Deere & Company manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase of their farm and construction equipment.

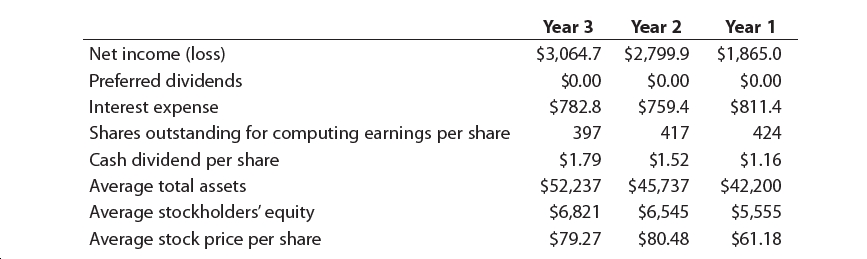

The following information is available for three recent years (in millions except pershare amounts):

Please see the attachment for details:

1. Calculate the following ratios for each year, rounding ratios and percentages to one decimal place, except for per-share amounts:

a. Return on total assets

b. Return on stockholders’ equity

c. Earnings per share

d. Dividend yield

e. Price-earnings ratio

2. Based on these data, evaluate Deere’s profitability.

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

- Dell Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In a recent annual report, the balance sheet included the following information ($ in millions): 2020 2019 Current assets: Receivables, less allowance of $94 in 2020 and $85 in 2019 $ 12,484 $ 12,371 In addition, the income statement reported sales revenue of $92,154 million for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $91,868 million. There could have been significant recoveries of accounts receivable previously written off. Required: Compute the following ($ in millions): The amount of bad debts written off by Dell during 2020 (Hint: Treat it as a plug in the gross accounts receivable account). The amount of bad debt expense that Dell included in its income statement for 2020 (Hint: Treat it as a plug in the allowance…arrow_forwardGretchen’s sales, current assets and current liabilities (all in thousands of pesos) have been reported as follows over the last four years (Year 4 is the most recent year): Year 4 Year 3 Year 2 Year 1 Sales P5,400 P4,950 P4,725 P4,500 Current assets 1,448 1,332 1,368 1,280 Current liabilities 318 324 330 300 Express all of the assets, liabilities and sales data in trend percentages (show percentages in each item). Use year 1 as the base year and carry computations to one decimal place.arrow_forwardNeed Helparrow_forward

- Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets, current liabilities, and sales have been reported as follows over the last five years (Year 5 is the most recent year): Year 1 Year 2 Year 3 Year 4 Year 5 Sales $4,546,750 $4,760,520 $5,009,460 $5,429,040 $5,695,160 $ $ 2$ 2$ 87,970 513,073 895,198 $ 73,368 572,803 907,666 Cash 90,291 401,499 815,059 95,951 417,195 869,228 92,001 448,219 832,208 Accounts receivable, net Inventory Total current assets $1,306,849 $1,382,374 $1,372,428 $1,496,241 $1,553,837 Current liabilities $ 318,258 $ 335,298 $ 335,856 $ 325,402 $ 399,778 Required: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. (Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3).) Year 1 Year 2 Year 3 Year 4 Year 5 Sales % % % % % Current assets: Cash Accounts receivable Inventory Total current…arrow_forwardGranite, Incorporated is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2019 fiscal year, the company reported sales revenue of $6.1 billion and Cost of Goods Sold of $4.3 billion. Fiscal Year Balance Sheet (amounts in millions) Cash and Cash Equivalents Accounts Receivable, Net Inventory Prepaid Rent and Other Current Assets Accounts Payable Salaries and Wages Payable Notes Payable (short-term) Other Current Liabilities 2019 Current Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio $ 540 860 330 795 210 520 116 28 2018 $430 810 340 660 190 520 28 320 Required: Assuming that all sales are on credit, compute the following ratios for 2019. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.arrow_forwardHousehold Brands Incorporated (HBI) manufactures household goods in the United States. The company made two acquisitions in previous years to diversify their product lines. In 2011, HBI acquired cosmetics and consumer electronics companies. HBI is now, in 2022, comprised of three divisions: cosmetics, household, and consumer electronics. The following information (in thousands of dollars) presents operating revenues, operating income, and invested assets of the company over the last three years: Revenue Operating Income Assets Cosmetics 2020 $ 24,500 $ 2,300 $ 10,000 2021 22,500 1,900 10,000 2022 19,600 1,800 9,500 Household 2020 17,400 1,300 7,500 2021 15,300 1,100 8,000 2022 12,500 900 6,500 Electronics 2020 13,500 1,500 4,500 2021 9,500 1,100 4,500 2022 8,700 1,050 4,300 Household Brands Total 2020 55,400 5,100 22,000 2021 47,300 4,100 22,500 2022 40,800 3,750 20,300 The current compensation package is an annual…arrow_forward

- Here is some financial statement data for Nestlé (in millions of Swiss francs): After reviewing the information, calculate the following ratios for Nestlé for 2021:1) Inventory turnover2) Profit margin3) Return on assets4) Free cash flowRound all answers to two decimal places. Do not include dollar signs because Nestlé's accounting information is in Swiss francs. Show the calculations for each answer.arrow_forwardIn a recent year Ley Corporation had net income of $150,000, interest expense of $30,000, and a times interest earned ratio of 7. What was Ley Corporation's income before taxes for the year?arrow_forwardWant Answerarrow_forward

- Dengerarrow_forwardComputer World reports income tax expense of $230,000. Income taxes payable at the beginning and end of the year are $54,500 and $64,000, respectively.What is the cash paid for income taxes during the year?arrow_forwardYukon Bike Corp. manufactures mountain bikes and distributes them through retail outlets in Canada, Montana, Idaho, Oregon, and Washington. Yukon Bike Corp. declared the following annual dividends over a six-year period ending December 31 of each year: Year 1, $32,000; Year 2, $40,000; Year 3, $64,000; Year 4, $184,000; Year 5, $232,000; and Year 6, $280,000. During the entire period, the outstanding stock of the company was composed of 20,000 shares of 4% preferred stock, $100 par, and 100,000 shares of common stock, $20 par. Instructions: 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. Assume that preferred dividends are paid before any common dividends. If required, round your answers to the nearest cent. If the amount is zero, please enter "0". Common Dividends Preferred Dividends Per Share Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Total Dividends $ 32,000 40,000 64,000 184,000 232,000 280,000 Total 1000 $…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education