Statistics for Business and Economics (13th Edition)

13th Edition

ISBN: 9780134506593

Author: James T. McClave, P. George Benson, Terry Sincich

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14.5, Problem 14.31ACI

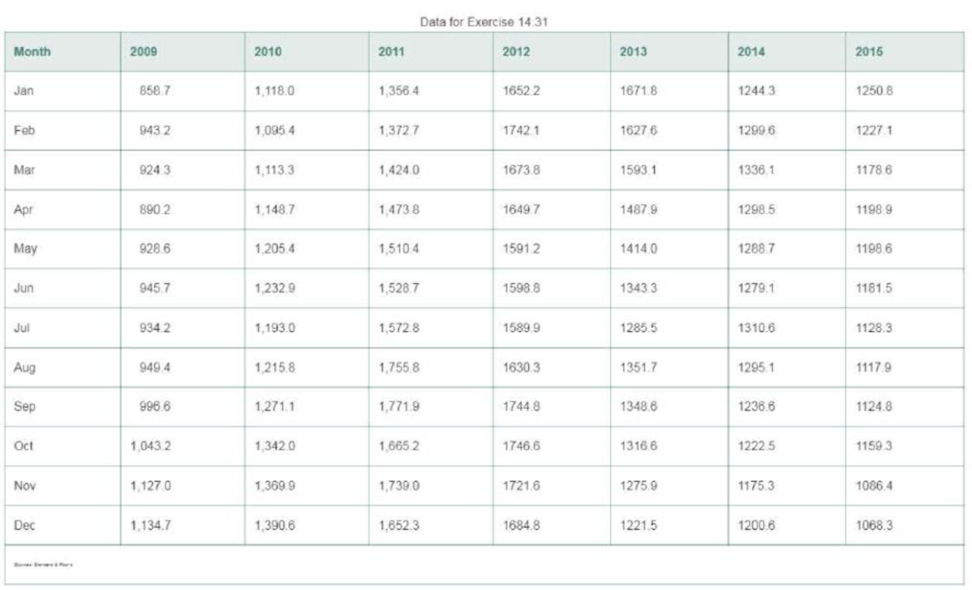

Monthly gold prices. The fluctuation of gold prices is a reflection of the strength or weakness of the U.S. dollar. The table below shows monthly gold prices from January 2009 to December 2015.

a. Use exponential smoothing with w = .5 to calculate monthly smoothed values from 2009 to 2014. Then forecast the monthly gold prices for 2015.

b. Calculate 12 one-step-ahead forecasts for 2015 by updating the exponentially smoothed values with each month’s actual value and then forecasting the next month’s value.

c. Repeat parts a-b using Holt’s method with w = .5 and v = .5. Jan: 1,742.9; Dec.: 1,780.3

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Siena Ltd attempts to find the trend of its sales over the past five years. Siena is considering which model that best represent the trends of its sales. Following are the result of linear and exponential model trend analysis:

a. Calculate the MSE and MAD for the linear trend model

b. Calculate the MSE and MAD for the exponential trend model

c. Which model that performs better

The accompanying dataset provides the closing prices for four stocks and the stock exchange over 12 days. Complete part a

Click the icon to view the closing prices data.

a. Use Excel's Data Analysis Exponential Smoothing tool to forecast each of the stock prices using simple exponential smoothing with a smoothing constant of 0.3.

Use the border crossings data below and a = = 0.3 and ẞ = 0.2.

Truck Crossings

Month

February

113,691

March

139,204

April

121,498

May

127,511

June

131,500

July

105,245

August

126,606

Copy Data

Step 2 of 2: Calculate the adjusted exponential smoothing forecast for September 2011. Assume the forecast component

for February 2011 to be the actual truck crossing value minus the initial trend. Let the initial trend be 10,000 trucks. Round

your answer to two decimal places.

Chapter 14 Solutions

Statistics for Business and Economics (13th Edition)

Ch. 14.1 - Explain in words how to construct a simple index.Ch. 14.1 - Explain in words how to calculate the following...Ch. 14.1 - Explain in words the difference between Laspeyres...Ch. 14.1 - The table below gives the prices for three...Ch. 14.1 - Refer to Exercise 14.4. The next table gives the...Ch. 14.1 - Annual median family income. The table below lists...Ch. 14.1 - Annual U.S. craft beer production. While overall...Ch. 14.1 - Quarterly single-family housing starts. The...Ch. 14.1 - Spot price of natural gas. The table shown in the...Ch. 14.1 - Employment in farm and nonfarm categories....

Ch. 14.1 - GOP personal consumption expenditures. The gross...Ch. 14.1 - GDP personal consumption expenditures (contd)....Ch. 14.1 - Weekly earnings for workers. The table in the next...Ch. 14.1 - Production and price of metals. The level or price...Ch. 14.2 - Describe the effect of selecting an exponential...Ch. 14.2 - A monthly time series is shown in the table to the...Ch. 14.2 - Annual U.S. craft beer production. Refer to the...Ch. 14.2 - Foreign fish production. Overfishing and pollution...Ch. 14.2 - Yearly price of gold. The price of gold is used by...Ch. 14.2 - Personal consumption in transportation. There has...Ch. 14.2 - OPEC crude oil imports. The data in the table...Ch. 14.2 - SP 500 Stock Index. Standard Poors 500 Composite...Ch. 14.5 - How does the choice of the smoothing constant w...Ch. 14.5 - Refer to Exercise 14.4 (p. 14-9). The table with...Ch. 14.5 - Annual U.S. craft beer production. Refer to...Ch. 14.5 - Quarterly single-family housing starts. Refer to...Ch. 14.5 - Consumer Price Index. The CPI measures the...Ch. 14.5 - OPEC crude oil imports. Refer to the annual OPEC...Ch. 14.5 - SP 500 Stock Index. Refer to the quarterly...Ch. 14.5 - SP 500 Stock Index (contd). Refer to Exercise...Ch. 14.5 - Monthly gold prices. The fluctuation of gold...Ch. 14.6 - Annual U.S. craft beer production. Refer to the...Ch. 14.6 - Annual U.S. craft beer production (contd). Refer...Ch. 14.6 - SP 500 Stock Index. Refer to your exponential...Ch. 14.6 - SP 500 Stock Index (contd). Refer to your Holt...Ch. 14.6 - Monthly gold prices. Refer to the monthly gold...Ch. 14.6 - US school enrollments. The next table reports...Ch. 14.8 - The annual price of a finished product (in cents...Ch. 14.8 - Retail sales in Quarters 14 over a 10-year period...Ch. 14.8 - What advantage do regression forecasts have over...Ch. 14.8 - Mortgage interest rates. The level at which...Ch. 14.8 - Price of natural gas. Refer to Exercise 14.9 (p....Ch. 14.8 - A gasoline tax on carbon emissions. In an effort...Ch. 14.8 - Predicting presidential elections. Researchers at...Ch. 14.8 - Life insurance policies in force. The table below...Ch. 14.8 - Graphing calculator sales. The next table presents...Ch. 14.8 - Prob. 14.47ACICh. 14.9 - Define autocorrelation. Explain why it is...Ch. 14.9 - For each case, indicate the decision regarding the...Ch. 14.9 - What do the following Durbin-Watson statistics...Ch. 14.9 - Company donations to charity. Refer to the Journal...Ch. 14.9 - Forecasting monthly car and truck sales. Forecasts...Ch. 14.9 - Predicting presidential elections. Refer to the...Ch. 14.9 - Mortgage interest rates. Refer to the data on...Ch. 14.9 - Price of natural gas. Refer to the annual data on...Ch. 14.9 - Life insurance policies in force. Refer to the...Ch. 14.9 - Modeling the deposit share of a retail bank....Ch. 14 - Insured Social Security workers. Workers insured...Ch. 14 - Insured Social Security workers (contd). Refer to...Ch. 14 - Retail prices of food items. In 1990, the average...Ch. 14 - Demand for emergency room services. With the...Ch. 14 - Mortgage interest rates. Refer to the annual...Ch. 14 - Price of Abbott Labs stock. The yearly closing...Ch. 14 - Price o f Abbott Labs stock (contd). Refer to...Ch. 14 - Prob. 14.65ACICh. 14 - Prob. 14.66ACICh. 14 - Quarterly GOP values (contd). Refer to Exercise...Ch. 14 - Prob. 14.68ACICh. 14 - Prob. 14.69ACICh. 14 - Prob. 14.70ACICh. 14 - IBM stock prices. Refer to Example 14.1 (p. 14-5)...Ch. 14 - Prob. 14.72ACI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Similar questions

- Enter the data from Table 2 into a graphing calculator and graph the ranking scatter plot. Determine whetherthe data from the table would likely represent a function that is linear, exponential, or logarithmic.arrow_forwardExplain why the values of an increasing exponentialfunction will eventually overtake the valuesof anincreasing linear function.arrow_forwardTable 6 shows the year and the number ofpeople unemployed in a particular city for several years. Determine whether the trend appears linear. If so, and assuming the trend continues, in what year will the number of unemployed reach 5 people?arrow_forward

- Does a linear, exponential, or logarithmic model best fit the data in Table 2? Find the model.arrow_forwardWhat might a scatterplot of data points look like if it were best described by a logarithmic model?arrow_forward9. A certain bacteria population triples each minute. Suppose you begin with a single bacteria cell. a. Create a table of values to show the population of bacteria at the end of each minute for the first 5 minutes of growth. b. Graph the data from your table using the desmos graphing calculator. (insert below). c. Is the population of bacteria growing linearly or exponentially? Explain.arrow_forward

- Forecast the percentage of tax returns that will be electronically filed for 2010 using exponential smoothing with α=0.1.arrow_forwardCynthia’s Design Studios had sales in the last four months of $12,700, $14,500, $19,100, and $15,800. Sales are related to how many designers Cynthia has on duty. The sales forecast helps her decide on the proper staffing levels. What is the forecast for the fifth month using a two-period moving average? What is the forecast for the fifth month using = 0.8 in an exponential smoothing model with A4 = $15,800 and F4 = $17,913 to get things started.arrow_forwardChina had a population in 2008 of about 1.14 billion people. The populaton is growing by about 1.34% each year. If this trend continues, when will China's population reach 1.2 billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition...

Algebra

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

College Algebra

Algebra

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:Cengage Learning

Big Ideas Math A Bridge To Success Algebra 1: Stu...

Algebra

ISBN:9781680331141

Author:HOUGHTON MIFFLIN HARCOURT

Publisher:Houghton Mifflin Harcourt

College Algebra (MindTap Course List)

Algebra

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897...

Algebra

ISBN:9780079039897

Author:Carter

Publisher:McGraw Hill

Time Series Analysis Theory & Uni-variate Forecasting Techniques; Author: Analytics University;https://www.youtube.com/watch?v=_X5q9FYLGxM;License: Standard YouTube License, CC-BY

Operations management 101: Time-series, forecasting introduction; Author: Brandoz Foltz;https://www.youtube.com/watch?v=EaqZP36ool8;License: Standard YouTube License, CC-BY