Principles Of Auditing & Other Assurance Services

21st Edition

ISBN: 9781259916984

Author: WHITTINGTON, Ray, Pany, Kurt

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 37FOQ

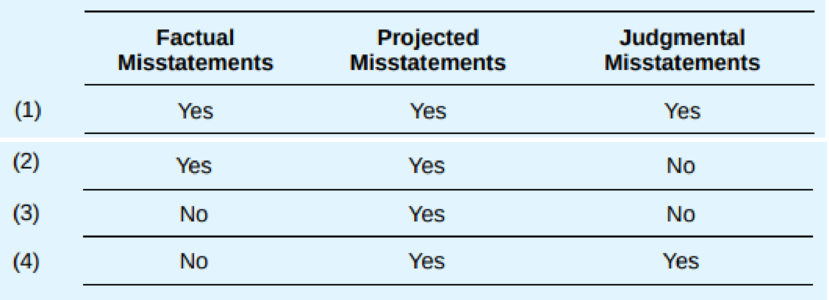

The aggregated misstatement in the financial statements is made up of:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with this problem and accounting

What is the true answer of this question general Accounting

Please help with accounting

Chapter 16 Solutions

Principles Of Auditing & Other Assurance Services

Ch. 16 - Prob. 1RQCh. 16 - Prob. 2RQCh. 16 - Identify three items often misclassified as...Ch. 16 - Prob. 4RQCh. 16 - Prob. 5RQCh. 16 - Prob. 6RQCh. 16 - Prob. 7RQCh. 16 - Prob. 8RQCh. 16 - Prob. 9RQCh. 16 - What safeguards should be employed when the...

Ch. 16 - You are asked by a client to outline the...Ch. 16 - Prob. 12RQCh. 16 - Prob. 13RQCh. 16 - Prob. 14RQCh. 16 - Prob. 15RQCh. 16 - What are loss contingencies? How are such items...Ch. 16 - Prob. 17RQCh. 16 - Prob. 18RQCh. 16 - Prob. 19RQCh. 16 - What is the meaning of the term commitment? Give...Ch. 16 - Prob. 21RQCh. 16 - What are subsequent events?Ch. 16 - Describe the manner in which the auditors evaluate...Ch. 16 - Prob. 24RQCh. 16 - Prob. 25RQCh. 16 - Prob. 26RQCh. 16 - In your audit of the financial statements of Wolfe...Ch. 16 - Prob. 28QRACh. 16 - Prob. 29QRACh. 16 - Prob. 30QRACh. 16 - Prob. 31QRACh. 16 - The auditors opinion on the fairness of financial...Ch. 16 - Prob. 33QRACh. 16 - Prob. 34QRACh. 16 - Prob. 35QRACh. 16 - Prob. 36QRACh. 16 - Prob. 37AOQCh. 16 - Prob. 37BOQCh. 16 - Prob. 37COQCh. 16 - When auditing the statement of cash flows, which...Ch. 16 - The search for unrecorded liabilities for a public...Ch. 16 - The aggregated misstatement in the financial...Ch. 16 - Prob. 37GOQCh. 16 - Prob. 37HOQCh. 16 - Prob. 37IOQCh. 16 - Prob. 37JOQCh. 16 - Prob. 37KOQCh. 16 - Which of the following events occurring on January...Ch. 16 - Prob. 38OQCh. 16 - Prob. 39OQCh. 16 - Prob. 40OQCh. 16 - Match the following terms to the appropriate...Ch. 16 - Prob. 42OQCh. 16 - Prob. 43PCh. 16 - Prob. 44PCh. 16 - Prob. 45PCh. 16 - Prob. 46PCh. 16 - Prob. 47PCh. 16 - Prob. 48PCh. 16 - The audit staff of Adams, Barnes Co. (ABC), CPAs,...Ch. 16 - Prob. 50RDC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For Eckstein Company, the predetermined overhead rate is 118% of direct labor cost. During the month, Eckstein incurred $119,000 in factory labor costs, of which $98,200 is direct labor and $26,400 is indirect labor. The actual overhead incurred was $132,600. Compute the amount of manufacturing overhead applied during the month. Determine the amount of under- or overapplied manufacturing overhead.??arrow_forwardProvide answer with calculationarrow_forwardHello tutor please provide correct answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License