FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

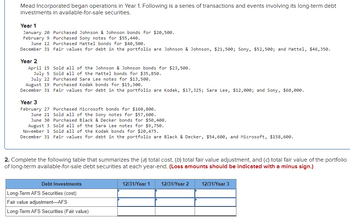

Transcribed Image Text:Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt

investments in available-for-sale securities.

Year 1

January 20 Purchased Johnson & Johnson bonds for $20,500.

February 9

Purchased Sony notes for $55,440.

June 12 Purchased Mattel bonds for $40,500.

December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350.

Year 2

Sold all of the Johnson & Johnson bonds for $23,500.

Sold all of the Mattel bonds for $35,850.

April 15

July 5

July 22

August 19

Purchased Sara Lee notes for $13,500.

Purchased Kodak bonds for $15,300.

December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000.

Year 3

February 27 Purchased Microsoft bonds for $160,800.

June 21 Sold all of the Sony notes for $57,600.

June 30 Purchased Black & Decker bonds for $50,400.

August 3 Sold all of the Sara Lee notes for $9,750.

November 1 Sold all of the Kodak bonds for $20,475.

December 31 Fair values for debt in the portfolio are Black & Decker, $54,600, and Microsoft, $158,600.

2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio

of long-term available-for-sale debt securities at each year-end. (Loss amounts should be indicated with a minus sign.)

Debt Investments

Long-Term AFS Securities (cost)

Fair value adjustment-AFS

Long-Term AFS Securities (Fair value)

12/31/Year 1

12/31/Year 2 12/31/Year 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In footnotes to its year-end annual report, Bancfirst Corp. reported that held-to-maturity debt securities with an amortized cost of $8,730 thousand had an estimated fair value of $8,806 thousand. The balance sheet reported: Select one: a. Held-to-maturity assets of $8,730 thousand b. Held-to-maturity assets of $8,806 thousand c. Accumulated other comprehensive income of $76 thousand related to held-to-maturity assets d. Both A and C e. Both B and Carrow_forwardPharoah Company had the following transactions pertaining to debt securities held as an investment. Jan. 1 Dec. 31 Purchased 75, 6%, $1,000 Sheridan Company bonds for $75,000 cash. Interest is payable annually on January 1. Accrued $4,500 annual interest on Sheridan Company bonds. Journalize the purchase and the receipt of interest. Assume no interest has been accrued. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Jan. 1 Debt Investments Cash Dec. 31 Interest Receivable Interest Revenue Debit 75,000 4,500 Credit 75,000 4,500arrow_forwardOn February 1, 20x1, Broncos Company issued 9.75% bonds with a face amount of $20 million. The bonds mature in 5 years. For bonds of similar risk and maturity, the market yield is 11.5%. Interest is paid semiannually on July 31 and January 31. Broncos is a calendar-year corporation. 1) Determine the price of the bonds on February 1, 20x1 using the Excel. 2) Prepare the journal entry to record the bond issuance on February 1, 20x1. 3) Prepare an amortization table for 5 years using the effective interest method. 4) Prepare the journal entries (using the effective interest method) on July 31, 20x1 (1st payment). 5) Prepare the journal entry (using the effective interest method) on December 31, 20x1 (adjusting entry, no cash payment!) 6) What would be the journal entry if all bonds are retired at 102.5 on August 1, 20x2 right after the third payment. Prepare the journal entry for the bond retirement.arrow_forward

- 3 N is Prepare Garzon Company's journal entries to record the following transactions for the current year. January 1 Purchases 8.5% bonds (as a held-to-maturity investment) issued by PBS at a cost of $52,800, which is the par value. June 30 Receives first semiannual payment of interest from PBS bonds. December 31 Receives a check from PBS in payment of principal ($52,800) and the second semiannual payment of interest. View transaction list Journal entry worksheet 1 2 3 Purchases 8.5% bonds (as a held-to-maturity investment) issued by PBS at a cost of $52,800, which is the par value. Date January 01 Note: Enter debits before credits. General Journal *** Debit Creditarrow_forwardThe following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: 20Y1 July 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, 20Y1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y2 June 30 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y3 June 30 Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. (Record the…arrow_forwardKier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. The bonds have a 5.50% stated rate of interest interest is payable in cash on December 31 each year. Based on this information alone, what are the amounts of interest expense and cash flows from operating activities, respectively, that will be reported in the financial statements for the year ending December 31, Year 1? Multiple Choice O Zero and $40,700 $40,700 and $40,700 Zero and Zero $40,700 and Zeroarrow_forward

- It is year 1, the White Caps Ltd.’s first year of operations. White Caps Ltd. had the following transactions regarding their investments: May 1 Purchased 600 Jerry Co. common shares for $180 per share. This investment is classified as held for trading. June 1 Purchased 1,000 bonds of Larry Inc. at $300 each. These bonds pay interest at a rate of 6%, paid semi-annually on November 30 and May 31. These bonds were also purchased for trading purposes. July 1 Purchased 4,000 Barry Ltd. common shares for $210 per share. These shares represent 25% of the issued common shares of Barry ltd. Because of this investment, the directors of Barry Ltd. invited a White Caps Ltd. executive to sit on their board. Sept. 1 Received a $3-per-share cash dividend from Barry Ltd. Nov. 1 Sold 200 Jerry Co. common shares for $189 per share. 30 Interest on the Larry Inc. bonds was received. Dec. 15 A $0.50-per-share cash dividend on Jerry Co. common shares was received. 31 As of this date,…arrow_forwardPrepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardOn the day Federer Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Prepare a residual analysis for the bond redemption. Prepare the journal entry for the bond redemption. If you recognise a gain or loss, state where in the Statement of Comprehensive Income the gain or loss should appeararrow_forward

- The following bond investment transactions were completed during a recent year by Starks Company: Year 1 Jan. 31 Purchased 75, $1,000 government bonds at 100 plus accrued interest of $313 (one month). The bonds pay 5% annual interest on July 1 and January 1. July 1 Received semiannual interest on bond investment. Aug. 30 Sold 33, $1,000 bonds at 95 plus $275 accrued interest (two months). Required: a. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year. b. Provide the December 31, Year 1, adjusting journal entry for semiannual interest earned on the bonds.arrow_forwardDoyle Company issued $362,000 of 10-year, 5 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $52, 500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1. Journal entry worksheet Note: Enter debits before credits. 4 Date Dec 31 5 ü 6 Record the interest expense for bonds payable for Year 2. General Journal C 7 8 Debit Credit >arrow_forward1.Prepare Hertog Company’s journal entries to record the following transactions for the current year. May 7 Purchases Kraft bonds as a short-term investment in trading securities at a cost of $10,830. June 6 Sells its entire investment in Kraft bonds for $11,330 casharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education