cost per foot of finished product for each Round to the nearest whole cent. Determine the ratio of the number of resin pounds output in conduit by the number of pounds input into the process for each month. Round percentages to one decimal pl Interpret the resin materials cost per foot for the three months.Use the information in (a) and (b) to explain what is happening. Determine the conversion cost per foot of finished product…arrow_forwardTerminal Industries (TI) produces a product using three departments: Mixing, Processing, and Filtering. New material is added only in the Mixing Department. The following information is given for the Processing Department for August. TI uses process costing. WIP Inventory Processing Department: August 1 Quantity (60% complete) Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total WIP cost: August 1 Current production and costs (August) Units started Current costs Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total current cost: August WIP Inventory Processing Department (August 31) Quantity (20 % complete) Transferred-in costs (from Mixing Department) Conversion costs (Processing Department) Total WIP cost: August 31 Flow of units: Units to be accounted for: Beginning WIP inventory Units started this period Total units to account for Units accounted for: Completed and transferred out Units in ending…arrow_forward

- Christie's Co. manufactures cookies. The company has two departments, Mixing and Baking. For the Baking Department, material is added at the beginning of the process. Work happens evenly throughout the process, so Conversion Costs are added evenly to the product. Once mixing is complete, the cookies pieces are immediately transferred to the Baking Department. Once the baking is complete, the final product is transferred to Finished Goods Inventory. Data for the Baking Department is as follows: Units Transfer $ DirectMaterials $ % Complete Conv Costs % Complete Opening WIP 550 $3,500 $2,800 100% $2,100 30% New units & Costs 2,000 $12,300 $8,100 $14,000 Ending WIP 680 ??? 65% Calculate the physical and equivalent units for Transferred-In, Direct Materials and Conversion Costsarrow_forwardWhite Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. The balance in the account Work in Process—Sifting Department was as follows on July 1:Work in Process—Sifting Department (900 units, 3/5 completed) on July 1Cost Source Dollar AmountDirect Materials (900 x $3.15) $2,835Conversion (900 x 3/5 x $0.30) 162Total Materials and Conversion 2,997The following costs were charged to Work in Process—Sifting Department during July:Work in Process—Sifting DepartmentCost Source Dollar AmountDirect materials transferred from Milling Department: 15,700 units at $2.30 a unit $36,110Direct Labor 5,420Factory Overhead 2,384During July, 15,500 units of flour were completed. Work in Process—Sifting Department on July 31 was 1,100 units, 4/5 completed.Instructionsa. Prepare a cost…arrow_forwardLimpiar Company produces a liquid household cleaning product. The Mixing Department, the first process department, mixes the ingredients required for the cleaning product. The following data are for May: Work in process, May 1 Quarts started Quarts transferred out Quarts in EWIP Direct materials cost Direct labor cost Overhead applied Direct materials are added throughout the process. Ending inventory is 40 percent complete with respect to direct labor and overhead. Required: Prepare a production report for the Mixing Department for May. If an answer is zero, enter "0". Limpiar Company Mixing Department Production Report for May Unit Information Units to account for: 270,000 225,000 45,000 $1,437,000 $169,000 $338,000 Total units to account for Units accounted for: Total units accounted for Work completed Physical Flow Equivalent Unitsarrow_forward

- Vishnuarrow_forwardSheridan Company manufactures pizza sauce through two production departments: Cooking and Canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits. Beginning work in process Direct materials Direct labor Manufacturing overhead Costs transferred in April 30 30 Cooking 30 $0 30 23,940 9,690 35,910 Journalize the April transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Canning $4,560 Date Account Titles and Explanation 10,260 (To record materials used) 7,980 29,480 60,420 (To assign direct labour to production) (To assign overhead to production) (To record transfer of units to the Canning Department) Debit Creditarrow_forwardManjiarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardAlchemy Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments Mixing, Refining, and Packaging. On January 1, the first department-Mixing-had no beginning inventory. During January, 52,000 fl. oz. of chemicals were started in production. Of these, 36,000 fl. oz. were completed and 16,000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process. The weighted average method is used. At the end of the month, Alchemy calculated equivalent units of production. The ending inventory in the Mixing Department was 70% complete with respect to conversion costs. With respect to direct materials, what is the number of equivalent units of production in the ending inventory? OA. 16,000 equivalent units B. 36,000 equivalent units OC. 52,000 equivalent units OD. 11,200 equivalent units ***arrow_forwardDengo Co. makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Beginning work in process inventory.. Units started and completed... Units completed and transferred out... Ending work in process inventory.... [continued on next page] Units 3,000 19,200 22,200 2,400 [continued from previous page] Required Direct Materials Percent Complete 100% 100% Chapter 16 Process Costing and Analysis Conversion Percent Complete 40% 80% Problem 16-7Aª FIFO: Cost per equivalent unit; costs assigned to products C2 Beginning work in process.. Costs added this period Direct materials. Conversion....... Total costs to account for... $248,400 1,082,970 $ 120,870 1,331,370 $1,452,240 1. Compute equivalent units of production for both direct materials and conversion. 2. Compute…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education