Concept explainers

White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour.

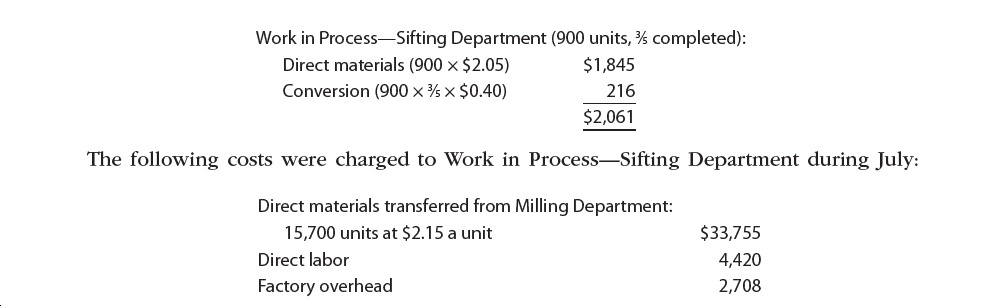

The balance in the account Work in Process—Sifting Department was as follows on July 1:

Attachment

During July, 15,500 units of flour were completed. Work in Process—Sifting Department on July 31 was 1,100 units, 4⁄5 completed.

Instructions

1. Prepare a cost of production report for the Sifting Department for July.

2.

3. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs.

4. Discuss the uses of the cost of production report and the results of part (3).

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 6 images

- Units of production data for the two departments of Pacific Cable and Wire Company for November of the current fiscal year are as follows: Drawing Department Winding Department 5,700 units, 35% completed 1,700 units, 90% completed Work in process, November 1 Completed and transferred to next processing department during November Work in process, November 30 4,300 units, 60% completed 2,300 units, 20% completed a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for November for the Drawing Department. If an amount is zero, enter in "0". Drawing Department Direct Materials and Conversion Equivalent Units of Production For November Inventory in process, November 1 Started and completed in November Transferred to Winding Department in November Inventory in process, November 30 Total 78,100 units Inventory in process, November 1 Started and completed in November Transferred to finished…arrow_forwardCarlberg Company has two manufacturing departments, Assembly and Painting. The Assembly department started 12,300 units during November. The following production activity in both units and costs refers to the Assembly department's November activities. Assembly Department Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Cost of beginning work in process Direct materials Conversion Costs added this month Direct materials Conversion Beginning work in process To complete beginning work in process Direct materials Conversion Started and completed Direct materials Conversion Completed and transferred out Ending work in process Direct materials Conversion Units 3,200 12,300 10, 200 5,300 Total costs accounted for Percent Complete for Direct Materials 75% $ 1,143 624 1,143 13,827 17,856 CARLBERG COMPANY Cost assignment-FIFO EUP Assign costs to the Assembly department's output-specifically, the units transferred…arrow_forwardRadford Products adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of January is available. Units started in January 892,000 Units completed in January 916,000 Work in process, January 1 (25% complete with respect to conversion) 97,000 Work in process, January 31 (40% complete with respect to conversion) 73,000. Compute the equivalent units for materials costs and for conversion costs using the FIFO method.arrow_forward

- White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. The balance in the account Work in Process—Sifting Department was as follows on July 1:Work in Process—Sifting Department (900 units, 3/5 completed) on July 1Cost Source Dollar AmountDirect Materials (900 x $3.15) $2,835Conversion (900 x 3/5 x $0.30) 162Total Materials and Conversion 2,997The following costs were charged to Work in Process—Sifting Department during July:Work in Process—Sifting DepartmentCost Source Dollar AmountDirect materials transferred from Milling Department: 15,700 units at $2.30 a unit $36,110Direct Labor 5,420Factory Overhead 2,384During July, 15,500 units of flour were completed. Work in Process—Sifting Department on July 31 was 1,100 units, 4/5 completed.Instructionsa. Prepare a cost…arrow_forwardSuper Sports Drinks, Inc. has two departments: Mixing and Bottling. Direct materials are added at the beginning of the mixing process and at the end of the bottling process. Conversions costs are added evenly throughout each process. Data for the month of May for the Mixing Department are as follows: Units Amount Beginning Work-in-Process Inventory 0 units Started in production 8,150 units Completed and transferred out to Bottling 4,200 units Ending Work-in-Process Inventory 60% through mixing process 3,950 units Costs Amount Beginning Work-in-Process Inventory $0.00 Costs added during May: Direct Materials $8,581 Direct Labor $2,153 Manufacturing overhead allocated $4,470 Total costs added during May $15,204 Complete the production report for the month of May.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).Super Sports Drinks, Inc. Equivalent Units UNITS Whole Units Transferred…arrow_forwardThe Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process.Description Dollar amountWork in process, January 1, 1,400 units, 75% completed $22,960Direct materials (1,400 x $13) $18,200Conversion (1,400 x 12) 16,800Total direct materials and conversion 35,000Materials added during January from weaving department, 58,000 units 745,000Direct labor for January 134,550Factory overhead for January 151,661Goods finished during January (includes goods in process, January 1), 56,200 units ?Work in process, January 31, 3,200 units, 30% completed ?a. Find the missing values in the last two rowsb. Prepare a cost of production report for the Cutting Department. c. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (Decemberarrow_forward

- Super Sports Drinks, Inc. has two departments: Mixing and Bottling. Direct materials are added at the beginning of the mixing process and at the end of the bottling process. Conversions costs are added evenly throughout each process. Data for the month of May for the Mixing Department are as follows: Units Amount Beginning Work-in-Process Inventory 0 units Started in production 7,780 units Completed and transferred out to Bottling 4,110 units Ending Work-in-Process Inventory 60% through mixing process 3,670 units Costs Amount Beginning Work-in-Process Inventory $0.00 Costs added during May: Direct Materials $8,531 Direct Labor $2,264 Manufacturing overhead allocated $4,680 Total costs added during May $15,475 Complete the production report for the month of May.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forwardFriedman Company has a production process that involves three processes. Units move through the processes in this order: cutting, stamping, and then polishing. The company had the following transactions in November: View the transactions. Prepare the joumal entries for Friedman Company. (Record debits first, then credits. Exclude explanations from journal entries.) 1. Cost of units completed in the Cutting Department, $14,000 Date Nov. 30 Accounts Debit Credit Transactions 1. Cost of units completed in the Cutting Department, $14,000 2. Cost of units completed in the Stamping Department, $28,000 $39,000 3. Cost of units completed in the Polishing Department, 4. Sales on account, $40,000 5. Cost of goods sold is 80% of sales - Xarrow_forwardRSTN Company produces its product in two sequential processing departments. During October, the first process finished and transferred 295,000 units of its product to the second process. Of these units, 34,000 were in process at the beginning of the month and 261,000 were started and completed during the month. At month-end, 27,500 units were in process. Compute the number of equivalent units of production for direct materials for the first process for October under each of the following three separate assumptions using the FIFO method. 1 All direct mastarrow_forward

- RSTN Company produces its product in two sequential processing departments. During October, the first process finished and transferred 295,000 units of its product to the second process. Of these units, 34,000 were in process at the beginning of the month and 261,000 were started and completed during the month. At month-end, 27,500 units were in process. Compute the number of equivalent units of production for direct materials for the first process for October under each of the following three separate assumptions using the FIFO method. 1 All direct mastarrow_forwardThe towson company has gathered the following information for the month of September pertaining to its use of materials in Work in Process; beginning inventory had 4,500 (equivalent units of production) valued at $13,500; $202,000 of materials were added during th emonth ending inventory consisted of 16,000 (equivalent units of production) and 50,000 units were completed and transfered to the next department. What is the FIFO cost per equivalent units of production of materials added for the month of september? Round to the nearest $.001arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education