FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

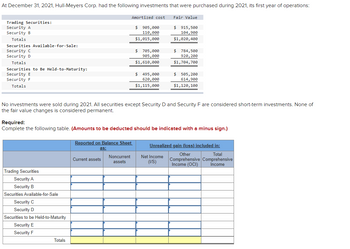

Transcribed Image Text:At December 31, 2021, Hull-Meyers Corp. had the following investments that were purchased during 2021, its first year of operations:

Trading Securities:

Security A

Security B

Totals

Securities Available-for-Sale:

Security C

Security D

Totals

Securities to Be Held-to-Maturity:

Security E

Security F

Totals

Trading Securities

Security A

Security B

Securities Available-for-Sale

Security C

Security D

Securities to be Held-to-Maturity

Security E

Security F

Totals

Amortized cost

Reported on Balance Sheet

as:

Current assets

$ 905,000

110,000

$1,015,000

Noncurrent

assets

$ 705,000

905,000

$1,610,000

$ 495,000

620,000

$1,115,000

No investments were sold during 2021. All securities except Security D and Security F are considered short-term investments. None of

the fair value changes is considered permanent.

Required:

Complete the following table. (Amounts to be deducted should be indicated with a minus sign.)

Fair Value

$915,500

104,900

$1,020,400

$ 784,500

920, 200

$1,704,700

Net Income

(I/S)

$ 505,200

614,900

$1,120,100

Unrealized gain (loss) included in:

Other

Total

Comprehensive Comprehensive

Income (OCI) Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Fair value adjustment for available-for-sale investments M. Jones Inc. purchased the following available-for-sale securities during 20Y5, its first year of operations: Issuing Company Arden Enterprises Inc. French Broad Industries Inc. Pisgah Construction Inc. $150,000 66,000 104,000 $320,000 The fair value of the various available-for-sale securities on December 31, 20Y5, was as follows: Fair Value, Dec. 31, 20Y5 Issuing Company Arden Enterprises Inc. French Broad Industries Inc. Cost Pisgah Construction Inc. $168,000 72,000 97,000 $337,000arrow_forwardWhat is the maximum percentage (%) of net assets of a mutual fund that can be invested in derivatives (except for specific funds that have received an exemption from this rule)? 1.0% 2.10% 3.25% 4.50%arrow_forward07:34 ET N W(0) Problem 1: 5.74% of 2026 GOI security is trading at 6.96 YTM. If the security experiences a 100 basis points hike. Calculate PV01 for 69 such securities. NOTE: Assume the face value of the security to be 100 . Problem 2: 2031, 6.68% GOI security with YTM 7.05% with a face value of 100 undergoes an increase in the YTM by 75 basis points. Calculate the PV01. NOTE: There is only oarrow_forward

- 48 The Sunland Products Co. currently has debt with a market value of $300 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,434.63 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $10 per share. The preferred shares pay an annual dividend of $1.20. Sunland also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever. If Sunland is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen…arrow_forwardPresented below is information taken from a bond investment amortization schedule with related fair values provided. These bonds are classified as available-for-sale. 12/31/20 12/31/21 12/31/22 Amortized cost $410,900 $445,100 $546,300 Fair value $416,800 $434,600 $546,300 (a) Indicate whether the bonds were purchased at a discount or at a premium. Prepare the adjusting entry to record the bonds at fair value at December 31, 2020. The Fair Value Adjustment account has a debit balance of $1,100 prior to adjustment. (c) Prepare the adjusting entry to record the bonds at fair value at December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardAll of the securities below have annual payments. [Do not round interim calculations] Years Coupon Market Maturity Security Rating Treasury Treasury Treasury Treasury Treasury Corp A Corp B Corp C A 88 AA 1 3 5 10 15 5 10 Multiple Choice Multiple Choice $109.40 $89.50 $76.00 Face Value $ 1,000 $ 1,000 $ 1,000 $70.00 $1,000 $ 1,000 $ 1,000 $1,000 $ 1.000 Rate 0.00% 1.90% 4.30% 6.80% 6.60% 8.10% 7.90% 7.00% Price $ S $ $ $ $ $ You are advising the CEO and CFO of an IU Ventures portfolio company in the issuance of new bonds. The company has been rated as BB and wants to issue 3-year bonds and receive full face value. Assuming the bonds are trading at equilibrium, how much should each annual coupon payment be for the new bonds? S 965.00 939.06 932.42 100712 908.25 990.00 859.88 860.00 There is not enough information provided to answer this question.arrow_forward

- After completing calculation exhibit 13.2, what questions the board could ask about the numbers?arrow_forwardPlease dont provide solution image based thanxarrow_forwardA $1,000, 12 year bond carries a 3.5% coupon. If the prevailing market rate on the date of purchase is 4.5% compounded semiannually, what is the purchase price of the bond? Multiple Choice $1,25470 $047.93 S1097.30 $908.05 $2.180 44arrow_forward

- All the securities below have annual payments. [Do not round interim calculations] Security Rating Maturity (yrs) Face Value Coupon Price T-Bill 1 $1,000 0% $982.33 T-Note 5 $1,000 2.40% $992.44 T-Bond 10 $1,000 3.25% $1,005.53 T-Bond 20 $1,000 3.90% $1,002.26 Corp Bond BBB 5 $1,000 3.80% $944.55 Corp Bond AA 10 $1,000 3.40% $968.12 Corp Bond A 20 $1,000 5.10% $982.35 What price would you pay for a 5-year, A bond with a coupon rate of 2.70%, a $1,000 Face Value and annual payments? 1. $958.32 2. $945.39 3. $1,001.33 4. $1,09.56 5. None of the abovearrow_forward00Ucation.com/exl/map/index.html?.con con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%2 JTFA 2021 6 Sved General Corporation purchased $938,000 of bonds with a coupon rate of 10% at face value on December 5, 2021. The market pric the bond was $984,000 on December 31, 2021, Required: Prepare the appropriate journal entry on December 31, 2021, to properly value the bonds assuming the bonds are classified as: (If m entry is required for a transaction/event, select "No journal entry required" in the first account field.) Ignore the journal entry for coupon payment and interest recognition. 1. Trading securities. 2. Securities available-for-sale. 19 3. Held-to-maturity securities. View transaction list Journal entry worksheet Record the unrealized holding gain or loss for securities available-for-sale. Note: Enter debits before credits Transaction General Joumal Debit Credit 2. MacBook Pro DII FA FS FR %23 24 & 4. 6. 8 Q R T Y F H. J K C V command ption…arrow_forwardWhich type of security does it refer to? “First pay two times the Original Purchase Price on each share of Series A Preferred. The balance of any proceeds shall be distributed pro rata to holders of Common Stock.”arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education