Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 2TIF

Real-world annual report

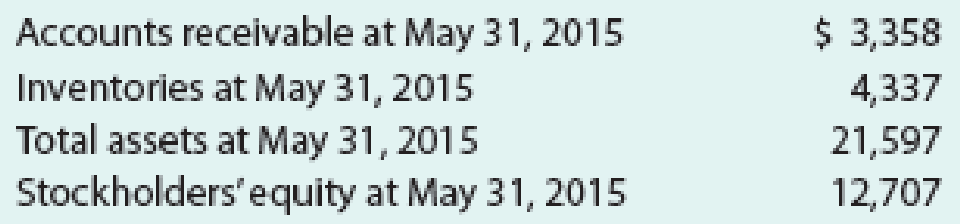

The financial statements for Nike, Inc. (NKE), are presented in Appendix E at the end of the text. The following additional information is available (in thousands):

Instructions

- 1. Determine the following measures for the fiscal years ended May 31, 2017, and May 31, 2016. Round ratios and percentages to one decimal place.

- a.

Working capital - b.

Current ratio - c. Quick ratio

- d.

Accounts receivable turnover - e. Number of days’ sales in receivables

- f. Inventory turnover

- g. Number of days’ sales in inventory'

- h. Ratio of liabilities to stockholders’ equity

- i. Asset turnover

- j. Return on total assets, assuming interest expense is $82 million for the year ending May 31. 2017, and $33 million for the year ending May 31, 2016.

- k. k. Return on common stockholders’ equity

- l. Price-eamings ratio, assuming that the market price was $52.81 per share on May 31, 2017, and $54.35 per share on May 31, 2016.

- m. m. Percentage relationship of net income to sales

- 2. What conclusions can be drawn from these analyses?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculate the debt to equity ratio

The correct amount of prepaid insurance shown in a company's December 31, 2023, balance sheet was $900. On July 1, 2024,

the company paid an additional insurance premium of $600. In the December 31, 2024, balance sheet, the amount of prepaid

insurance was correctly shown as $500. The amount of insurance expense that should appear in the company's 2024 income

statement is:

Can you help me with accounting questions

Chapter 14 Solutions

Financial And Managerial Accounting

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Prob. 3DQCh. 14 - How would the current and quick ratios of a...Ch. 14 - Prob. 5DQCh. 14 - What do the following data, taken from a...Ch. 14 - A. How does the return on total assets differ from...Ch. 14 - The Kroger Company (KR), a grocery store chain,...Ch. 14 - The dividend yield of Suburban Propane Partners,...Ch. 14 - Prob. 10DQ

Ch. 14 - Prob. 1BECh. 14 - Income statement information for Einsworth...Ch. 14 - Prob. 3BECh. 14 - A company reports the following: Determine (a) the...Ch. 14 - Prob. 5BECh. 14 - Prob. 6BECh. 14 - A company reports the following: Determine the...Ch. 14 - A company reports the following: Determine the...Ch. 14 - Prob. 9BECh. 14 - A company reports the following: Determine (a) the...Ch. 14 - Prob. 11BECh. 14 - Vertical analysis of income statement Revenue and...Ch. 14 - The following comparative income statement (in...Ch. 14 - Common-sized income statement Revenue and expense...Ch. 14 - Prob. 4ECh. 14 - Prob. 5ECh. 14 - The following data were taken from the balance...Ch. 14 - PepsiCo, Inc. (PEP), the parent company of...Ch. 14 - Current position analysis The bond indenture for...Ch. 14 - Accounts receivable analysis The following data...Ch. 14 - Prob. 10ECh. 14 - Inventory analysis The following data were...Ch. 14 - Inventory analysis QT, Inc. and Elppa Computers,...Ch. 14 - Ratio of liabilities to stockholders equity and...Ch. 14 - Hasbro, Inc. (HAS), and Mattel, Inc. (MAT), are...Ch. 14 - Recent balance sheet information for two companies...Ch. 14 - Prob. 16ECh. 14 - The following selected data were taken from the...Ch. 14 - Ralph Lauren Corporation (RL) sells apparel...Ch. 14 - Six measures of solvency or profitability Obj. 4,...Ch. 14 - Five measures of solvency or profitability The...Ch. 14 - Prob. 21ECh. 14 - The table that follows shows the stock price,...Ch. 14 - Earnings per share, discontinued operations The...Ch. 14 - Income statement and earnings per share for...Ch. 14 - Unusual items Explain whether Colston Company...Ch. 14 - Comprehensive income Anson Industries, Inc.,...Ch. 14 - Prob. 1PACh. 14 - Prob. 2PACh. 14 - Effect of transactions on current position...Ch. 14 - Measures of liquidity, solvency, and profitability...Ch. 14 - Solvency and profitability trend analysis Addai...Ch. 14 - Horizontal analysis of income statement For 20Y2,...Ch. 14 - Prob. 2PBCh. 14 - Effect of transactions on current position...Ch. 14 - Prob. 4PBCh. 14 - Solvency and profitability trend analysis Crosby...Ch. 14 - Prob. 1MADCh. 14 - Prob. 2MADCh. 14 - Deere Company (DE) manufactures and distributes...Ch. 14 - Marriott International, Inc. (MAR), and Hyatt...Ch. 14 - Prob. 1TIFCh. 14 - Real-world annual report The financial statements...Ch. 14 - Prob. 3TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License