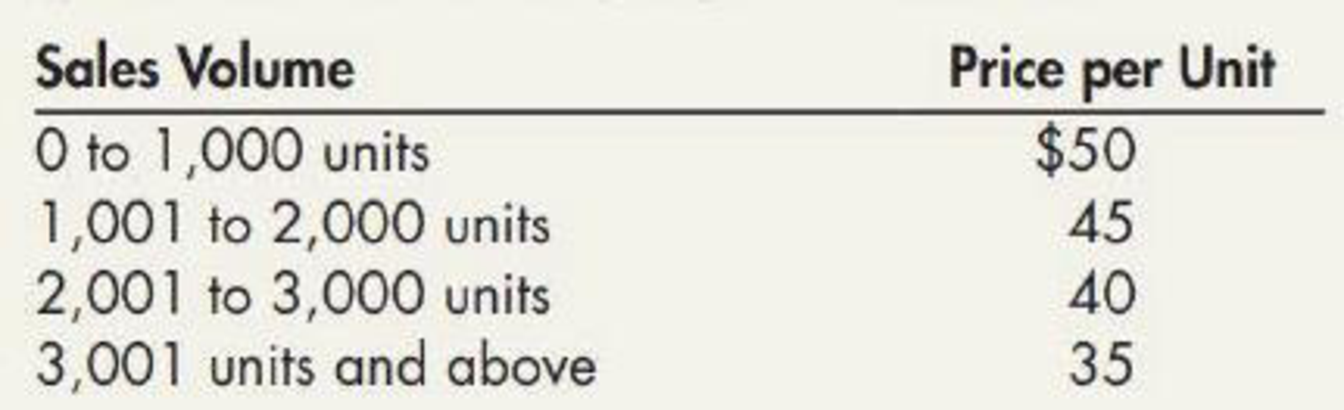

On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular product, the gadget. The contract stipulates that the price per unit will decrease as Save-Mart purchases higher volumes of the gadget, as follows:

The contract states that Save-Mart pays Piper the unit price based on the current sales volume. Once a volume threshold is reached, the price is retroactively reduced to the applicable price per unit. Based on its past experience with similar contracts, Piper believes that the total sales volume for the year will be 1,800 units and uses the most likely amount approach to estimate variable consideration. In addition, Piper concludes it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur once the uncertainty surrounding the variable consideration is resolved.

Required:

1. Determine the transaction price per unit that Piper should use to record revenue.

2. Assume that Save-Mart purchases 800 units in the first quarter of 2019 and 900 units in the second quarter of 2019. Prepare Piper’s journal entries to record the sales in the first and second quarters.

3. Given the higher than expected sales volume in the first half of the year, Piper increases its estimate of the sales volume to 2,800 units. Prepare the

1.

Ascertain the transaction price per unit that is used to record the revenue.

Explanation of Solution

Transaction price:

Transaction price is the amount of consideration that is estimated by the company to be authorized in exchange, for delivering the promised goods and services to the customer. Transaction price is examined by the seller by analyzing the terms of the contract and the normally conducts of the business.

$45 is the transaction price per unit since, sales of 1,800 units is expected and the price per unit with sales volume of 1,001-2,000 units is $45.

2.

Journalize entries to record the sakes made in the first and second quarters.

Explanation of Solution

Contract:

Contract is an agreement among two parties or more parties which includes enforceable obligations and rights. A contract can be written, oral or implied by ordinary business practices.

Journal entry:

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Prepare journal entry for the first quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (1) | 40,000 | ||

| Sales revenue (2) | 36,000 | ||

| Return liability (3) | 4,000 | ||

| (To record the recognition of liability) |

Table (1)

- Cash is an asset and it is increased. Therefore, debit cash account by $40,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $36,000.

- Return liability is increased. Therefore, credit returns liability account by $4,000.

Prepare journal entry for the second quarter:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cash (Balancing figure) | 36,500 | ||

| Refund liability (3) | 4,000 | ||

| Sales revenue (4) | 40,500 | ||

| (To record the payment of refund) |

Table (2)

- Cash is an asset and it is increased. Therefore, debit cash account by $36,500.

- Refund liability is decreased. Therefore, debit returns liability account by $4,000.

- Sales revenue is a component of stockholders’ equity and it is increased. Therefore, credit sales revenue account by $40,500.

Working notes:

(1)Calculate the amount of cash during the first quarter:

Note: $50 is the price per unit for the sales of 0 to 1,000 units.

(2)Calculate the amount of sales revenue:

Note: $45 is the price per unit for the sales of 1,001 to 2,000 units.

(3)Calculate the amount of refund liability:

Note: $5 is the difference between

(4)Calculate the amount of sales revenue:

3.

Journalize entries to record the change in estimate.

Explanation of Solution

Prepare journal entry:

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Sales revenue (5) | 8,500 | ||

| Refund liability | 8,500 | ||

| ( To record the refund liability) |

Table (3)

- Sales revenue is a component of stockholders’ equity and it is decreased. Therefore, debit sales revenue account by $8,500.

- Refund liability is increased. Therefore, credit returns liability account by $8,500.

Working note:

(5)Calculate the amount of sales revenue:

Note: $5 is the difference between

Want to see more full solutions like this?

Chapter 17 Solutions

Intermediate Accounting: Reporting And Analysis

- Mit Distributors provided the following inventory-related data for the fiscal year: Purchases: $385,000 Purchase Returns and Allowances: $10,200 Purchase Discounts: $4,300 Freight In: $55,000 Beginning Inventory: $72,000 Ending Inventory: $95,500 What is the Cost of Goods Sold (COGS)?arrow_forwardanswer ? general accountingarrow_forwardBrightTech Corp. reported the following cost of goods sold (COGS) figures over three years: • 2023: $3,800,000 • 2022: $3,500,000 • 2021: $3,000,000 If 2021 is the base year, what is the percentage increase in COGS from 2021 to 2023?arrow_forward

- Sun Electronics operates a periodic inventory system. At the beginning of 2022, its inventory was $95,750. During the year, inventory purchases totaled $375,000, and its ending inventory was $110,500. What was the cost of goods sold (COGS) for Sun Electronics in 2022?arrow_forwardi want to this question answer of this general accountingarrow_forwardA clothing retailer provides the following financial data for the year. Determine the cost of goods sold (COGS): ⚫Total Sales: $800,000 • Purchases: $500,000 • Sales Returns: $30,000 • Purchases Returns: $40,000 • Opening Stock Value: $60,000 • Closing Stock Value: $70,000 Administrative Expenses: $250,000arrow_forward

- subject : general accounting questionarrow_forwardBrightTech Inc. had stockholders' equity of $1,200,000 at the beginning of June 2023. During the month, the company reported a net income of $300,000 and declared dividends of $175,000. What was BrightTech Inc.. s stockholders' equity at the end of June 2023?arrow_forwardQuestion 3Footfall Manufacturing Ltd. reports the following financialinformation at the end of the current year: Net Sales $100,000 Debtor's turnover ratio (based on net sales) 2 Inventory turnover ratio 1.25 fixed assets turnover ratio 0.8 Debt to assets ratio 0.6 Net profit margin 5% gross profit margin 25% return on investments 2% Use the given information to fill out the templates for incomestatement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year endingDecember 31, 20XX(in $) Sales 100,000 Cost of goods sold gross profit other expenses earnings before tax tax @ 50% Earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX(in $) Liabilities Amount Assets Amount Equity Net fixed assets long term debt 50,000 Inventory short term debt debtors cash Total Totalarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning