FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

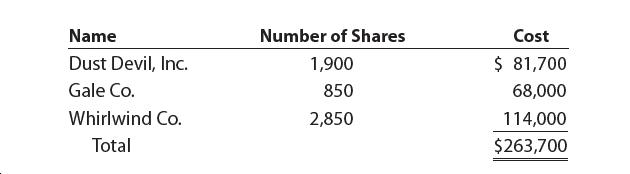

Storm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations:

Please see the attachment for details:

The market price per share for the available-for-sale security portfolio on December 31,

Year 1, was as follows:

Please see the attachment for details:

a. Provide the

b. Describe the income statement impact from the December 31, Year 1, journal entry.

Transcribed Image Text:Number of Shares

Name

Cost

$ 81,700

Dust Devil, Inc.

1,900

Gale Co.

850

68,000

Whirlwind Co.

2,850

114,000

Total

$263,700

Transcribed Image Text:Market Price per Share,

Dec. 31, Year 1

Dust Devil, Inc.

$40

Gale Co.

75

Whirlwind Co.

42

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pharoah Corporation purchased trading investment bonds for $60,000 at par. At December 31, Pharoah received annual interest of $2,400, and the fair value of the bonds was $57,400. Prepare Pharoah' journal entries for (a) the purchase of the investment, (b) the interest received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) (c) Debit Creditarrow_forward3.The following data relates to Available for Sale Securities: Please Journalize all the entries required for this problem and then answer the question below. On December 1, 2007, a company purchased securities totaling $6,200. On December 31, 2007, the FMV of the securities was $5,300. On December 31, 2008, the FMV was $6,000. On December 31, 2009, the FMV was $3,200. Please use the blank journal paper that I have uploaded to the files section of Canvas for this class. The name of your accounts must have the correct names. Question: The unrealized loss or gains would appear on which financial statement?arrow_forwardJournal entries for trading investments The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $216,000. The fair value of the securities on December 31, 20Y7, is $288,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 Accounting numeric field 20Y7 Dec. 31 Feedback Check My Work a. Increase the investment and reduce Cash for number of shares times the per share price. The unrealized gain (credit) or unrealized loss (debit) is the difference between the acquired per share price and the market price per share at 20Y7 taken times the number of shares acquired. The offset account for the gain or loss entry is the valuation allowance account. b. How is a unrealized gain or loss for trading investments reported on the financial statements? 00arrow_forward

- Carpark Services began operations in 2001 and maintains investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these debt securities follows. Available-for-Sale Securities December 31, 20x1 December 31, 20x2 Cost $ 250,000 $ 340,000 Fair Value $ 251,000 $ 350,000 The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X1 is: Debit Unvealed Gain-Equity $1000; Credit Fair Value Adjustment-Available for Sale $1.000 Debit Uzed Loss-Equity $1,000, Credit Fair Value Adjustment-Available-for-Sale $1.000 Detit Realized Loss-Income $1,000: Creat Fair Value Adjustment-Available for Sale $1,000 Debat Far Value Adjustment-Available for Sale $1.000 Credit Unrealized Loss-Equity $1,000arrow_forwardCompany X purchased trading securities in February. Company Y purchased available-for-sale securities in February as well, and it plans to sell them before December. Company Z purchased available-for-sale securities and is planning to hold onto them for at least two years. What is implied here? 1. Company X and Company Y will report their securities under current assets on the balance sheet, while Company Z will report their securities immediately below current assets in the investments section. 2. Company X will report their securities under current assets on the balance sheet, while Company Y and Company Z will report their securities immediately under current assets in the investments section. 3. Company X and Company Y will report their securities under current assets, while Company Z will report their securities under current liabilities. 4. Company X, Y, and Z will all report their securities under current assets on the balance sheet.arrow_forwardMead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 Sold all of the Johnson & Johnson bonds for $23,500. Sold all of the Mattel bonds for $35,850. April 15 July 5 July 22 August 19 Purchased Sara Lee notes for $13,500. Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara Lee notes for $9,750. November 1 Sold all of the…arrow_forward

- On December 31, Reggit Company held the following short-term investments in its portfolio of available-for-sale debt securities. Reggit had no short-term investments in its prior accounting periods. Available-for-Sale Securities Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds epare the December 31 adjusting entry to report these investments at fair value. Fair Value Adjustment Computation of fair value adjustment. Complete this question by entering your answers in the tabs below. General Journal Cost $ 76,000 57,000 72,000 Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds Total Fair Value Adjustment Computation - Available for Sale Portfolio Unrealized Amount Cost $ Fair Value $ 74,480 50,730 69,120 Fair Value 76,000 $ 74,480 57,000 50,730 72,000 69,120 $ 205,000 $ 194,330 COarrow_forwardOn January 1, Valuation Allowance for Available-for-Sale Investments had a zero balance. On December 31, the cost of the available-for-sale securities was $78,400, and the fair value was $72,330. Prepare the adjusting entry to record the unrealized gain or loss on available-for-sale investments on December 31. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardAt December 31, 2025, Pharoah Company has a portfolio of equity securities valued at $136000. Its cost was $116000. If the Fair Value Adjustment has a debit balance of $7200, which of the following journal entries is required at December 31, 2025? O Unrealized Holding Gain or Loss-Income Fair Value Adjustment Fair Value Adjustment Unrealized Holding Gain or Loss-Income Fair Value Adjustment Unrealized Holding Gain or Loss-Income Unrealized Holding Gain or Loss-Income Fair Value Adjustment 12800 12800 20000 20000 12800 12800 20000 20000arrow_forward

- At December 31, 2024, Hull-Meyers Corporation had the following investments that were purchased during 2024, its first year of operations: Trading Securities: Amortized cost Fair Value Security A Totals Security B Securities Available-for-Sale: Security C Security D Totals Securities to Be Held-to-Maturity: Security E Security F Totals $ 960,000 165,000 $ 1,125,000 $760,000 960,000 $ 1,720,000 $ 550,000 675,000 $ 1,225,000 $ 975,000 159,400 $ 1,134,400 $ 834,000 977,400 $ 1,811,400 $ 561,200 669,800 $ 1,231,000 No investments were sold during 2024. All securities except Security D and Security F are considered short-term investments. None of the fair value changes is considered permanent. Required: Complete the following table. Note: Amounts to be deducted should be indicated with a minus sign. Trading Securities Security A Security B Securities Available-for-Sale Security C Security D Securities to be Held-to- Answer is not complete. Reported on Balance Sheet as: Unrealized gain…arrow_forwardGadubhiarrow_forwardVikrambhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education