FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

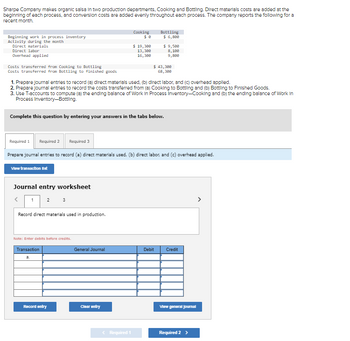

Transcribed Image Text:Sharpe Company makes organic salsa in two production departments, Cooking and Bottling. Direct materials costs are added at the

beginning of each process, and conversion costs are added evenly throughout each process. The company reports the following for a

recent month.

Beginning work in process inventory

Activity during the month

Direct materials

Direct labor

Overhead applied

Costs transferred from Cooking to Bottling

Costs transferred from Bottling to finished goods

View transaction list

Journal entry worksheet

<

2 3

1. Prepare journal entries to record (a) direct materials used. (b) direct labor, and (c) overhead applied.

2. Prepare journal entries to record the costs transferred from (a) Cooking to Bottling and (b) Bottling to Finished Goods.

3. Use T-accounts to compute (a) the ending balance of Work in Process Inventory-Cooking and (b) the ending balance of Work In

Process Inventory-Bottling.

Complete this question by entering your answers in the tabs below.

1

Record direct materials used in production.

Required 1 Required 2

Required 3

Prepare journal entries to record (a) direct materials used, (b) direct labor, and (c) overhead applied.

Note: Enter debits before credits.

Transaction

a.

Record entry

Cooking

General Journal

$ 19,300

13,300

16,300

Clear entry

< Required 1

Bottling

$ 6,800

$ 9,500

8,100

9,800

$ 43,300

68,300

Debit

Credit

View general Journal

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Use the following information for the Exercises below. (Algo) Skip to question [The following information applies to the questions displayed below.]The first production department of Stone Incorporated reports the following for April. Units Direct Materials Conversion Percent Complete Percent Complete Beginning work in process inventory 82,000 70% 30% Units started this period 432,000 Completed and transferred out 410,000 Ending work in process inventory 104,000 85% 35% Exercise 3-11A (Algo) FIFO: Costs assigned to output LO C2 The production department had the cost information below. Beginning work in process inventory Direct materials $ 206,850 Conversion 35,490 $ 242,340 Costs added this period Direct materials 1,512,630 Conversion 991,230 2,503,860 Total costs to account for $ 2,746,200 (a) Calculate the costs per equivalent unit of production for both direct materials and conversion for the…arrow_forwardPlease answer in proper format with all working clearlyNote : Every entry should have narration pleasearrow_forwardHansabenarrow_forward

- At Rebecca's Company, direct materials direct materials are added at the start of the process and conversion costs Conversion cost are added evenly during the process. Company is using FIFO Method. The following is given for a baking department for month of May: Physical Units Beginning Work in process inventory (CC 75% complete) 12,000 Units started during current month 74,000 Units completed and transferred out during current month: 65,000 Ending Work in process inventory (CC 80% complete) 18,000 Inspection occurs when production is 100 percent completed. Normal spoilage is 4 percent of good units that successfully pass the inspection point in current month. BWIP cost direct materials was $216,000 and conversion cost was $27,000 Cost added during the month, direct materials 1,346,800 and conversion cost was 234,880 Compute total normal spoilage cost? PLease help.arrow_forwardCrane Company manufactures pizza sauce through two production departments: Cooking and Canning. In each process, materials and conversion costs are incurred evenly throughout the process. For the month of April, the work in process inventory accounts show the following debits. Beginning work in process Direct materials Direct labor Manufacturing overhead Costs transferred in Cooking $0 17,220 6,970 25,830 Canning $3,280 7,380 5,740 21,160 43,460 Journalize the April transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardSuper Sports Drinks, Inc. has two departments: Mixing and Bottling. Direct materials are added at the beginning of the mixing process and at the end of the bottling process. Conversions costs are added evenly throughout each process. Data for the month of May for the Mixing Department are as follows: Units Amount Beginning Work-in-Process Inventory 0 units Started in production 7,780 units Completed and transferred out to Bottling 4,110 units Ending Work-in-Process Inventory 60% through mixing process 3,670 units Costs Amount Beginning Work-in-Process Inventory $0.00 Costs added during May: Direct Materials $8,531 Direct Labor $2,264 Manufacturing overhead allocated $4,680 Total costs added during May $15,475 Complete the production report for the month of May.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forward

- Betty DeRose, Inc. operates two departments, the handling department and the packaging department. During April, the handling department reported the following information: work in process, April 1 units started during April work in process, April 30 work in process, April 1 costs added during April total costs units Calculate the conversion costing method. 27,000 59,000 34,000 % complete DM 60% 70% The cost of beginning work in process and the costs added during April were as follows: % complete 85% 40% conversion Conversion $191,175 $208.985 $400,160 DM $ 25,310 $190.720 $216,030 unit cost using the weighted average process Total cost $216,485 $399,705 $616,190arrow_forwardAzule Company manufactures in two sequential processes, Cutting and Binding. The two processes r recent month. Beginning work in process inventory costs added this period Direct materials Conversion cutting $ 3,445 Transferred from cutting to Binding Transferred from Binding to finished goods Ending work in process inventory 8,240 11, 100 Cutting Binding $ 6,426 Determine the ending balances in the Work in Process Inventory accounts for Cutting and for Binding in Process Inventory for both Cutting and for Binding. tatou 6,356 18,575 Binding $ 15,685 30,000arrow_forwardSubject: acountingarrow_forward

- Question Pierce Co. manufactures a single product that goes through two processes — mixing and cooking. The following data pertains to the Mixing Department for September. Work-in-process inventory, September 1 38,000 units Conversion — 60% completed Work-in-process inventory, September 30 24,000 units Conversion — 40% completed Units started into production 86,000 units Units completed and transferred out ? units Costs: Work-in-process inventory, September 1 Material R $122,300 Material S 143,780 Conversion 194,550 Costs added during September: Material R 409,660 Material S 246,820 Conversion 526,618 Material R is added at the beginning of work in the Mixing Department. Material S is also added in the Mixing Department, but not until units of product are thirty percent completed with regard to conversion.…arrow_forwardGreat Pasta Company manufactures a single product that goes through two processes-mixing and cooking. The following data pertains to the Mixing Department for September Work-in-process Inventory September 1 Conversion complete Work-in-process inventory September 38 Conversion complete Units started into production in September Units completed and transferred out) Costs Work-in-process inventory September 1 Material P Material Q Conversion Costs added in September Material P Material Q Conversion 31,000 units 70% 19,000 units 50% 87,000 ? units $ 146,000 134,000 146,000 $ 219,000 200,000 430,800 Material P is added at the beginning of work in the Mixing Department. Material Q is also added in the Moxing Department, but not until units of product are forty percent completed with regard to conversion. Conversion costs are incurred uniformly during the process. Cost per equivalent unit for Material P under the weighted average method is calculated to be:arrow_forwardsd subject-Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education