Concept explainers

1.

Allocate the company’s service department costs using the direct method combined with dual allocation.

1.

Explanation of Solution

Service department: A service department is a division in an organization which is not involved directly in producing the goods or services of an organization. But, the service department also offers a service that aids the organization to take place the goods or services that are produced.

Allocate the company’s service department costs using the direct method combined with dual allocation as follows:

Variable costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $50,000 | $22,222 | $27,778 | ||

| Maintenance | 80,000 | 37,333 | 42,667 | ||

| Computer aided design | 50,000 | 37,500 | 12,500 | ||

| Total | $180,000 | $97,055 | $82,945 | ||

| Grand total | $830,000 | ||||

Table (1)

Note:

The proportions are based on short-run usage.

Fixed costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $200,000 | $82,353 | $117,647 | ||

| Maintenance | 150,000 | 100,000 | 50,000 | ||

| Computer aided design | 300,000 | 240,000 | 60,000 | ||

| Total | $650,000 | $422,353 | $227,647 | ||

| Grand total | $650,000 | ||||

Table (2)

Note:

The proportions are based on long-run usage.

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 97,055 | $ 82,945 |

| Fixed costs | 422,353 | 227,647 |

| Total costs | $519,408 | $310,592 |

| Grand total | 830,000 | |

Table (3)

2.

Allocate the company’s service department costs using the step-down method combined with dual allocation.

2.

Explanation of Solution

Allocate the company’s service department costs using the step-down method combined with dual allocation:

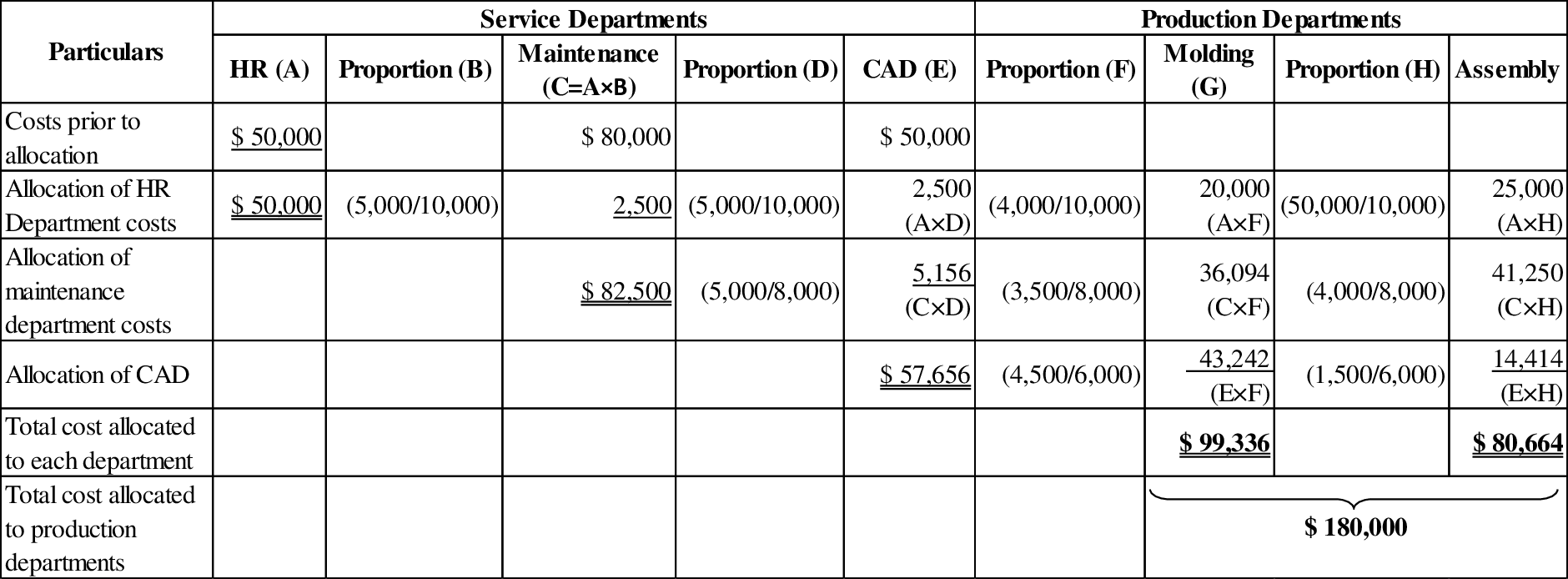

Variable costs:

Table (4)

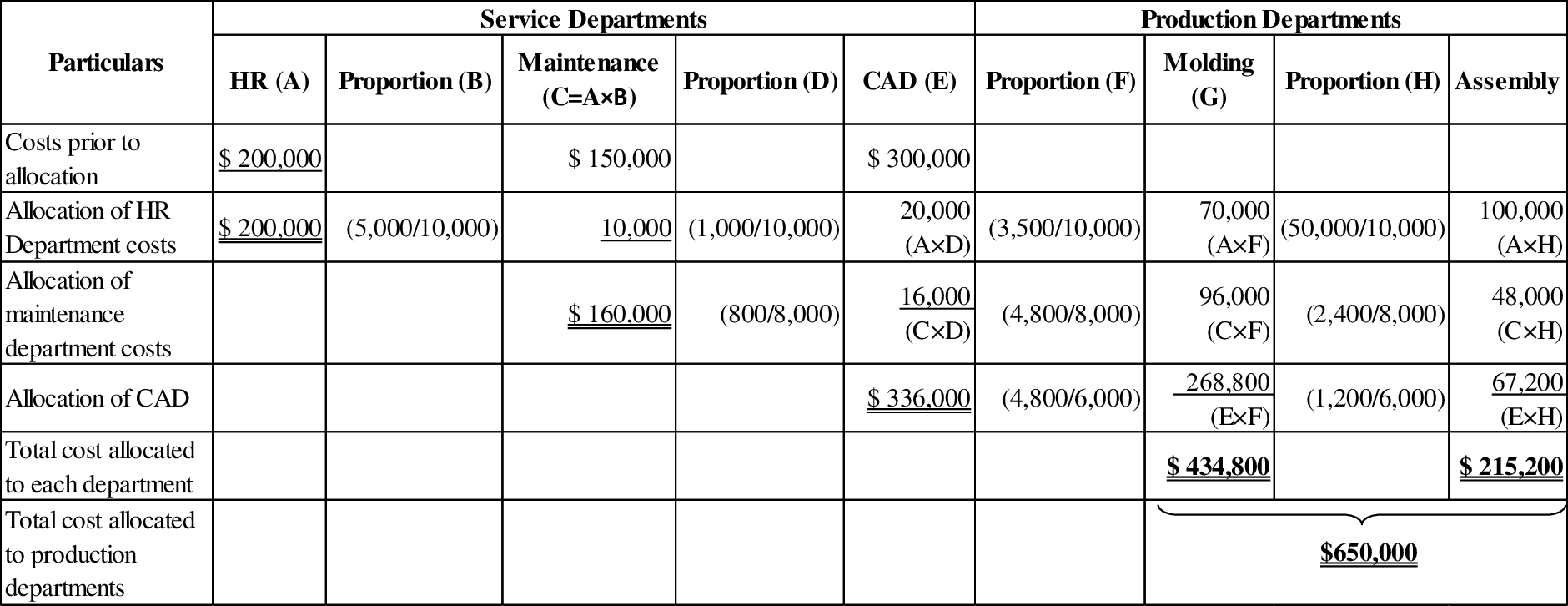

Fixed costs:

Table (5)

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 99,336 | $80,664 |

| Fixed costs | 434,800 | 215,200 |

| Total costs | $534,136 | $295,864 |

| Grand total | 830,000 | |

Table (6)

Want to see more full solutions like this?

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- The management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forwardOxmoor Corporation has two service departments (Maintenance and Human Resources) and three production departments (Machining, Assembly, and Finishing). The two service departments service the production departments as well as each other, and studies have shown that Maintenance provides the greater amount of service. On the basis of this information, which of the following cost allocations would likely occur under the step-down method? Maintenance cost would be allocated to Finishing. Machining cost would be allocated to Assembly. Maintenance cost would be allocated to Human Resources. Human Resources cost would be allocated to Maintenance. Both maintenance cost would be allocated to Finishing and maintenance cost would be allocated to Human Resources.arrow_forwardYou have been asked by management to classify the costs associated with the start-up of this new product line. Using the cost information provided below, classify each cost under the appropriate heading according to the chart provided below. Note that some costs may be classified under more than one heading. For example, a cost may be a fixed cost and a period cost. Name of cost Variable Cost Fixed Cost Direct Materials Direct Labor Factory Overhead Period Cost Prime Cost Conversion Cost Carlson “New Product” Cost Information Cost Amount Cost Type Depreciation on Building (annual) $ 10,000 Direct Labor Cost (per unit) $ 75 Direct Materials Cost (per unit) $ 60 Factory Utilities (per unit) $ 8 Indirect Materials (per unit) $ 4 Interest on Investments (annual) $3,000 Machinery Rental (monthly) $ 6,000 Marketing (annual) $ 35,000 Rent from Tenant (annual) $40,000…arrow_forward

- 1. Describe the key features of the reciprocal method. 2. Allocate the support departments' costs (human resources and information systems) to the two operating departments using the reciprocal method. Use (a) linear equations and (b) repeated iterations. 3. In the case presented in this exercise, which method (direct, step-down, or reciprocal) would you recommend? Why? Direct allocation data Support Departments Operating Departments HR Info. Systems Corporate Consumer Total Costs incurred $90,000 $227,000 $994,000 $484,000 $1,795,000 Allocation of HR costs (90,000) 49,500 40,500 Allocation of Info. Systems costs (227,000) 158,900 68,100 Total budgeted costs of operating departments $0 $0 $1,202,400 $592,600 $1,795,000 A B C D E 1 SUPPORT DEPARTMENTS OPERATING DEPARTMENTS 2 Human Resources Information Systems…arrow_forwardThe following data have been extracted from the records of Puzzle Incorporated: Production level, in units Variable costs Fixed costs Mixed costs Total costs Required A Required B Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high-low method. c. Calculate the total cost that would be incurred for the production of 12,880 units. d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c. Required C Production level, in units Variable costs Fixed costs Mixed costs Total costs Complete this question by entering your answers in the tabs below. Calculate the missing costs. Note: Do not round intermediate calculations. February 9,200 $ 19,320 ? 16,312 $ 71,532 February 9,200 $ 19,320 $ 2 X 16,312 $ 71,532 Required D August August 20, 240 $? 35,900 ? $ 106,970 Answer is not complete. 20,240 34,255 35,900 52,475 $ 106,970arrow_forwardConsider the business application," filing excess capacity 'below cost'. As noted there, the determination of cost depends on the way in which cost of delivery services are allocated to different customers. Assume that USPS has to customers people who made first class letters and business that ship packages to customers. Management at USPS wants to understand how profitable each customer Group is. how would you recommend the costs of the USPS network (Trucks,buildings,carriers and so on)be allocated to these two customers to answer that question?arrow_forward

- Required information [The following information applies to the questions displayed below.] Data Performance, a computer software consulting company, has three major functional areas: computer programming, information systems consulting, and software training. Carol Bingham, a pricing analyst, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Carol is considering three different methods of the departmental allocation approach to allocate overhead costs: the direct method, the step method, and the reciprocal method. She assembled the following data from the two service departments, information systems and facilities: a. b. Budgeted overhead (base) Information Systems (computer hours) Facilities (square feet) C. Service Departments Information Systems $ 368,000 240 Direct Method Step Method (Information Systems Goes First) Step Method (Facilities Goes First) Reciprocal method Computer…arrow_forwardAssume that a company has recently switched to JIT manufacturing. Each manufacturing cell produces a single product or major subassembly. Cell workers have been trained to perform a variety of tasks. Additionally, many services have been decentralized. Costs are assigned to products using direct tracing, driver tracing, and allocation. For each cost listed, indicate the most likely product cost assignment method used before JIT and after JIT. Set up a table with three columns: Cost Item, Before JIT, and After JIT. You may assume that direct tracing is used whenever possible, followed by driver tracing, with allocation being the method of last resort. Inspection costs Power to heat, light, and cool plant Minor repairs on production equipment Salary of production supervisor (department/cell) Oil to lubricate machinery Salary of plant supervisor Costs to set up machinery Salaries of janitors Power to operate production equipment Taxes on plant and equipment Depreciation on production…arrow_forwardThe graphs below represent cost behavior patterns that might occur in a company’s cost structure. The vertical axis represents total cost, and the horizontal axis represents activity output Required:For each of the following situations, choose the graph from the group a–1 that best illustrates the cost pattern involved. Also, for each situation, identify the driver that measures activity output.1. The cost of power when a fixed fee of $500 per month is charged plus an additional charge of $0.12 per kilowatt-hour used.2. Commissions paid to sales representatives. Commissions are paid at the rate of 5 percent of sales made up to total annual sales of $500,000, and 7 percent of sales above $500,000.3. A part purchased from an outside supplier costs $12 per part for the first 3,000 parts and $10 per part for all parts purchased in excess of 3,000 units.4. The cost of surgical gloves, which are purchased in increments of 100 units (gloves come in boxes of 100 pairs).5. The cost of tuition…arrow_forward

- 2. Based on your response in part (1), determine the total costs allocated from each support department to each production department using the sequential method. Maintenance Molding Assembly Department Department Department Personnel Department cost allocation $ 1,500 X 24 X Maintenance Department cost allocation$ 7,740 3. Which allocation method is usually the most accurate? a. Direct method. b. Reciprocal method. c. Sequential method. d. None of the above. What is a potential disadvantage of the reciprocal method? a. It is the most complex method of cost allocation. b. Both fixed and variable costs are allocated based on the computed cost base. c. It considers the support department cost as its own department cost. d. All the above. aarrow_forwardInstructions: Read and analyze the scenario below. Write your answers on the spaces provided. In the Interesting box, write down how each costing method would contribute in achieving the main objective of Expedia Industries. In the My Decision box, write down your Recta recommendation about the most effective costing approach that will resolve the problem in the given scenario using one (1) between the two (2) costing methods being compared. Scenario: Expedia Industries Expedia Industries is the largest supplier and manufacturer of modern women's clothing in the United States. The main objective of the company is to establish a costing procedure that will monitor the inflow and outflow of their raw materials relative in their production of clothes. The board members of the company have separate views in employing FIFO costing method or the Moving Average costing method since according to most of them, their major raw material which is cotton doesn't even have an expiration date, and…arrow_forwardEisenhower Services, Inc., a management consulting firm, has been using a single predetermined overhead allocation rate with direct labor hours as the allocation pase to allocate overhead costs. The president of Eisenhower decided to develop an ABC system to more accurately allocate the indirect costs. She identified two activities related to the total indirect costs-travel and information technology (IT) support. The other relevant details are given below: Estimated quantity of allocation base Activity Allocation base Estimated costs 1,800 miles 7,400 DLH. Travel $10,000 72,000 $82,000 Miles driven IT Support Direct labor hours Total During the current month, Eisenhower's consultants spent 240 labor hours for Miller, Inc. The job required the professionals to travel 360 miles in total. Direct Labor i billed at $55 per hour. Determine the total cost of the consulting job using the ABC system. (Round any intermediate calculations to the nearest cent and your final answer to thé nearest…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning