Concept explainers

Badger Valve and Fitting Company, located in southern Wisconsin, manufactures a variety of industrial valves and pipe fittings that are sold to customers in nearby states. Currently, the company is operating at about 70 percent capacity and is earning a satisfactory

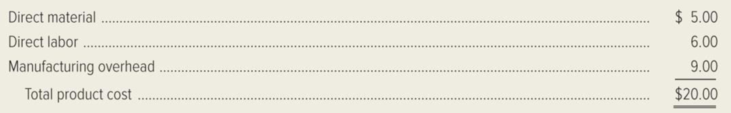

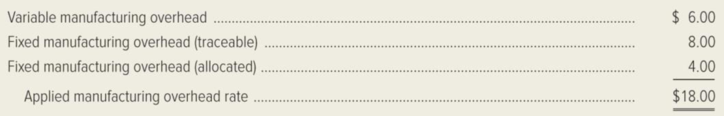

Manufacturing overhead is applied to production at the rate of $18 per standard direct-labor hour. This overhead rate is made up of the following components.

Additional costs incurred in connection with sales of the pressure valve include sales commissions of 5 percent and freight expense of $1.00 per unit. However, the company does not pay sales commission son special orders that come directly to management. In determining selling prices, Badger adds a 40 percent markup to total product cost. This provides a $28 suggested selling price for the pressure valve. The Marketing Department, however, has set the current selling price at $27 in order to maintain market share. Production management believes that it can handle the Glasgow Industries order without disrupting its scheduled production. The order would, however, require additional fixed factory overhead of $12,000 per month in the form of supervision and clerical costs. If management accepts the order, 30,000 pressure valves will be manufactured and shipped to Glasgow Industries each month for the next four months. Glasgow’s management has agreed to pay the shipping charges for the valves.

Required:

- 1. Determine how many direct-labor hours would be required each month to fill the Glasgow Industries order.

- 2. Prepare an analysis showing the impact of accepting the Glasgow Industries order.

- 3. Calculate the minimum unit price that Badger Valve and Fitting Company’s management could accept for the Glasgow Industries order without reducing net income.

- 4. Identify the factors, other than price, that Badger’s management should consider before accepting the Glasgow Industries order.

- 5. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements (2) and (3) above. Show how the solution will change if the following information changes: the direct material and direct labor per unit are $4.90 and $6.10, respectively.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Kleen Corporation, a privately owned and operated single-stream recycling facility, has annual contracts with several cities in the Tri-County Metropolitan Area, Kleen Corporation wants to add a new set of sensors to its existing machinery that will separate plastics and metals from paper and glass materials earlier in the separation process. Two versions of the sensor equipment are available from the Green Corporation. Model 400 has a first cost of $700,000, while Model 1000 costs $1 million. Both have an expected 10% salvage value after their respective useful lives of 6 and 3 years. Assume you work for Kleen Corporation as a project engineer. You have made first-cut estimates of the annual savings (with no annual increases for efficiency) and expenses (AOC with no annual decreases or increases) for both models. Required: a. Perform a ROR analysis using MARR = 5% per year to recommend one of the two models to your president. b. Whether there is any ranking inconsistency present with…arrow_forwardBasuras Waste Disposal Company has a long-term contract with several large cities to collect garbage and trash from residential customers. To facilitate the collection, Basuras places a large plastic container with each household. Because of wear and tear, growth, and other factors, Basuras places about 200,000 new containers each year (about 20% of the total households). Several years ago, Basuras decided to manufacture its own containers as a cost-saving measure. A strategically located plant involved in this type of manufacturing was acquired. To help ensure cost efficiency, a standard cost system was installed in the plant. The following standards have been established for the products variable inputs: During the first week in January, Basuras had the following actual results: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in January. Also, a new manufacturing process was implemented on a trial basis. The new process required a slightly higher level of skilled labor. The higher- quality material has no effect on labor utilization. However, the new manufacturing process was expected to reduce materials usage by 0.25 pound per container. Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Assume that the 0.25 pound per container reduction of materials occurred as expected and that the remaining effects are all attributable to the higher-quality material. Would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing process, should it be continued or discontinued? In answering, consider the new processs materials reduction effect as well. Explain. 3. CONCEPTUAL CONNECTION Refer to Requirement 2. Suppose that the industrial engineer argued that the new process should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 9,000 and the labor cost was 99,000. Should the new process be adopted? Assume the variances are attributable to the new process. Assuming production of 6,000 units per week, what would be the projected annual savings? (Include the materials reduction effect.)arrow_forwardMallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.arrow_forward

- MSI is considering outsourcing the production of the handheld control module used with some of its products. The company has received a bid from Monte Legend Company (MLC) to produce 10,000 units of the module per year for $16 each. The following information pertains to MSI’s production of the control modules: Direct materials $ 9 Direct labor 4 Variable manufacturing overhead 2 Fixed manufacturing overhead 3 Total cost per unit $ 18 MSI has determined it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSI has no specific use in mind for the space that is currently dedicated to the control module production. Required: 1. Compute the difference in cost between making and buying the control module. 2. Should MSI buy the modules from MLC or continue to make them? 3-a. Suppose the MSI space currently used for the modules could be utilized by a new product line that would generate…arrow_forwardThe company has an offer from Duvall Valves to produce the part for $2,000 per unit and supply 1,000 valves (the number needed in the coming year). If the company accepts this offer and shuts down production of valves, production workers and supervisors will be reassigned to other areas. The equipment cannot be used elsewhere in the company, and it has no market value. However, the space occupied by the production of the valve can be used by another production group that is currently leasing space for $55,000 per year. What is the incremental savings of buying the valves? (The answer should be stated in a per-unit format and is a positive number)arrow_forwardFruit-To-Go (FTG) processes fruit for shipping overseas. FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $54,000 for the report.The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,100,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 4 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $200,000 and will be for the next 2 years. The old machine could be sold today for $260,000. In 5 years it will be worth nothing. Installing the new machine will require staff training (a tax deductible expense) of $35,000 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is…arrow_forward

- Fruit-To-Go (FTG) processes fruit for shipping overseas. FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $54,000 for the report.The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,100,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 4 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $200,000 and will be for the next 2 years. The old machine could be sold today for $260,000. In 5 years it will be worth nothing. Installing the new machine will require staff training (a tax deductible expense) of $35,000 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is…arrow_forwardFruit-To-Go (FTG) processes fruit for shipping overseas. FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $54,000 for the report.The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,100,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 4 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $200,000 and will be for the next 2 years. The old machine could be sold today for $260,000. In 5 years it will be worth nothing. Installing the new machine will require staff training (a tax deductible expense) of $35,000 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is…arrow_forwardFruit-To-Go (FTG) processes fruit for shipping overseas. FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $54,000 for the report.The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,100,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 4 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $200,000 and will be for the next 2 years. The old machine could be sold today for $260,000. In 5 years it will be worth nothing. Installing the new machine will require staff training (a tax deductible expense) of $35,000 before production can commence. Due to the lower cost of the bags Inventory required will be reduced by $80,000 for the life of the project. The new sales of bagged fruit is…arrow_forward

- Fruit-To-Go (FTG) processes fruit for shipping overseas. FTG commissioned a study to look into the feasibility of changing the packaging of the fruit from cans to sealed bags. The Consultant charged $54,000 for the report. The report concluded that the new packaging will increase sales and reduce some operating costs. The new packaging machinery will cost $1,100,000. The new machine is expected to last 5 years. The Taxation Office advise the life of the machine, for tax purposes, is 4 years. The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at The old canning machinery was purchased 2 years ago for $800,000 and was being depreciated at $200,000 and will be for the next 2 years. The old machine could be sold today for $260,000. In 5 years it will be worth nothing. Installing the new machine will require staff training (a tax deductible expense) of $35,000 before production can commence. Due to the lower cost of the bags Inventory required…arrow_forwardBethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold on the spot market. The coal mining industry, especially high-sulfur coal operations such as Bethesda, has been hard-hit by environmental regulations. Recently, however, a combination of increased demand for coal and new pollution reduction technologies has led to an improved market demand for high-sulfur coal. Bethesda has just been approached by Mid-Ohio Electric Company with a request to supply coal for its electric generators for the next four years. Bethesda Mining does not have enough excess capacity at its existing mines to guarantee the contract. The company is considering opening a strip mine in Ohio on 5,000 acres of land purchased 10 years ago for $4 million. Based on a recent appraisal, the company feels it could receive…arrow_forwardHome Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in the Maritimes. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $15,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. Which of the following should be included as part of the incremental earnings for the proposed new store? a. The original purchase price of the land where the store will be located. b. The cost of demolishing the abandoned warehouse and clearing the lot. c. The loss of f sales in the existing retail outlet, if customers who previously drove from Dartmouth to Halifax to shop at the existing outlet become customers of the new store instead. d.…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning