MANAGERIAL ACCOUNTING (LL) W/CONNECT >C<

17th Edition

ISBN: 9781264384150

Author: Garrison

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15.A, Problem 2E

EXERCISE 14A-2 Net Cash Provided by Operating Activities LO14-4

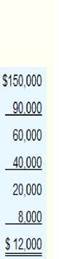

Wiley Company’s income statement for Year 2 follows:

The company’s selling and administrative expense for Year 2 includes $7,500 of

Required:

- Using the direct method, convert the company’s income statement to a cash basis.

- Assume that during Year 2 Wiley had a $9,000 gain on sale of investments and a $3,000 loss on the sale of equipment. Explain how these two transactions would affect your computations in (1) above.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hrs

Skysong Corporation had the following 2025 income statement.

Sales revenue

$186,000

Cost of goods sold

127,000

Gross profit

59,000

Operating expenses (includes depreciation of $22,000)

45,000

Net income

$14,000

The following accounts increased during 2025: Accounts Receivable $13,000, Inventory $12,000, and Accounts Paya

Prepare the cash flows from operating activities section of Skysong's 2025 statement of cash flows using the direct n

SKYSONG CORPORATION

Statement of Cash Flows-Direct Method (Partial)

For the Year Ended December 31, 2025

Cash Flows from Operating Activities

Cash Received from Customers

Cash Payment to Suppliers

Cash Payment for Operating Expenses

$

$

Net Cash Provided by Operating Activities

$

On January 1, 2024, Oriole Ltd. issued bonds with a maturity value of $8.00 million when the market rate of interest was 4%. The

bonds have a coupon (contractual) interest rate of 5% and mature on January 1, 2034. Interest on the bonds is payable semi-annually

on July 1 and January 1 of each year. The company's year end is December 31.

Click here to view the factor table. Present Value of 1

Click here to view the factor table. Present Value of an Annuity of 1

(a)

✓ Your answer is correct.

Calculate the issue price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round

final answer to O decimal places, e.g. 5,275.)

(b)

(c)

Issue price

$

eTextbook and Media

List of Accounts

8654046

Your Answer

Correct Answer (Used)

Attempts: 1 of 3 used

Prepare a bond amortization schedule from the date of issue up to and including January 1, 2027. (Round answers to O decimal

places, e.g. 5,275.)

Date

Jan. 1, 2024

ORIOLE LTD.

Bond Premium…

Chapter 15 Solutions

MANAGERIAL ACCOUNTING (LL) W/CONNECT >C<

Ch. 15.A - Prob. 1ECh. 15.A - EXERCISE 14A-2 Net Cash Provided by Operating...Ch. 15.A - Prob. 3ECh. 15.A - Prob. 4ECh. 15.A -

PROBLEM 14A-5 Prepare and Interpret a Statement...Ch. 15.A - Prob. 6PCh. 15.A - PROBLEM 14A-7 Prepare and Interpret a Statement of...Ch. 15 - Prob. 1QCh. 15 - Prob. 2QCh. 15 - Prob. 3Q

Ch. 15 - Prob. 4QCh. 15 - Prob. 5QCh. 15 - Prob. 6QCh. 15 - Prob. 7QCh. 15 - Prob. 8QCh. 15 - Prob. 9QCh. 15 -

14-10 If the Accounts Receivable balance...Ch. 15 - Prob. 11QCh. 15 - Prob. 12QCh. 15 - Prob. 1F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 3F15Ch. 15 - Prob. 4F15Ch. 15 - Prob. 5F15Ch. 15 - Prob. 6F15Ch. 15 - Ravenna Company is a merchandiser that uses the...Ch. 15 - Prob. 8F15Ch. 15 - Prob. 9F15Ch. 15 - Prob. 10F15Ch. 15 - Prob. 11F15Ch. 15 - Prob. 12F15Ch. 15 - Prob. 13F15Ch. 15 - Prob. 14F15Ch. 15 - Prob. 15F15Ch. 15 - Prob. 1ECh. 15 - EXERCISE 14-2 Net Cash Provided by Operating...Ch. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - Prob. 6ECh. 15 - Prob. 7PCh. 15 - Prob. 8PCh. 15 - Prob. 9PCh. 15 - Prob. 10PCh. 15 - Prob. 11PCh. 15 - Prob. 12PCh. 15 - Prob. 13PCh. 15 - Prob. 14P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. The company's actual labor cost is $114,000 for Procedure 1. Determine the actual cost of direct labor, direct materials, and overhead for each procedure, and the total cost of production for each procedure. Cost makeup of Procedure 1: Direct Labor Direct Materials Overhead Total Cost makeup of Procedure 2: Direct Labor Direct Materials Overhead Totalarrow_forwardRalston Company reports the following information for the 2011 fiscal year: Sales on account $355,000, Accounts Receivable $90,000, Allowance for Doubtful Accounts $3,500. Determine the average number of days it takes Ralston to collect its accounts receivable. A. 80. B. 85. C. 89. D. 98.arrow_forwardZerbel Company, a wholesaler of large, custom-built air conditioning units for commercial buildings, has noticed considerable fluctuation in its shipping expense from month to month: Month January Units Total Shipping Shipped Expense February 7 March April May June 4752368 $2,200 $3,100 $2,600 $1,500 $2,200 $3,000 $3,600 Using the high-low method, estimate the cost formula for shipping expense. Julyarrow_forward

- Que Horton Stores exchanged land and cash of $4,400 for similar land. The book value and the fair value of the land were $90,000 and $100,400, respectively. Assuming that the exchange has commercial substance, Horton would record land-new and a gain/(loss) of: Table 1-59 Land Gain/Loss A. $ 94,400 $ 10,400 B. $1,04,800 $0 C. $ 94,400 $0 D. $1,04,800 $ 10,400 Captionarrow_forwardIn 2014, Wainwright Company has net credit sales of $1,300,000 for the year. It had a beginning accounts receivable (net) balance of $101,000 and an ending accounts receivable (net) balance of $107,000. Compute Wainwright Company's (a) accounts receivable turnover and (b) average collection period in days.arrow_forwardRosenthal Design has daily sales of $59,000. The financial management team determined that a lockbox would reduce the collection time by 1.6 days. Assuming the company can earn 5.2 percent interest per year, what are the savings from the lockbox?arrow_forward

- The Malcolm Company uses a standard cost system in which manufacturing overhead costs are applied to products on the basis of standard direct labor-hours (DLHs). The standards call for 4 hours of direct labor per unit produced. The following data pertain to the company's manufacturing overhead for the month of July: Actual fixed manufacturing overhead costs incurred Denominator activity Number of units produced $28,440 6,325 DLHS 3,800 units $3,140 Unfavorable Budget variance What is the fixed component of the predetermined overhead rate for June? (Round your answer to 2 decimal places.) a. $4.00 b. $4.77 c. $4.11 d. $4.50arrow_forwardThe tax savings from an expense item are $75,000 for a company that spends 25% of its income to taxes. How much does the item cost before tax? a. $250,000 b. $ 200,000 c. $150,000 d. $300,000arrow_forwardThe following items are components of a traditional balance sheet. How much is the total equity of the firm? Long-term debt Common stock Accounts payable Paid in excess $12,000 15,000 8,000 6,000 Accrued interest payable 1,500 Plant and equipment 60,000 Retained earnings 28,000 Accounts receivable 22,000arrow_forward

- Negus Enterprises has an inventory conversion period of 50 days, an average collection period of 35 days, and payables deferral period of 25 days. Assume that the costs of goods sold are 80% of its sales. a) What is the length of the firm's cash conversion cycle? b) If Negus's annual sales are $4,380,000 and all sales are on credit, what is the firm's investment in accounts receivable? c) How many times per year does Negus Enterprises turn over its inventory?arrow_forwardOn November 1, Year 1. Noble Co. borrowed $72,000 from South Bank and signed an 11%, six-month note payable, all due at maturity. The interest on this loan is stated separately. On December 31, Year 1. Noble Co.'s overall liability for this loan amounts to: a. $72,000 b. $73,320 c. $74,640 d. $75,960arrow_forwardCurly and Rita are married, file a joint return, and have two dependent children, ages 11 and 13. Their AGI is $117,000. By how much is their child credit reduced in 2015? a. $0 b. $300 c. $350 d. $700 e. $7,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License