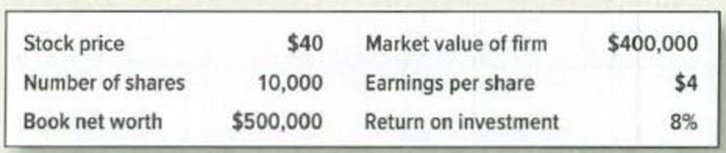

Dilution Here is recent financial data on Pisa Construction Inc.

Pisa has not performed spectacularly to date. However, it wishes to issue new shares to obtain $80,000 to finance expansion into a promising market. Pisa’s financial advisers think a stock issue is a poor choice because, among other reasons, “sale of stock at a price below book value per share can only depress the stock price and decrease shareholders’ wealth.” To prove the point they construct the following example: “Suppose 2,000 new shares are issued at $40 and the proceeds are invested. (Neglect issue costs.) Suppose

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70.”

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

PRIN.OF CORPORATE FINANCE

- Which of the following statements is true? a. High liquidity means a company is short on cash and may be unable to pay its debts.b. When a company decides to go public through an IPO, it is typically targeting to sell its shares to only a handful of shareholders. c. If the company has a higher than expected extremely high profit this year, equity holders will benefit more than debt holders as debtholders are the residual claimers for the cash flows of the company.d. In the extreme case, the debt holders take legal ownership of the firm's assets through a process called bankruptcy.e. Equity holders expect to receive dividends and the firm is always legally obligated to pay them.arrow_forwardDavid Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing. The company uses short-term debt to finance its temporary working capital needs, but it does not use any permanent (long-term) debt. Other solar technology companies have debt, and Mr. Lyons wonders why they use debt and what its effects are on stock prices. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant: d. Suppose that Firms U and L have the same input values as in Part c except for debt of 980,000. Also, both firms have total net operating capital of 2,000,000 and both firms are expected to grow at a constant rate of 7%. (Assume that the EBIT in part c is expected at t = 1.) Use the compressed adjusted present value (APV) model to estimate the value of U and L. Also estimate the levered cost of equity and the weighted average cost of capital.arrow_forwardDavid Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing. The company uses short-term debt to finance its temporary working capital needs, but it does not use any permanent (long-term) debt. Other solar technology companies have debt, and Mr. Lyons wonders why they use debt and what its effects are on stock prices. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant: Now assume that Firms L and U are both subject to a 25% corporate tax rate. Using the data given in part b, repeat the analysis called for in parts b(1) and b(2) using assumptions from the MM model with taxes.arrow_forward

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardDavid Lyons, CEO of Lyons Solar Technologies, is concerned about his firm’s level of debt financing. The company uses short-term debt to finance its temporary working capital needs, but it does not use any permanent (long-term) debt. Other solar technology companies have debt, and Mr. Lyons wonders why they use debt and what its effects are on stock prices. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant: Who were Modigliani and Miller (MM), and what assumptions are embedded in the MM and Miller models?arrow_forwardDavid Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing. The company uses short-term debt to finance its temporary working capital needs, but it does not use any permanent (long-term) debt. Other solar technology companies have debt, and Mr. Lyons wonders why they use debt and what its effects are on stock prices. To gain some insights into the matter, he poses the following questions to you, his recently hired assistant: e. Suppose the expected free cash flow for Year 1 is 250,000 but it is expected to grow faster than 7% during the next 3 years: FCF2 = 290,000 and FCF3 = 320,000, after which it will grow at a constant rate of 7%. The expected interest expense at Year 1 is 128,000, but it is expected to grow over the next couple of years before the capital structure becomes constant: Interest expense at Year 2 will be 152,000, at Year 3 it will be 192,000 and it will grow at 7% thereafter. What is the estimated horizon unlevered value of operations (i.e., the value at Year 3 immediately after the FCF at Year 3)? What is the current unlevered value of operations? What is the horizon value of the tax shield at Year 3? What is the current value of the tax shield? What is the current total value? The tax rate and unlevered cost of equity remain at 25% and 14%, respectively.arrow_forward

- Which one of the following statements is NOT CORRECT? o Investors may interpret a stock repurchase program as a signal that the firm's managers believe the stock is undervalued or alternatively, as a signal that the firm does not have many good investment opportunities. O If a firm follows the residual dividend model then a sudden increase in the number of profitable projects would be likely to lead to a reduction of the firm's dividend payout ratio. Gordon and Lintner's "bird-in-the-hand" fallacy suggests that investors prefer dividends to capital gains because dividends are more certain than capital gains. O One of the advantages to dividend reinvestment plans or DRIPS is that stockholders pay no income tax on dividends if the dividends are automatically reinvested into the stocks of the paying companies.arrow_forward1. What do you think the consequences might be in financial markets if individuals consumed more of their incomes and thereby reduced the supply of funds available to financial institutions? 2. Stem Corporation received confirmation that all its PSE listing requirements were in order, and that it may proceed to issue its stock. The company plans to raise P500 million on the stock issue. On what market do you expect this stock to be traded? Would this transaction take place on the money market or the capital market? 3. Over the past 100 years, the level of government regulation of financial institutions and markets has ebbed and flowed or, as some economists might argue, has ebbed and flooded. Although the laws and regulatory agencies created by the government have various defined and not-so-well defined goals, what might you argue is the single biggest benefit of government regulation?arrow_forwardSchalheim Sisters Inc. has always paid out all of its earnings as dividends; hence, the firm has no retained earnings. This same situation is expected to persist in the future. The company uses the CAPM to calculate its cost of equity, and its target capital structure consists of common stock, preferred stock, and debt. Which of the following events would REDUCE its WACC? A. The flotation costs associated with issuing preferred stock increase. B. The company's beta increases. C. The flotation costs associated with issuing new common stock increase. D. The market risk premium declines. E. Expected inflation increases.arrow_forward

- As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $2.40 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year. Term Value The risk-free rate (RF) is 5.00%, the market risk premium (RPM) is 6.00%, and Portman's beta is 1.70. Dividends one year from now (D1) Horizon value (P1) ☑ Intrinsic value of Portman's stock ་ Assuming that the market is in equilibrium, use the information just given to complete the…arrow_forwardAs companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $2.40 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 20.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 4.00% per year. Assuming that the market is in equilibrium, use the information just given to complete the table. Term Dividends one year from now (D₁) Horizon value (P₁) Intrinsic value of Portman's stock The risk-free rate (TRF) IS 5.00%, the market risk premium (RPM) is 6.00 %, and Portman's beta is 1.30. What…arrow_forwardWhich of the following is/are true regarding payout policy to shareholders? A. Most of the time that firms announce an increase in dividends, the market reacts negatively, as this is an admission that the firm has few good investment opportunities going forward. B. Large, mature firms should return a lot of cash to shareholders because there aren’t enough good investment opportunities out there for them. C. Flexibility is one key reason why we have seen much more use of share repurchases to return cash to shareholders in the last 3 decades. D. The primary value driver for the firm is how cash is paid out, not cash generation. E. (A) and (B) F. (B) and (C) G. (C) and (D)arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT