FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

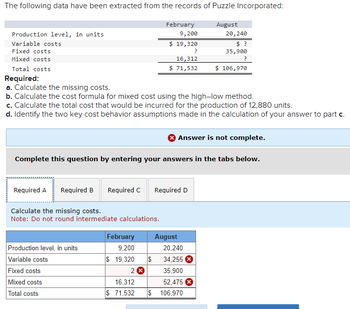

Transcribed Image Text:The following data have been extracted from the records of Puzzle Incorporated:

Production level, in units

Variable costs

Fixed costs

Mixed costs

Total costs

Required A Required B

Required:

a. Calculate the missing costs.

b. Calculate the cost formula for mixed cost using the high-low method.

c. Calculate the total cost that would be incurred for the production of 12,880 units.

d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c.

Required C

Production level, in units

Variable costs

Fixed costs

Mixed costs

Total costs

Complete this question by entering your answers in the tabs below.

Calculate the missing costs.

Note: Do not round intermediate calculations.

February

9,200

$ 19,320

?

16,312

$ 71,532

February

9,200

$ 19,320 $

2 X

16,312

$ 71,532

Required D

August

August

20, 240

$?

35,900

?

$ 106,970

Answer is not complete.

20,240

34,255

35,900

52,475

$ 106,970

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The JAG Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. JAG Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. The following are data from the most recent periods: Cost Hours $25,000 5,025 25,100 4,000 34,000 7,515 60,370 15,500 38,000 9.500 Required: (a) Using the high-low method, estimate the cost function. Round to two decimal places. Show work to receive partial credit!! (b) Calculate the estimated total costs at an operating level of 6,000 hours. Show work to receive partial credit!!!arrow_forward1. Top-down versus bottom-up estimates. pts. a. Describe the methods and uses of each of the approaches. 2. Compare the advantages and disadvantages of each of the approaches. 3. What are the three types of costs discussed in the text? Define them. 4. For a small project requiring 120 hours at $50/hr and having a direct overhead rate of 40%, calculate the direct cost (Exercise 1 in Chapter 5). To that add indirect costs (G&A) at 20% and then profit at 20% for a total project price. What are the estimated costs for: Design Programming In-house testing Which “approach to estimating” is this? What weaknesses are inherent in this approach? 5. Take another look at Exercise #5. Use Exercise Figure 5.1 on page 160. But now you are asked to do a bottom-up estimate based on the following data and compare it with the top-down estimate of $800,000. If confronted with these two estimates, what, if any, actions would you take? Deliverables Estimated Hours Rate:…arrow_forwardDetermine fixed and variable costs using the high-low method and prepare graph. E2.26 (LO 3) The controller of Furgee Industries has collected the following monthly expense data for use in analyzing the cost behaviour of maintenance costs. Total Maintenance Costs Total Machine Hours Month January February March April May June $2,500 3,000 3,600 4,500 3,200 4,900 300 350 500 690 400 700 Instructions a. Determine the fixed and variable cost components using the high-low method. b. Prepare a graph showing the behaviour of maintenance costs, and identify the fixed and variable cost components. Use 100-hour increments and $1,000 cost increments.arrow_forward

- Given the following cost and activity observations for Leno Enterprises' utilities, use the high-low method to calculate Leno's variable utilities cost per machine hour. September October November December a) £0.08 b) £4.86 c) £0.25 d) £12.50 Cost Machine Hours £4,100 22,000£3,700 18,000£3,900 19,000 £4,500 28,000arrow_forwardThe following data pertain to Royal Lighting Company's oak-clad, contemporary chandelier. Variable manufacturing cost Applied fixed manufacturing cost Variable selling and administrative cost Allocated fixed selling and administrative cost Required: For each of the following cost bases, develop a cost-plus pricing formula that will result in a price of $735 for the oak chandelier. (Round your percentage answers to 2 decimal places (i.e., .1234 should be entered as 12.34).) 1. Variable manufacturing cost 2. Absorption manufacturing cost 3. Total cost 4. Total variable cost $ $ $ $ 735 = 735 735 735 Cost-Plus Pricing Formula + + $350 105 57 87 + + ( ( % % % x % xarrow_forwardPlease help mearrow_forward

- APPLY THE CONCEPTS: Prepare a contribution margin income statement Assume that you are part of the accounting team for Starr Productions. The company has only one product that sells for $40 per unit. Starr estimates total fixed costs to be $3,700. Starr estimates direct materials cost of $12.00 per unit, direct labor costs of $15.00 per unit, and variable overhead costs of $3.00 per unit. The CEO would like to see what the gross margin and operating income will be if 600 units are sold in the next period. Prepare a contribution margin income statement. Starr Productions Contribution Margin Income Statement Sales Less: Variable costs Contribution margin Less: Fixed costs Operating incomearrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment $138,000 Number of setups 120 Ordering materials 21,600 Number of orders 1,200 Machining 107,100 Machine hours 11,900 Receiving 16,740 Receiving hours 930 Silven produces two models of cell phones with the following expected activity demands: Model X 4,600 80 400 Units completed Number of setups Number of orders Machine hours Receiving hours Required: 6,800 310 Model X Model Y Model Y 9,200 40 800 5,100 620 1. Determine the total overhead assigned to each product using the four activity drivers. Total Overhead Assignedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education