Concept explainers

Omaha Synthetic Fibers Inc. specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. The company has been in business for 20 years and has been profitable each of the past 15 years. Omaha Synthetic Fibers uses a standard-costing system and applies overhead on the basis of direct-labor hours. Management has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 15 percent before income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of $25 per blanket are not likely to be considered.

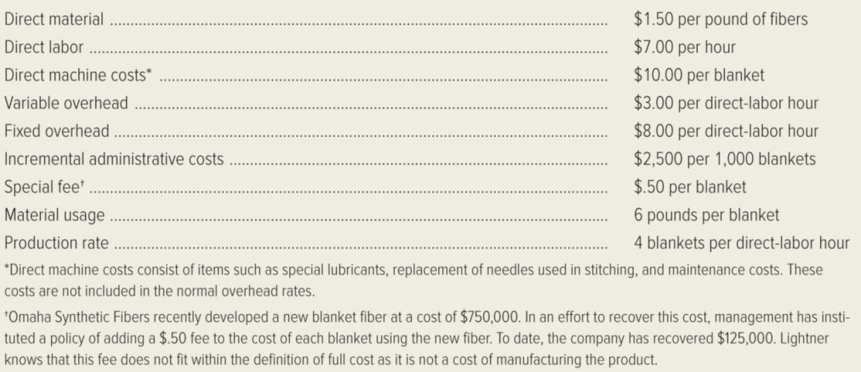

In order to prepare the bid for the 800,000 blankets, Andrea Lightner, director of cost management, has gathered the following information about the costs associated with the production of the blankets.

Required:

- 1. Calculate the minimum price per blanket that Omaha Synthetic Fibers Inc. could bid without reducing the company’s net income.

- 2. Using the full cost criteria and the maximum allowable return specified, calculate Omaha Synthetic Fibers Inc.’s bid price per blanket.

- 3. Independent of your answer to requirement (2), assume that the price per blanket that Omaha Synthetic Fibers Inc. calculated using the cost-plus criteria specified is greater than the maximum bid of $25 per blanket allowed. Discuss the factors that management should consider before deciding whether to submit a bid at the maximum acceptable price of $25 per blanket.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 16 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40 percent of next months sales are in the finished goods inventory. Ingles also purchases sufficient materials to ensure that materials inventory is 60 percent of the following months scheduled production. Ingless sales budget in units for the next quarter is as follows: Ingless ending inventories in units for July 31 are as follows: Required: 1. Calculate the number of tables to be produced during August. 2. Disregarding your response to Requirement 1, assume the required production units for August and September are 2,100 and 1,900, respectively, and the July 31 materials inventory is 4,000 units. Compute the number of table legs to be purchased in August. 3. Assume that Ingles Corporation will produce 2,340 units in September. How many employees will be required for the Assembly Department in September? (Fractional employees are acceptable since employees can be hired on a part-time basis. Assume a 40-hour week and a 4-week month.) (CMA adapted)arrow_forwardHelix Company produces costumes used in the television and movie industries. Recently the company received an ongoing order for Samurai robes to be worn in an upcoming Japanese historical action series made for television. The company uses a standard costing system to assist in the control of costs. According to the standards set for these robes, the factory has a denominator activity level of 780 direct labour-hours each month, which should result in the production of 1,950 robes. The standard costs associated with this level of production are as follows: Per Unit Direct materials Total $ 35,490 of Product $18.20 Direct labour $ 7,020 3.60 Variable manufacturing overhead* Fixed manufacturing overhead* $ 2,340 1.20 $ 4,680 2.40 $25.40 *Based on direct labour-hours During April, the factory worked only 760 direct labour-hours and produced 2,000 robes. The following actual costs were recorded during the month: Per Unit of Direct materials (6,000 metres) Direct labour Total $ 36,000…arrow_forwardRico Company produces custom-made machine parts. Rico recently has implemented an activity-based management (ABM) system with the objective of reducing costs. Rico has begun analyzing each activity to determine ways to increase its efficiency. Setting up equipment was among the first group of activities to be carefully studied. The study revealed that setup hours was a good driver for the activity. During the last year, the company incurred fixed setup costs of $860,200 (salaries of 17 employees). The fixed costs provide a capacity of 39,100 hours (2,300 per employee at practical capacity). The setup activity was viewed as necessary, and the value- added standard was set at 2,300 hours. Actual setup hours used in the most recent period were 37,110. Required: 1. Calculate the volume and unused capacity variances for the setup activity. Enter all amounts as positive values. Volume Variance 22 Unused Capacity Variance $ Show Me How 2. Prepare a report that presents value-added, non varue…arrow_forward

- Deming Incorporated recently implemented an activity-based costing system. Total results from all products manufactured in the current year are: Activity cost pool Total cost Total activity Assembly $7,500 1,500 machine-hours Packaging $3,150 450 number of orders Quality control inspections $900 200 number of inspections Deming manufactures sprinkler heads for commercial applications. Annual production and sales of the Sizzler, one type of its heads, is 2,300 units. The following relates the the most recent year. Annual machine hours 1,000 Annual number of orders…arrow_forwardMarvel Parts, Inc., manufactures auto accessories. One of the company’s products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 990 hours each month to produce 1,980 sets of covers. The standard costs associated with this level of production are: Total Per Setof Covers Direct materials $ 45,738 $ 23.10 Direct labor $ 6,930 3.50 Variable manufacturing overhead (based on direct labor-hours) $ 3,168 1.60 $ 28.20 During August, the factory worked only 1,000 direct labor-hours and produced 2,500 sets of covers. The following actual costs were recorded during the month: Total Per Setof Covers Direct materials (10,000 yards) $ 56,000 $ 22.40 Direct labor $ 9,250 3.70 Variable manufacturing overhead $ 4,500 1.80 $ 27.90 At…arrow_forwardYounger, Inc. manufactures recliners for the hotel industry. It has two products, the Heater and the Massager, and total overhead is $3,160,000. The company plans to manufacture 400 Heaters and 100 Massagers this year. In manufacturing the recliners, the company must perform 600 material moves for the Heater and 400 for the Massager; it processes 900 purchase orders for the Heater and 700 for the Massager; and the company's employees work 1,400 direct labor hours on the Heater product and 3,400 on the Massager. Younger's total material handling costs are $2,000,000 and its total processing costs are $1,160,000. Using ABC, how much overhead would be assigned to the Heater product? Group of answer choices $1,307,500 $1,852,500 $2,238,332 $1,580,000arrow_forward

- Big Trail Running Company has started to produce running apparel in addition to the trail running shoes that they have manufactured for years. They feel that a departmental overhead rate would best reflect their overall manufacturing overhead usage. Based on research the following information was gathered for the upcoming year: Estimated Manufacturing Overhead by Department Trail Running Shoes Running Apparel Machining Department $800,000 Trail Running Shoes 360,000 machine hours 15,000 direct labor hours 65,000 direct labor hours Running Apparel 40,000 machine hours Manufacturing overhead is driven by machine hours for the machining department and direct labor hours for the finishing department. At the end of the year, the following information was gathered related to the production of the trail running shoes and running apparel: Machining Department 362,000 hours Finishing Department 14,500 hours 66,000 hours 37,000 hours Finishing Department $100,000 OA. $156,173 OB. $225,000 OC.…arrow_forwardSleep-tight manufactures mattresses for the hotel industry. it has two products, down and firm and total overhead of 474000. the company plans to manufacture 400 downy mattresses and 100 firm mattresses this year. in manufacturing the mattresses, the company must perform 600 material moves for the downy and 400 for the firm. it processes 900 purchase orders for the downy and 700 for the firm. the companys employee work 1400 direct labor hours on the downy product and 3400 on the firm. sleep tights total material handling costs are 300000 and its total purchasing costs are 174000 using abc how much overhead would be assigned to the downy product? 1. 237,0002. 277,8753. 196,1254. 335,750arrow_forwardMarvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 990 hours each month to produce 1,980 sets of covers. The standard costs associated with this level of production are: Direct materials Total $ 45,738 Direct labor $ 6,930 Per Set of Covers $ 23.10 3.50 Variable manufacturing overhead (based on direct labor-hours) $ 3,168 1.60 $ 28.20 During August, the factory worked only 1,000 direct labor-hours and produced 2,500 sets of covers. The following actual costs were recorded during the month: Direct materials (10,000 yards) Direct labor Variable manufacturing overhead Total $ 56,000 $ 9,250 $ 4,500 Per Set of Covers $22.40 3.70 1.80 $ 27.90 At standard, each set of covers should require 3.3 yards of material. All of the…arrow_forward

- Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a job-order costing system. The capacity of the plant is determined by the capacity of its constraint, which is time on the automated bandsaw that makes finely beveled cuts in wood according to the preprogrammed specifications of each cabinet. The bandsaw can operate up to 184 hours per month. The estimated total manufacturing overhead cost at capacity is $15,088 per month. The company bases its predetermined overhead rate on capacity, so its predetermined overhead rate is $82 per hour of bandsaw use.The results of a recent month’s operations appear below:Sales $ 43,710Beginning inventories $ 0Ending inventories $ 0Direct materials $ 5,380Direct labor $ 8,860Manufacturing overhead incurred $ 14,260Selling and administrative expense $ 8,180Actual hours of bandsaw use 154Required:1-a. Prepare an income statement that records the cost of unused capacity on the income statement…arrow_forwardWixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a job-order costing system. The capacity of the plant is determined by the capacity of its constraint, which is time on the automated bandsaw that makes finely beveled cuts in wood according to the preprogrammed specifications of each cabinet. The bandsaw can operate up to 184 hours per month. The estimated total manufacturing overhead cost at capacity is $15,088 per month. The company bases its predetermined overhead rate on capacity, so its predetermined overhead rate is $82 per hour of bandsaw use. The results of a recent month's operations appear below: Sales Beginning inventories Ending inventories Direct materials Direct labor Manufacturing overhead incurred Selling and administrative expense Actual hours of bandsaw use Required: 1-a. Prepare an income statement for the month. Your income statement should include the cost of unused capacity as a period expense. 1-b. What…arrow_forwardMarvel Parts, Incorporated, manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company uses a standard cost system for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,055 hours each month to produce 2,110 sets of covers. The standard costs associated with this level of production are: Direct materials Total $ 51,273 Per Set of Covers $ 24.30 Direct labor $ 10,550 5.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,853 2.30 $ 31.60 During August, the factory worked only 1,000 direct labor-hours and produced 2,100 sets of covers. The following actual costs were recorded during the month: Per Set of Direct materials (6,800 yards) Direct labor Total $ 49,980. Covers $ 23.80 $ 10,920 5.20 Variable manufacturing overhead $ 5,460 2.60 $ 31.60 At standard, each set of covers should require 3.0 yards of material. All of the…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning